Since the start of the war, Slovakia has supported Ukraine by increasing its iron ore consumption

Under the conditions of the war, Slovakia became an important partner of Ukraine – an element of diversification of export routes, as well as a supplier of energy resources that have become critical for Ukraine and its economy. For Ukrainian mining companies, the Slovak steel mill US Steel Kosice has become an even more important consumer of iron ore amid difficulties in exporting products to other regions.

Trade balance

After the start of full-scale military aggression, Ukraine was forced to reorganize the entire logistics system of its export-import operations. In such conditions, the importance of all existing trade and logistics opportunities with neighboring countries, among which Slovakia has an important place, has sharply increased.

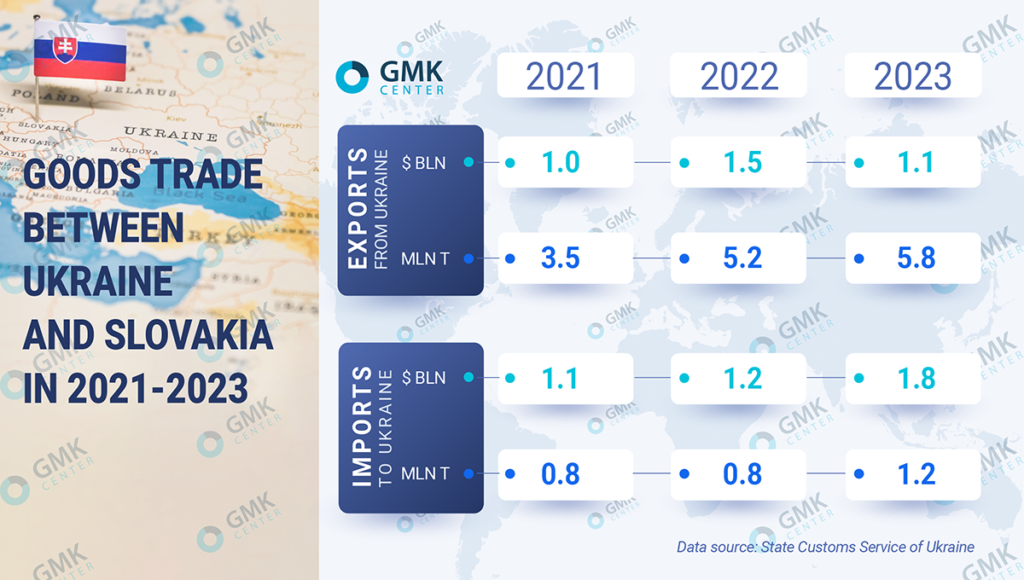

Compared to pre-war 2021, imports from Slovakia in 2023 increased by 44% in physical terms – to 1.2 million tons, and by 63% in monetary terms – to $1.8 billion. In turn, during the same period, Ukrainian exports increased by 64% – to 5.8 million tons in physical terms, while in monetary terms – by only 7%, to $1.1 billion.

In 2023, Ukrainian exports exceeded imports from Slovakia in physical terms by 4.8 times, while in monetary terms they were 41% lower. This ratio indicates that Ukraine mainly supplies Slovakia with raw materials. The largest items of Ukrainian exports in 2023 were iron ore ($502 million or 84% of exports in physical terms), meat ($104 million), cable ($88 million), coal ($50 million) and corn ($49 million). There are also insignificant supplies of various industrial raw materials, including unprocessed aluminum, wood products and consumer goods.

The largest imports from Slovakia are petroleum products ($358 million), gas ($346 million) and automobiles ($259 million). Supplies of energy resources (gas, oil products, electricity) from Slovakia are extremely important for Ukraine, in particular, to ensure fuel and safe operation of the energy system, especially against the background of Russian strikes on the energy infrastructure. The country also supplies Ukraine with paper and cardboard, TV equipment, steel, various industrial products and consumer goods, machinery, mechanisms and appliances.

The situation with trade and logistical restrictions on the part of Slovakia does not look much better than, for example, with Poland. On the one hand, at the end of November-2023, Slovak authorities extended the ban on imports of agricultural products from Ukraine for an indefinite period of time and expanded the list of goods. If earlier it included wheat and corn, now honey, barley, flour, sugar, etc. were added. On the other hand, at the end of last year, Slovak carriers blocked the only truck border crossing «Uzhhorod – Vyshne Nemecke» (demanding the cancellation of the «transport visa-free zone» for Ukraine) only for a short time, while Poles are still protesting.

Largest iron ore consumer

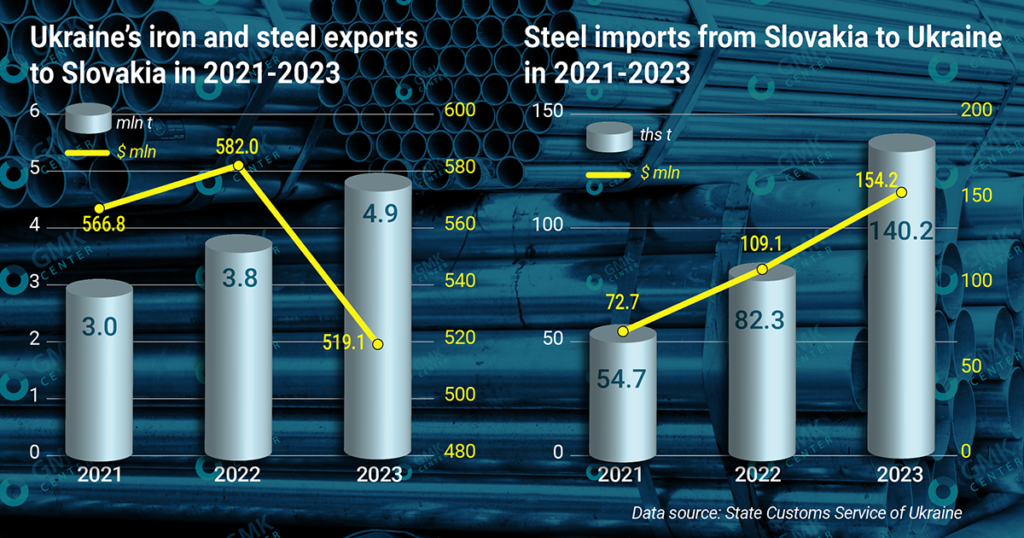

The geographical proximity of Slovakia allowed Ukrainian iron and steel companies to increase their exports in the war conditions. In 2023 compared to 2021, Ukrainian exports of iron and steel products to this country increased by 63% – to 4.9 million tons, but in monetary terms decreased by 8% – to $519 million. This was due to an increase in iron ore supplies and a decrease in exports of steel products.

Under the conditions of war due to the loss of capacity and reduction of domestic production in Ukraine, exports of steel products to Slovakia decreased by 75% – to 24.5 thousand tons in 2023 compared to 2021. Thus, Ukraine became a net importer of steel products from Slovakia.

In the absence of sea exports until the second half of 2023, Ukraine increased iron ore shipments to Slovakia by land by 67% – to 4.9 million tons in 2023 compared to 2021. However, due to lower market prices, export revenue grew by only 5% – to $502 million over the same period.

In the difficult 2022-2023 period, when the ability to deliver products to consumers was extremely limited, Slovakia supported Ukrainian iron ore producers with iron ore consumption and transit. Over the past two years, Slovakia’s share in the total volume of Ukrainian iron ore exports in monetary terms increased from 19.2% – to 28.4% in 2023.

A big advantage for iron ore exports is the existence of a 1520 mm wide Uzhhorod-Koshice railroad line, which is used for deliveries to US Steel Kosice. This reduces border crossing time, as it does not require rearrangement of wagon bogies (railroad gauge in Slovakia is 1435 mm).

The downside is the “dead-end” nature of this branch line, the dependence on a single buyer, and the practical difficulty of transporting other types of cargo. Although local railroad carriers speak about the possibility of accepting other cargoes than ore. Before the war, there were plans to extend the broad gauge railroad from Kosice to Bratislava and Vienna, but the European Union refused to finance the project.

Slovakia is also important for the transit of iron and steel cargoes. Iron ore is delivered through the Uzhgorod-Matevce border crossing to the Czech steel companies Liberty Ostrava and Trinecke Zelezarny, as well as to the Austrian Voestalpine.

Influx of Slovak rolled steel

Compared to pre-war 2021, Slovak imports of steel products to Ukraine in 2023 in volume terms increased by 2.6 times – to 140 thousand tons, in monetary terms – by 2.1 times, to $154 million.

Since the beginning of the war, the key imports of metal products from Slovakia to Ukraine have been flat hot-rolled and cold-rolled steel, as well as coated steel. In particular, supplies of hot-rolled steel in 2023, compared to pre-war 2021, increased 67 times – to 59 thousand tons. In turn, supplies of hot-rolled steel increased by 2.7 times, and coated rolled steel – by 1.4 times. Deliveries of the mentioned items increased due to a shortage of similar products on the Ukrainian market.

Although Slovak steel imports have increased in the context of the war, their volumes remain small compared to the scale of the Ukrainian market. It accounts for 11.3% of total steel imports to Ukraine or 4% of the country’s steel consumption in 2023.

According to WorldSteel, last year, Slovakia increased steelmaking by 15.4% y/y – to 4.5 million tons. In 2022, the trend was the opposite, down 20.4% y/y – to 3.9 million tons. Slovakia’s steel production in 2023 was only 3.5% (2.9% in 2022) of the EU figure.

The country is home to two steel mills – US Steel Kosice, which has a capacity of 4.5 mln tpa of steel and 5 mln tpa of pig iron, and Max Aicher Slovakia Steel Mills Strazske (620,000 tpa of steel).

Balance of interests

Under current conditions, Ukraine is more likely to be an interesting market for Slovak steel products than vice versa. Due to insufficient domestic production of steel products in Ukraine, only mining companies are interested in the Slovak market. At the same time, the possibility of increasing the consumption of Ukrainian iron ore by EU steel mills largely depends on the level of demand, i.e. the situation on the European steel market.

More distant prospects for iron ore supplies to Slovakia look uncertain. US Steel Kosice will receive €300 million from the country’s government for decarbonization of production – replacement of two blast furnaces with electric arc furnaces. Apparently, during the implementation of this ambitious project (tentatively – until 2026) and after it, the consumption of Ukrainian iron ore will decrease.

A limitation for the development of trade and transit is the overall small length of the Ukrainian-Slovak border (only 97 km), complex terrain and, as a consequence, some transport crossings. There are only three of them: Uzhgorod – Matevce (used for ore exports, capacity – 500 railcars) and Chop – Cierna nad Tisou (490 railcars) for rail freight traffic and only one for trucks – Uzhgorod – Vyshne Nemecke. Slovakia is open to expanding logistics with Ukraine, last year it actively modernized its border railway infrastructure, but it is difficult to quickly increase its capacity.

Source: https://gmk.center