Doing business

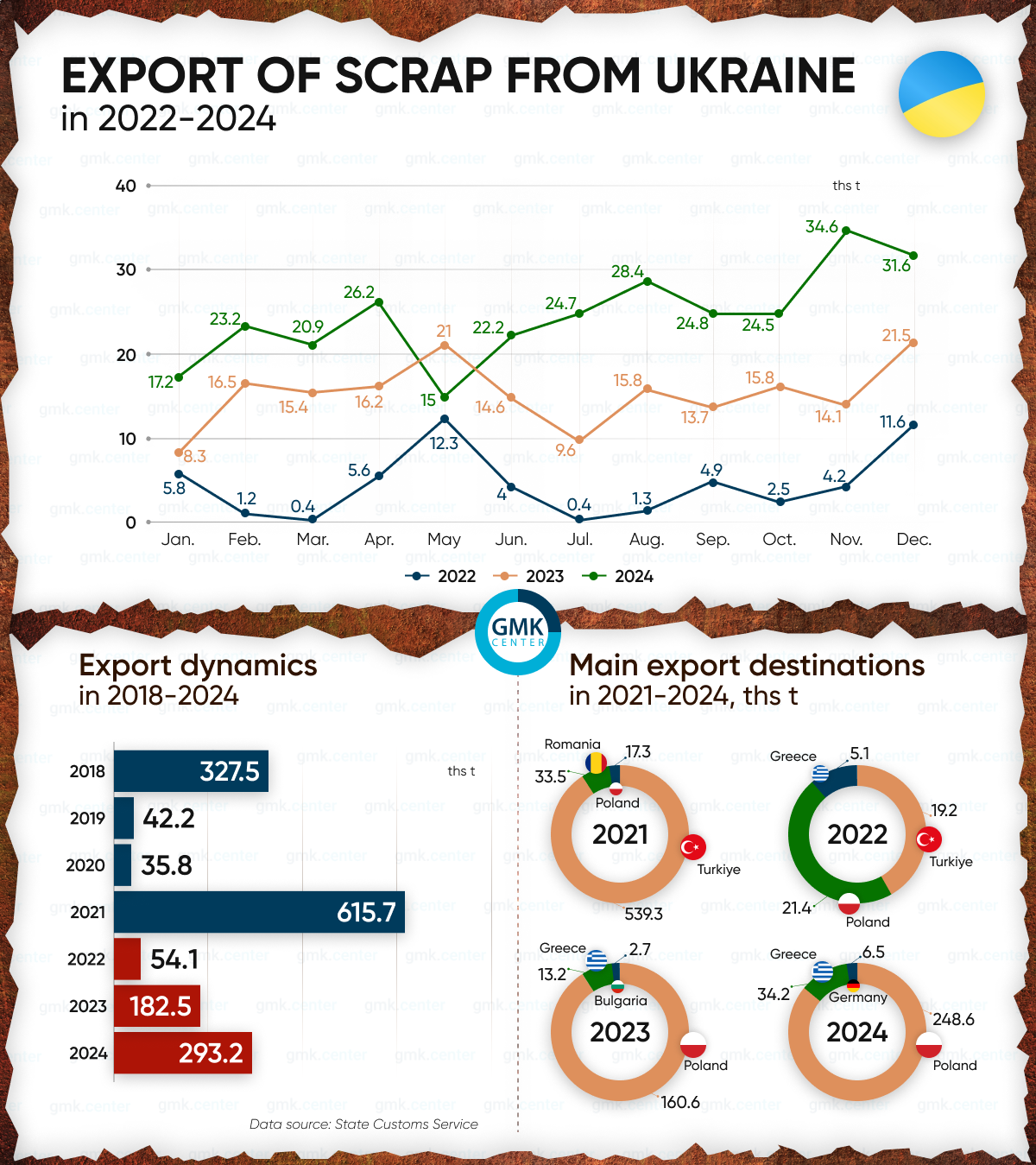

Exports of ferrous scrap from Ukraine in 2024 increased by 60% compared to 2023 – to 293.2 thousand tons. In 2023, scrap shipments abroad exceeded 182.5 thousand tons, up 3.4 times year-on-year, while in 2022 the figure was 54.1 thousand tons.

In 2021, Ukraine sharply increased scrap exports. In particular, 615.7 thousand tons of scrap were shipped during the year, while in 2020 these volumes were 35.8 thousand tons, and in 2019 – 42.2 thousand tons. The surge in exports was driven by an upward trend in the global steel industry following the COVID-19 downturn. Turkey which increased steel production by 12.7% y/y – to 40.1 million that year became the main scrap consumer (539.3 thousand tons). At the same time, in 2021, Ukraine also increased steel production by 3.6% y/y, to 21.4 million tons, and the sharp increase in the scrap outflow caused concern among steelmakers.

At the time, Ukraine had a €58/t scrap export duty, which was not sufficiently effective. Steelmakers appealed to the authorities to tighten restrictions, and at the end of the year, according to Presidential Decree No. 503/97 of 10.06.1997, a new duty on scrap exports of €180 per ton came into force.

In 2022, exports slowed down as the market adjusted to martial law. In addition, the list of companies specializing in scrap operations has decreased, in particular because most of them are located in the temporarily occupied territories or in areas of active hostilities. But in 2023, market activity gradually recovered, and exports increased significantly. At the same time, the list of end consumers has also undergone significant changes. In particular, direct deliveries to Turkey stopped after 2022, while shipments to EU countries increased significantly.

Thus, Poland consumed 160.6 thousand tons of Ukrainian scrap in 2023, and 248.6 thousand tons in 2024. At the same time, in 2023, Polish steelmakers reduced steel production by 13.1% y/y – to 6.44 million tons, and in 2024, they increased it by 10.1% y/y – to 7.1 million tons.

According to Eurostat, scrap exports from Poland amounted to 764.39 thousand tons in 2022 and exceeded 1.29 million tons in 2023 (+69.9% y/y). For 11 months of 2024, the figure was at 1.15 mln tonnes, which will also approach 1.3 mln tonnes by the end of the year. Since 2023, the supply of Polish scrap to Turkey has been marked by a sharp increase: 176.74 thousand tons in 2022, 228.27 thousand tons in 2023, and 452.71 thousand tons – in 11 months of 2024.

As Oleksandr Kalenkov, President of Ukrmetalurgprom, previously noted, Ukrainian scrap is exported through the European Union, which has a preferential export duty of €3 per ton, and from there the raw materials are redirected to real consumers in Turkey. He emphasized that exporting scrap directly to Turkey would cost €180 in export duties, and the Ukrainian budget has already lost more than UAH 350 million.

According to Access2Market, scrap supplies to the EU from Ukraine are currently not subject to export duties, meaning that the tariff is set at 0%. Thus, EU countries can be used to re-export critical raw materials, bypassing export duties and and payments to Ukraine’s budget.

Given the difficulties in collecting, the massive export of scrap abroad threatens the stability of the Ukrainian steel industry and the implementation of plans to increase steel production.

Source: https://gmk.center