Doing business

The Ukrainian steel market showed mixed trends in the first half of 2025: production of key products mostly declined, domestic consumption and imports recovered, while exports slowed down.

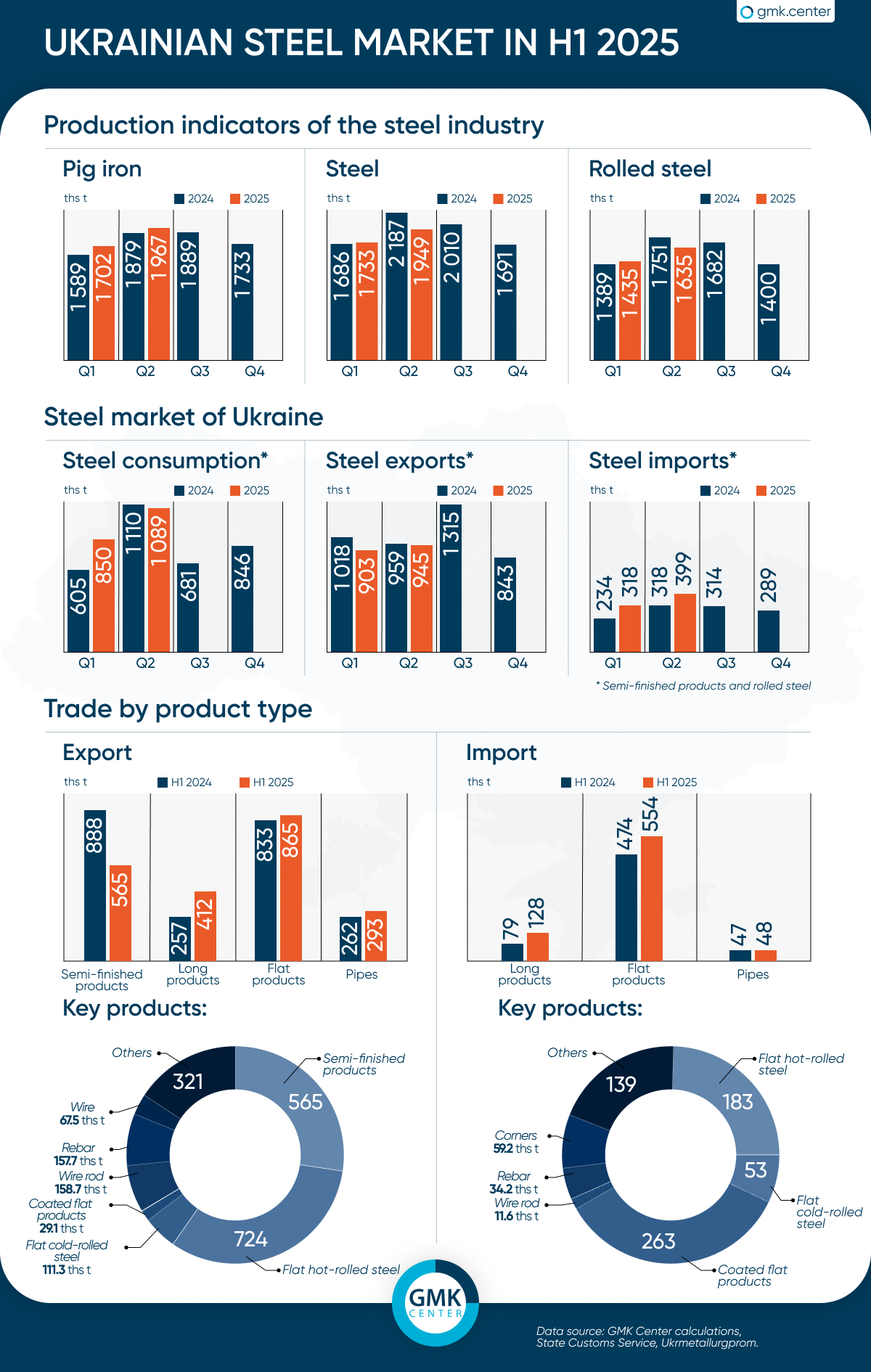

In January-June, steel enterprises increased pig iron production by 5.8% compared to the same period in 2024, to 3.67 million tons. Steel production fell by 4.9% y/y – to 3.68 million tons, and rolled steel production fell by 2.2% y/y to 3.07 million tons.

In the second quarter, pig iron production increased by 4.7% y-o-y and 15.5% q-o-q, to 1.96 million tons, while steel production fell by 10.9% y-o-y but increased by 12.5% q-o-q, to 1.95 million tons. Rolled steel production decreased by 6.6% y-o-y, but increased by 13.9% q-o-q – to 1.63 million tons.

Average quarterly output of pig iron during the current year amounted to 1.84 million tons compared to 1.77 million tons a year earlier, steel – 1.84 million tons against 1.89 million tons, rolled products – 1.53 million tons against 1.56 million tons. Thus, positive dynamics are observed only in pig iron production, which indicates an increase in demand for low value-added products.

Domestic consumption of steel (semifinished products, rolled steel) during the first half of 2025 increased by 13% compared to the same period last year, to 1.94 million tons. At the same time, 716.7 thousand tons (+29.6% y/y) accounted for imports. In particular, 127.75 thousand tons (+62.6% y/y) of long products and 554.1 thousand tons (+16.8% y/y) of flat products were imported. The share of imports increased by 4.73 percentage points compared to the first half of 2024.

Exports of steel products for the period decreased by 6.5% y/y – to 1.85 million tons. The decline was mainly due to a slowdown in export demand for semifinished products, which fell by 36.4% y/y – to 564,680 tons. Shipments of long products increased by 60.3% y-o-y to 412 thousand tons, and flat products – by 3.8% y/y – to 865 thousand tons.

Among the key products supplied to foreign markets were: flat hot-rolled products (HS – 7208) – 724.35 thousand tons, semifinished products (HS – 7207) – 564.68 thousand tons, flat cold-rolled products (HS – 7209) – 111.3 thousand tons, reinforcement bars (HS – 7214) – 157.74 thousand tons, wire rod (HS – 7213) – 158.67 thousand tons. Ukrainian consumers imported the most coated flat products (HS – 7210) – 263.26 thousand tons, hot-rolled flat products – 182.93 thousand tons, cold-rolled flat products – 52.82 thousand tons, and angles (HS – 7216) – 59.16 thousand tons.

Pipe exports in the first half of the year reached 292.94 thousand tons (+11.6% y/y), while imports reached 48.41 thousand tons (+2.5% y/y).

The main export markets for Ukrainian rolled steel products in the first six months of 2025 are the EU countries (83.1%), other European countries (7.5%), and the CIS (6.7%). Among steel importers, other European countries rank first (57.4%), followed by the EU (23.3%) and Asian countries (18.7%).

The deepening of negative trends in the industry is associated with a number of internal and external factors. The war continues to restrict logistics and reduce the competitiveness of Ukrainian rolled products due to longer delivery times, capacity shortages, and rising operating costs. Some enterprises are operating intermittently due to energy restrictions or proximity to the combat zone.

At the same time, the Ukrainian steel industry is also under pressure from the global market. European customers are becoming increasingly cautious in their purchases, focusing on more stable supplies, while growing imports from Asian countries are creating competition even in traditional markets. The situation is complicated by increased trade protectionism in the EU, new tariffs, CBAM, and other regulatory barriers.

Limited access to financing also remains a significant challenge—due to the risk of war, international investors are largely refraining from direct investments, and state support instruments, unlike in the EU, are almost non-existent. This forces companies to rely primarily on their own resources.

Despite the difficulties, the Ukrainian steel industry is demonstrating high resilience. Companies are not only maintaining production but also investing in modernization and reorienting themselves toward high value-added products. And although the 4.9% decline in steel production in the first half of 2025, against the backdrop of a projected annual decline of 9%, may seem alarming, in reality this is not a sign of deterioration, but the result of adaptation to new realities.

The decline in production is accompanied by increased efficiency: companies are implementing energy-saving solutions, developing new products, and investing in human capital and technology. Planned large-scale projects — the construction of electric furnaces, DRI modules, and the expansion of niche areas — indicate preparation for recovery and growth.

The Ukrainian steel industry is preparing for a transformation that will focus on green steel industry, deep processing, and integration into European value chains. If key investment projects are successfully implemented and the war ends in the medium term, Ukrainian steel has every chance of becoming the foundation for the country’s new industrial model.

Source: https://gmk.center/