Despite the risks, four mini-steel enterprises continue to operate in Ukraine, producing large-diameter steel pipes (426–1,420 mm). Most of these plants have demonstrated a gradual recovery in production and have been able to partially or fully return to pre-war production volumes.

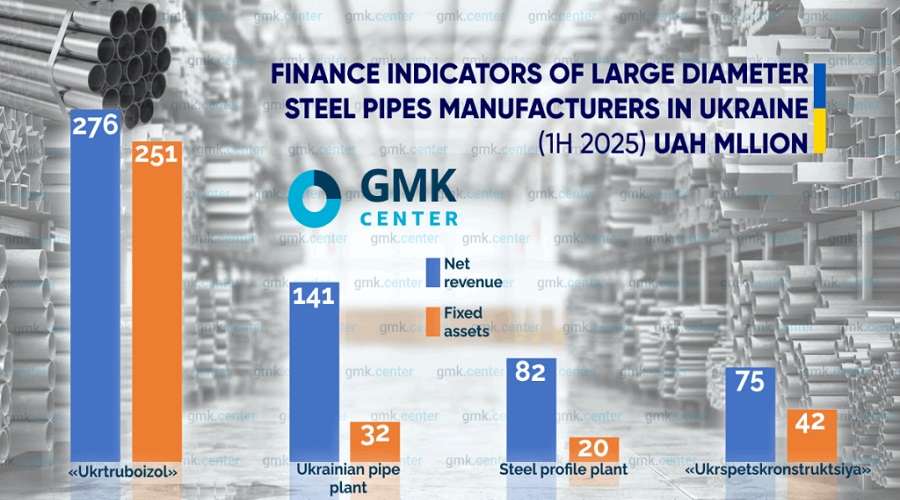

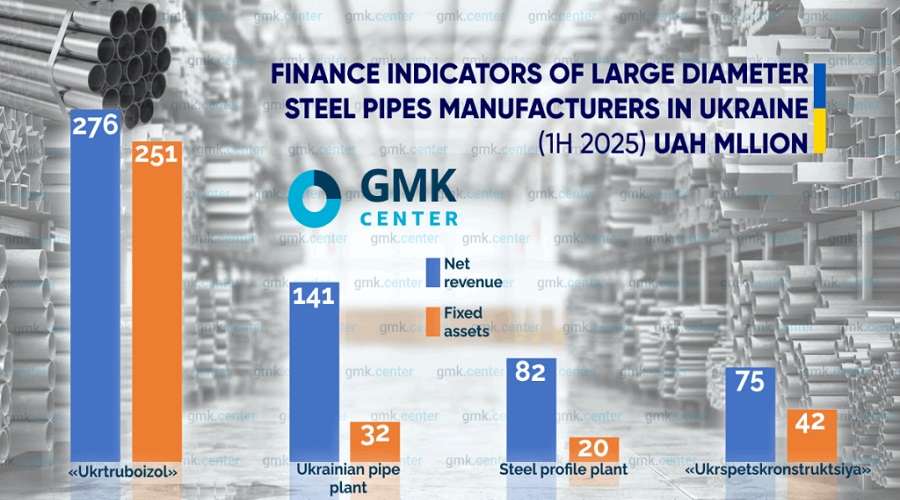

According to the results of the first half of 2025, the companies showed the following financial and economic results.

- During the reporting period, Ukrtruboizol is the leader among companies in this market segment (Meliorativne, Dnipropetrovsk region) sold products worth UAH 276 million excluding VAT, which is 65% more than in the same period last year (2024 – UAH 498 million). The cost of fixed assets for the same period amounted to UAH 251 million. The number of employees increased to 201 from 186 at the end of 2024. At the end of the first half of the year, the company reported a profit of UAH 15.4 million (in 2024 – UAH 55 million in profit).

- The Ukrainian Pipe Plant (Dnipro) received net sales revenue of UAH 141.5 million excluding VAT in the first six months, which is 56% less than last year (UAH 525 million in 2024). The value of fixed assets as of July 1, 2025, was UAH 31.7 million. The company employs 126 people, which is slightly less than at the end of 2024 (147 employees). The financial result for the half-year is a profit of UAH 3.3 million (2024 – UAH 12 million).

- The steel profile plant (Dnipro) sold products worth UAH 81.9 million excluding VAT, which is 10% less than in the first half of 2024. The total value of the company’s fixed assets is UAH 20 million, and it has 57 employees, which is almost the same as at the end of last year (59 employees). The financial result for the period is negative: a loss of UAH 1.4 million, while at the end of last year this figure was UAH 15 million.

- Ukrspetsconstruction (Kryvyi Rih) showed the lowest sales volume among the companies surveyed – UAH 75.1 million excluding VAT, which is 10% less than in the first half of 2024. At the end of last year, this figure was UAH 228 million. The cost of fixed assets as of July 1, 2025, was UAH 42 million, and the number of employees increased to 36 from 30 at the end of 2024. At the end of January-June, the company showed a profit of UAH 2.2 million.

An analysis of the financial results of the four manufacturers shows uneven dynamics in their activities in the first half of 2025. Ukrtruboizol remains the leader in terms of sales and profitability, demonstrating significant revenue growth. At the same time, Ukrainian Pipe Plant suffered a significant reduction in revenue but maintained a positive financial result. The steel profile plant continues to operate at a loss, which may indicate structural problems in production or market conditions. Ukrspetsconstruction demonstrates relative stability with a moderate decline in sales but an increase in profits and staff numbers. Overall, despite mixed results, most companies remain financially stable and are adapting to difficult market conditions.

Source: https://gmk.center/en