Doing business

Dnipropetrovsk Investment Agency keeps introducing about the results of foreign trade operations in the services sector of Dnipropetrovsk region for 9 months of 2025.

Military aggression against Ukraine has significantly affected the foreign economic activity of enterprises in Dnipropetrovsk region, particularly the dynamics of international services. Logistics limitations, changes in market conditions, business relocation and reduced investment activity by key partners have led to correction in trade volumes.

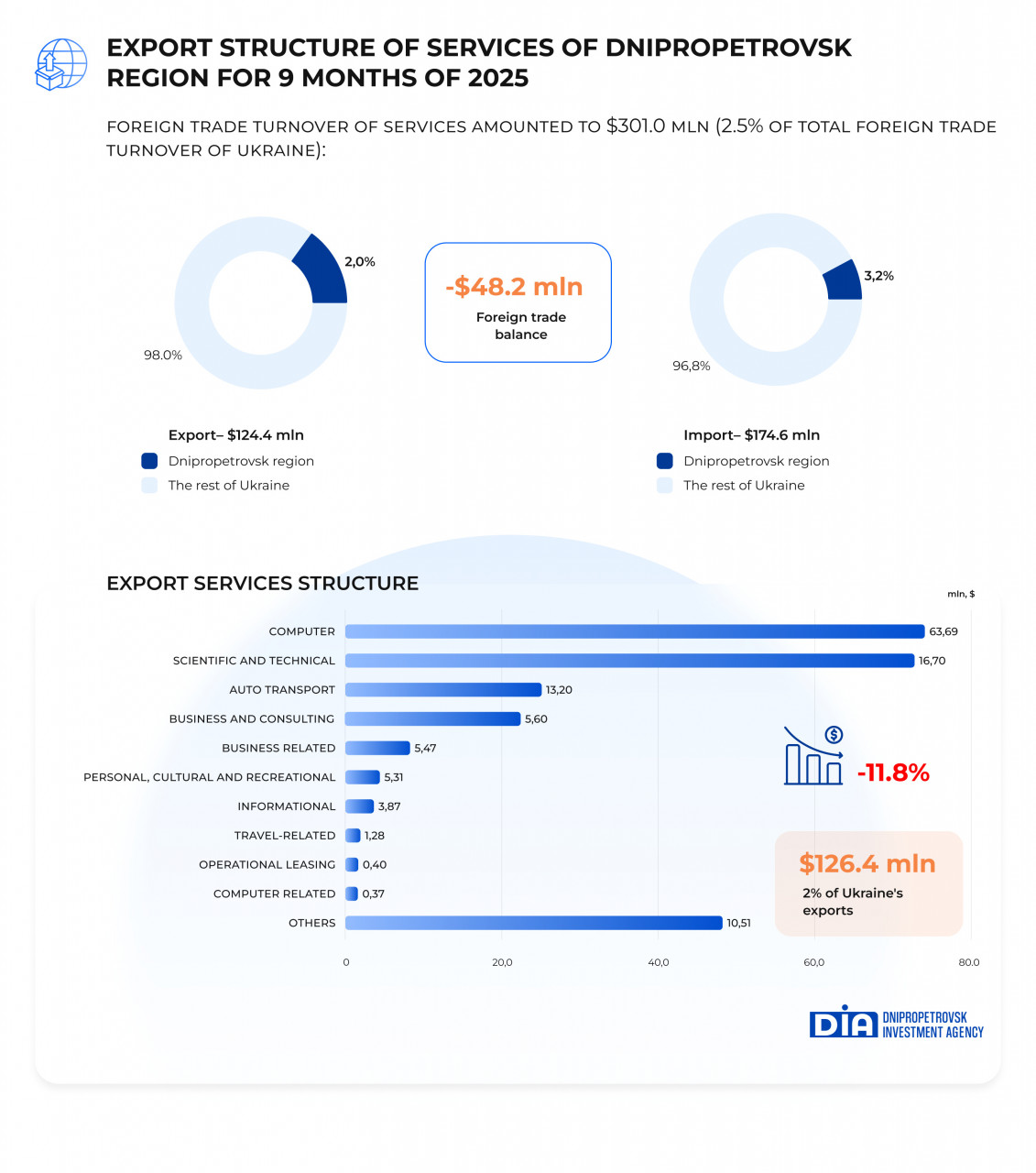

In the first nine months of 2025, foreign trade in services sector decreased by 11.2% compared to the same period in 2024 and amounted to $301.0 million (2.5% of the total turnover of Ukraine). The main factors behind the decline were limited access to certain foreign markets, a decrease in orders from international companies and the reallocation of Ukrainian resources towards defence needs. The foreign trade balance in services sector remains negative at $48.2 million.

Exports of services from Dnipropetrovsk region in January–September 2025 amounted to $126.4 million (2% of the total for Ukraine), which is 11.8% less than last year. The IT sector accounts for the largest share of exports, with $63.7 million (50.4% of total exports of services). The minor decline in IT exports (-1.4%) is due to the partial relocation of companies abroad, competition for contracts, and a general slowdown in global demand for IT services.

Exports of scientific and technical services decreased by almost 20% and amounted to $16.7 million (13.2%). The reasons for this were a reduction in R&D orders from foreign partners, the suspension of certain long-term projects and limited opportunities to conduct research in wartime conditions.

In third place are road transport services ($13.2 million, 10.4% of total exports). The decline of more than 24% is due to logistical difficulties, a decrease in transit, an increase in the insurance cost of transportation and instability in the operation of certain road corridors.

Compared to the previous period, export volumes increased in:

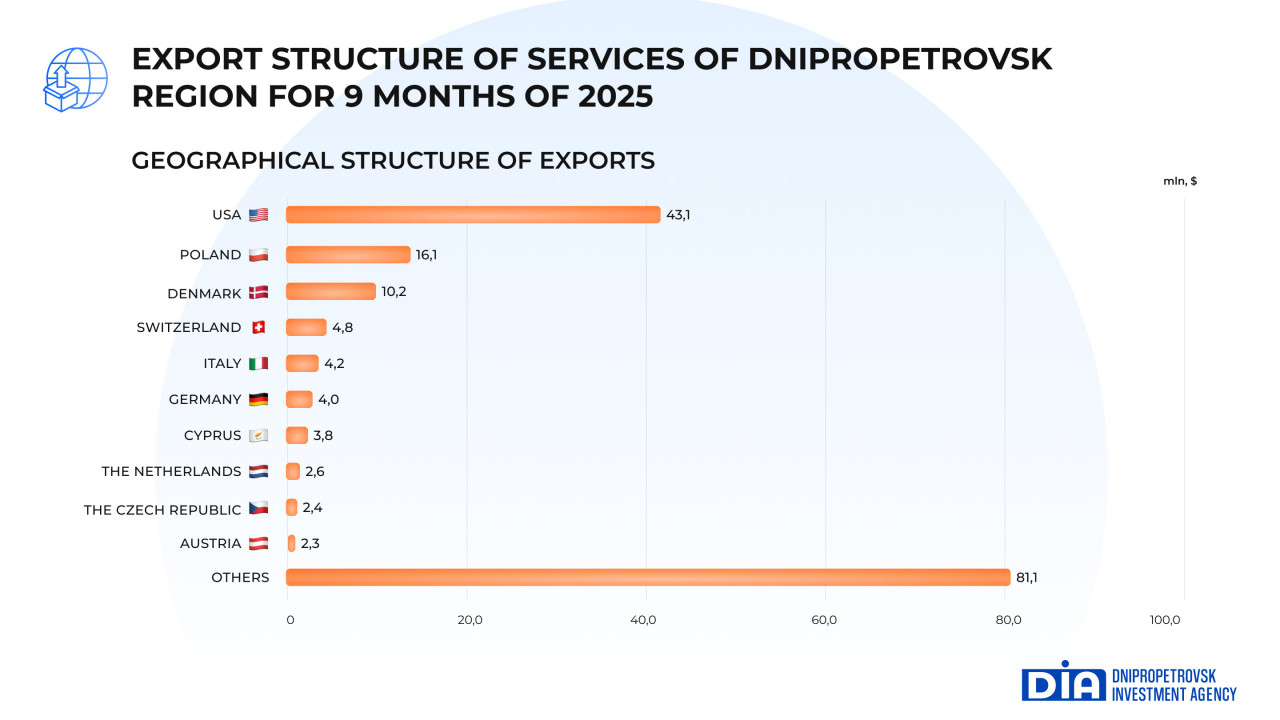

Leader among buyers of Ukrainian services is the United States ($43.1 million), with exports up 0.8% compared to last year. Poland ranks in second place in terms of service exports, with $16.1 million, although trade with Poland decreased by 28.9% compared to the previous period. Denmark ranks in third place with $10.2 million, with exports increasing by 9.7%.

Exports of services to Belgium, Israel, Lithuania, Moldova and Turkey increased significantly.

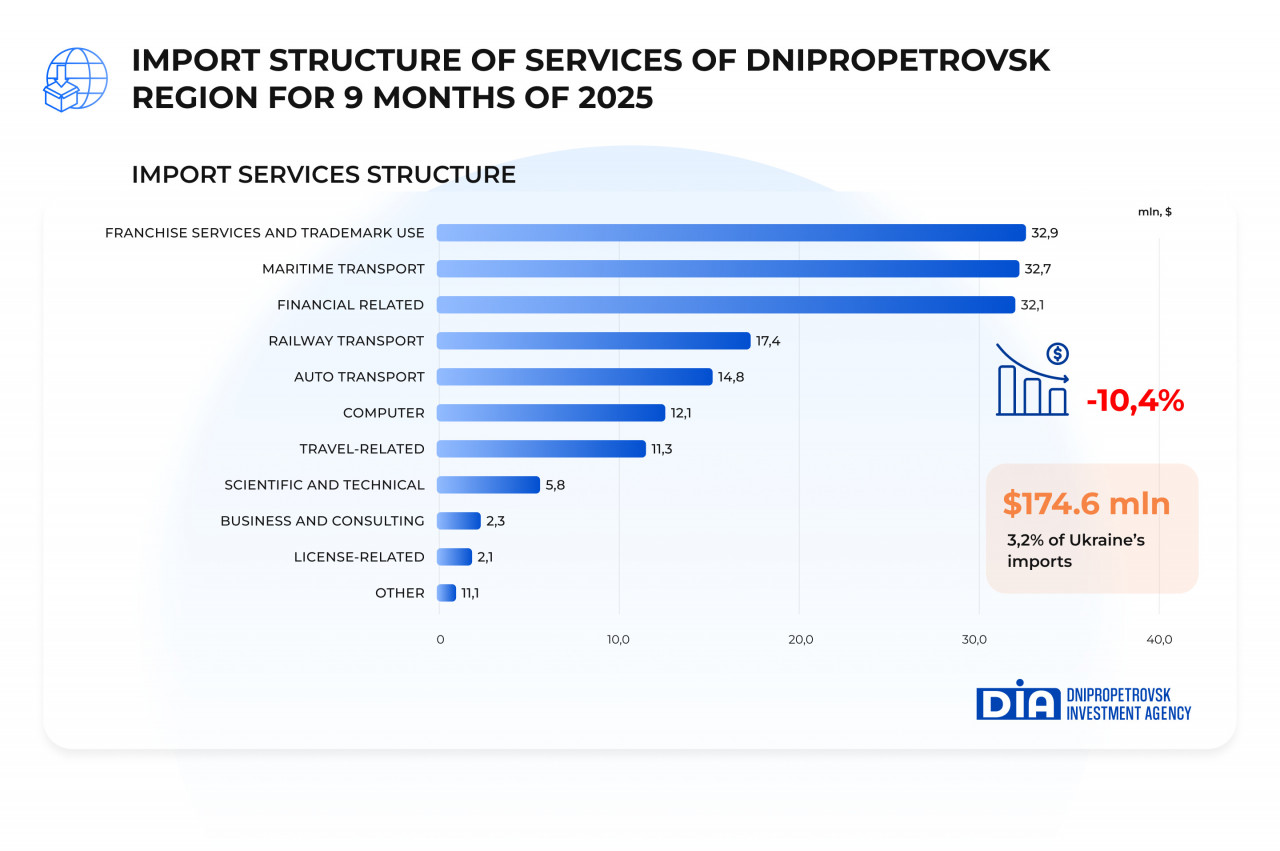

Imports of services to the Dnipropetrovsk region for the first nine months of 2025 amounted to $174.6 million (3.2% of total Ukrainian imports) and decreased by 10.6% compared to the same period in 2024. The decline was mainly due to reduced activity in sectors traditionally focused on imported specialized services, as well as business cost optimization in the context of the war.

In the import structure, franchise services and trademark use take first place with $32.9 million. Their volume increased by 10.9%, which may be due to the expansion of franchise business networks, the transition of some companies to international standards, and the conclusion of new licensing agreements to maintain competitiveness during a period of economic turbulence.

Imports of maritime transport services increased by 0.7% to $32.7 million. This minor increase can be explained by companies adapting to alternative logistics routes, increased transshipment volumes through third-country seaports, and a refocusing of exports/imports on sea routes instead of land corridors, access to which is sometimes difficult.

Third place is held by services related to financial activities, worth $32.1 million (18.4% of total imports). Imports of these services grew by more than 22%. This is due to increased demand for financial consulting, insurance products, risk assessment, support for international transactions and compliance services, which have become more in demand during the war and in the context of stronger regulatory control by foreign partners.

At the same time, there has been an increase in imports of the following types of services:

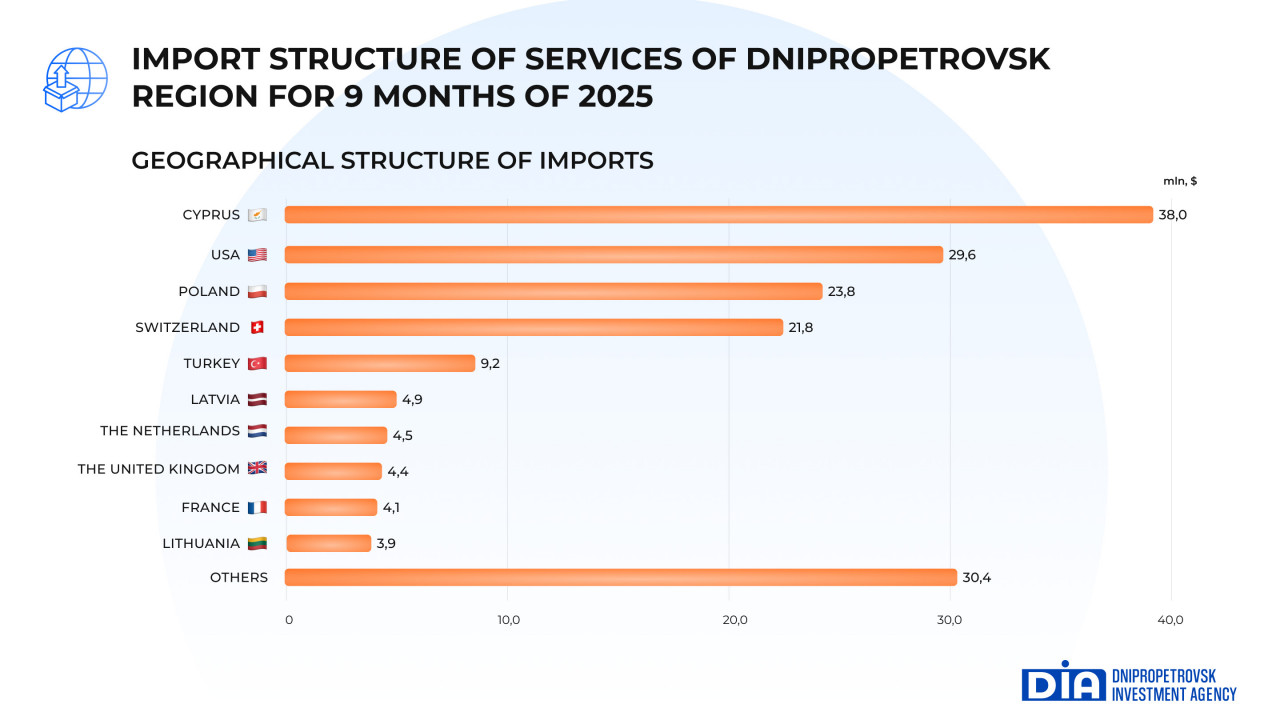

The largest imports were services from Cyprus, worth $38 million, which increased by 10.1%. In second place were imports of services from the United States, amounting to $29.6 million, with an increase of 26.9% compared to the previous period. Imports from Poland, which ranked in third place, decreased by 58.3% and amounted to $23.8 million.

Imports of services from Greece, India, Italy, Canada, the Netherlands, Finland and Lithuania increased more than twice.