Due to the high level of inventories, the real volume of consumption in January-June increased by 9% y/y

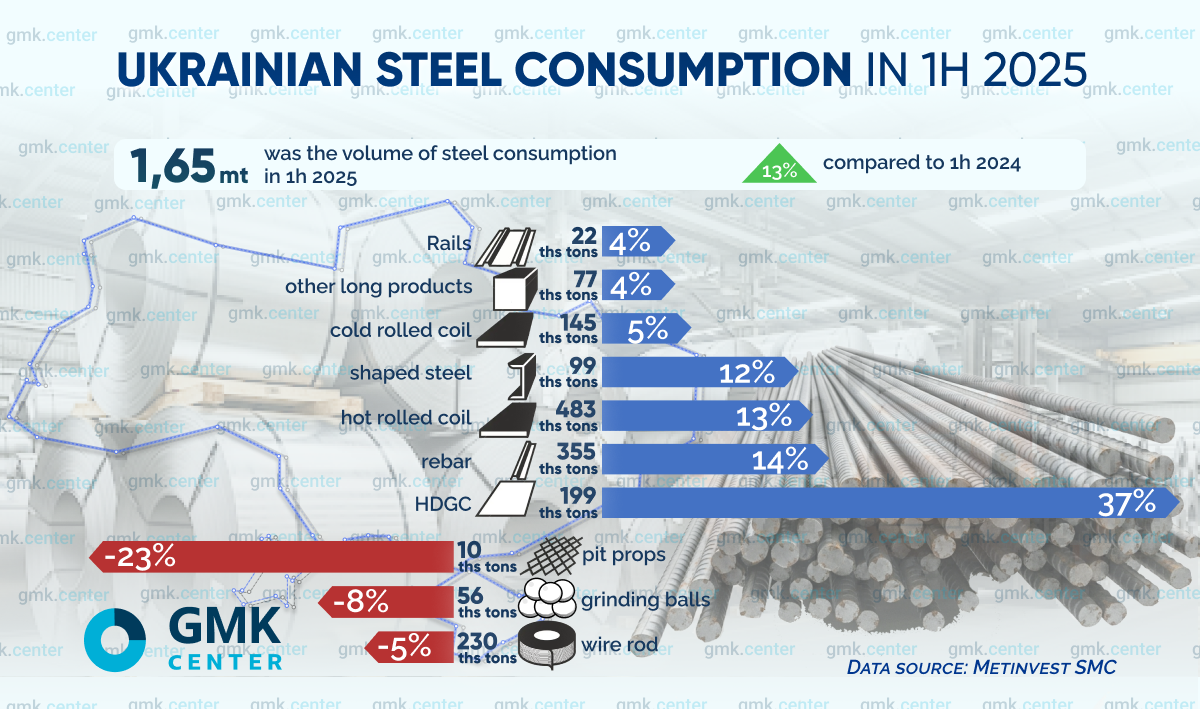

Consumption of steel products in the Ukrainian market (excluding polymer-coated rolled products, stainless steel and white tin plate) in the first half of 2025 increased by 13% y/y and amounted to 1.65 million tons. However, taking into account the increase in stocks at steel traders since the beginning of the year by 120+ thousand tons, the real growth in market capacity at the end of January-June amounted to about 9% y/y.

The dynamics of the main segments of long products in the first half of the year was as follows:

- Rebar. The capacity of the rebar market grew by 14% y/y – to 355 thousand tons. The rebar market saw a shift in demand towards residential construction, mainly in western Ukraine, in contrast to many infrastructure and fortification projects in 2024. The decline in sales was also due to the closure of the USAID program, which financed the construction of shelters over power facilities.

- Wire rod. The wire rod market decreased by 5% y/y, to 230 thousand tons. The decrease in demand for wire rod for defense fortifications was due, among other things, to the use of other non-metallic substitute goods. The market decline in the reinforcement segment was partially compensated for by growth in export sales of hardware products.

- Shaped rolled products. The market of shaped rolled products (beams, angles, channels) grew by 12% YoY, up to 99 thousand tons.

- Grinding balls. The market of grinding balls decreased by 8% y/y, to 56 thousand tons. Lower iron ore export supplies affected the utilization of mining and processing plants and, accordingly, the decrease in demand for balls.

- Rails. The rail market grew by 4% y/y, to 22 thousand tons.

- Other long products. The market of other long products (round, strip, square) grew by 4% y/y, up to 77 thousand tons.

- Welded pipes. The UHW profile market continued to stagnate and declined by 23% y/y, to 10 thousand tons. This was due to the curtailment of operations at mines in the war zone, primarily in Pokrovsk.

Flat rolled products showed the following growth dynamics in the first half of the year:

- hot-rolled steel – by 13% y/y, to 487 thousand tons;

- cold-rolled steel – by 5% y/y, to 145 thousand tons;

- galvanized steel – by 37% y/y, to 199 thousand tons, which significantly exceeds the growth dynamics of other segments of the flat rolled products market

Such a significant growth of galvanized rolled products was caused by significant imports by major players against the background of expected activation of this market segment, as well as by the development of domestic production of polymer-coated rolled products.

Higher growth rates in the flat products segment allowed to increase the share of this segment in the total consumption structure: at the end of the first half of 2025 it amounted to 49% against 45% for the same period last year.

The sectoral structure of demand (based on Metinvest-SMC sales data) shows the following distribution:

- The pipe industry became the supply leader with a 22% share in H1 2025 compared to 19% in H1 2024. This increase in share in the portfolio structure was made possible by an 18% YoY growth in hot-rolled coil sales.

- National steel traders remained the second major customer group, with their share rising to 21% from 20% a year earlier.

- Construction companies ranked third among large consumers with a 16% share in H1 2025, up from 17% a year earlier.

- Iron and steel enterprises. Due to the shutdown of the Pokrovsk mine and lower iron ore exports, supplies to steel enterprises decreased by 19% y/y. This led to a decrease in their share in the portfolio structure to 11% compared to 14% in the first half of 2024.

- Private customers. Activity among private customers remains at a medium level and is growing at a rate comparable to the market as a whole. Focus on the retail customer allowed us to increase sales by 18% YoY, which enabled us to increase our share in the portfolio structure to 11% by the end of 1H 2025 against 10% a year earlier.

Source: https://gmk.center