Doing business

Since the start of Russia’s full-scale invasion of Ukraine, the domestic steel market has undergone significant transformations and adapted to the new realities. The hostilities and the loss of logistics routes through the Black Sea ports have significantly affected the production and export volumes of Ukrainian iron and steel enterprises, which make a significant contribution to the country’s economy.

In 2023, Ukrainian steelmakers produced 6.23 million tons of steel and 5.37 million tons of rolled steel products. These figures have stabilized compared to 2022. However, if we exclude the bulk of the 2022 production, which fell on the pre-war months of January and February, the industry significantly improved its performance in 2023, adapting to the new business realities.

Exports and imports of steel products also underwent dramatic changes due to the blockade of seaports, which left Ukraine with a single trade window to Europe. In particular, exports of steel products in 2023 amounted to 1.78 million tons, while in 2022 they amounted to 2.47 million, and in 2021 – 8.34 million tons. Imports of the relevant products reached 1.18 million tons last year, 621.6 thousand tons – in 2022, and 1.12 million tons – in 2021. Thus, imports of rolled steel products in 2023 are already higher than in pre-war 2021, and the difference between exports and imports is gradually decreasing.

There are good reasons for this, including the occupation of Mariupol and the destruction of Mariupol steel mills, which accounted for about half of Ukraine’s steel production. The existing steel mills are currently unable to meet the market demand for some types of rolled steel, forcing consumers to import steel. At the same time, export opportunities are limited by the capacity of existing logistics routes.

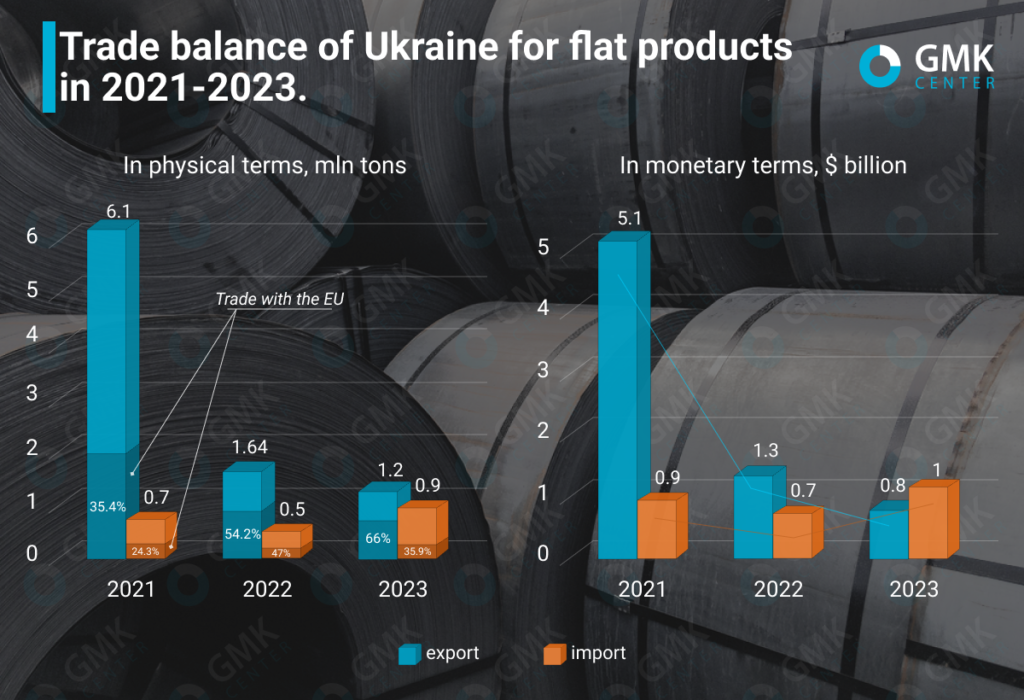

Exports of flat products from Ukraine, which account for more than 67% of total exports of rolled products, amounted to 1.202 million tonnes in 2023, down 26.9% compared to 2022. In 2021, exports of these products reached 6.1 million tons.

At the same time, imports of flat products increased by 92.4% last year compared to 2022, to 908.2 thousand tons. In 2021, the figure was 702.8 thousand tons. Thus, in 2023, the difference between exports and imports decreased to 293 thousand tons compared to 1.2 million tons in 2022, which gradually brings Ukraine closer to the status of a net importer in tons.

The implementation of recovery programs will be based to some extent on imported supplies of rolled steel and other construction products. Therefore, Ukraine’s transformation into a net steel importer is inevitable. How long this status will last will directly depend on the scope of the recovery work,» GMK Center analyst Andriy Glushchenko notes.

The main export product from Ukraine in 2023 is hot-rolled flat products. Last year, shipments of such products amounted to 941.91 thousand tons worth $582.61 million. Coated flat products are imported to Ukraine the most – 438.1 thousand tons worth $514.46 million.

In other words, Ukrainian exporters mainly ship untreated rolled products with minimal added value. At the same time, the bulk of imports are coated rolled products, which have a high added value.

In monetary terms, Ukraine is already a net importer of flat products, as exports in 2023 amounted to $782.3 million and imports – to $1.03 billion. In 2022, exports amounted to $1.35 billion and imports – to $698.8 million, and in 2021, respectively, $5.1 billion and $918.5 million.

The prospects for production and export growth can only be linked to the resolution of security and logistical challenges. In the short and medium term, Ukraine will be dependent on imports of flat products from the EU and Turkiye.

In January-November 2023, Ukraine exported 793.64 million tons of flat products to the European Union for €531.44 million. At the same time, Ukrainian consumers imported 325 thousand tons of products for €401.9 million.

In 2022, Ukraine exported 891.4 thousand tons of flat products to the EU worth €753.17 billion, imported 221.7 thousand tons worth €333.9 million, and in 2021, exported 2.16 million tons worth €1.8 billion and imported 171.12 thousand tons worth €210.9 million.

Thus, in 2023, the EU accounted for the bulk of Ukraine’s exports, accounting for more than 78% of the total. At the same time, European producers accounted for about 42% of the total imports.

The main types of flat products exported to the EU are hot-rolled flat products (68-78% of the total in 2021-2023). Ukraine, in turn, imports mainly coated flat products from the EU (44-74% over the past three years).

Turkiye and China account for the bulk of Ukraine’s imports. In 2023, Turkish producers were the leaders in the supply of almost all types of relevant products with a share of 17-63%, depending on the product. In particular, Turkiye and China shipped 25.7% and 22.5% of coated flat products, which is the main item of flat products imports to Ukraine in 2023 (48%). Poland accounted for another 16%.

Source https://gmk.center/ua/