Doing business

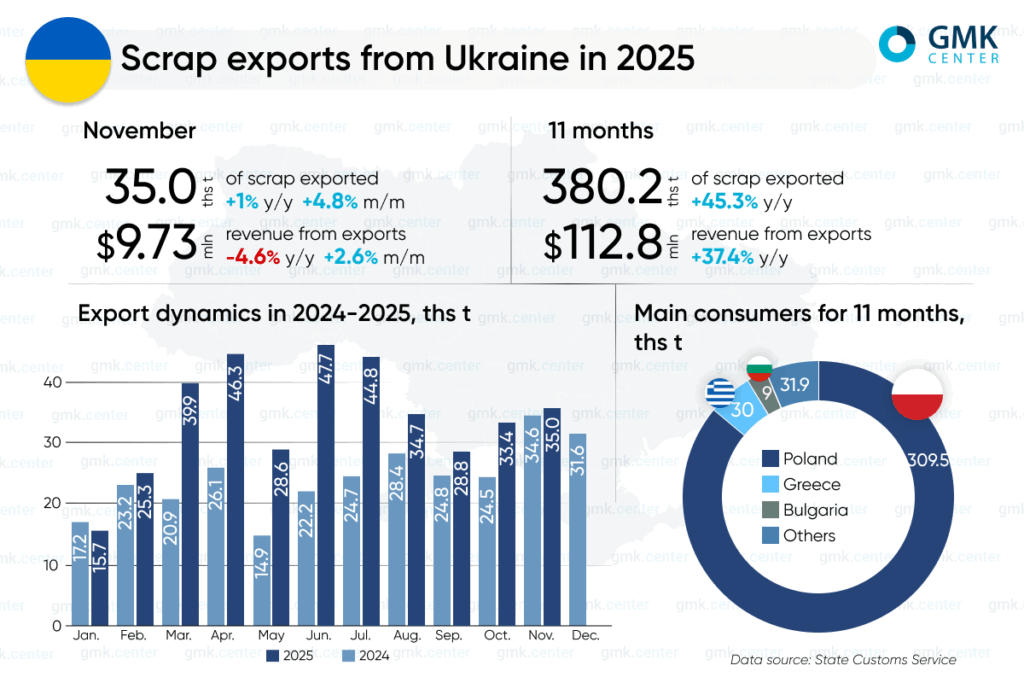

In January–November 2025, Ukraine’s scrap industry increased its exports of ferrous scrap by 45.3% compared to the same period in 2024, to 380.16 thousand tons. This figure has already exceeded last year’s total shipments by more than 86 thousand tons. This is evidenced by GMK Center’s calculations based on data from the State Customs Service.

Poland remains the main export destination. Over 11 months, 309.53 thousand tons of raw materials were sent to the Polish market, which is 68.5% of the total export volume and 38.5% more than in January–November 2024. Another 27.97 thousand tons of scrap were sent to Greece (+7.3% y/y), 8.72 thousand tons to Bulgaria (+172.3% y/y), and 4.93 thousand tons to Germany (-22% y/y).

In November, Ukrainian scrap companies exported 34.97 thousand tons of raw materials, which is 1% more y/y and 4.8% m/m.

Revenue from scrap exports in November increased by 2.6% compared to the previous month and by 4.6% year-on-year to $9.73 million. In January-November, the indicator increased by 37.4% year-on-year to $112.78 million.

It should be noted that in 2024, scrap exports from Ukraine increased by 60% compared to 2023, reaching 293.2 thousand tons. In 2023, shipments of raw materials abroad exceeded 182.5 thousand tons, which is 3.4 times more y/y, while in 2022, the figure was 54.1 thousand tons. The main consumers of raw materials last year were Poland (248,600 tons), Greece (34,200 tons), and Germany (6,500 tons).

For many years, Ukraine has been trying to curb the outflow of scrap abroad in order to provide raw materials for domestic steel industry. Back in 2015, the state began to tighten export regulations by introducing a duty of €10/ton, which gradually increased to €180/ton in 2021. This decision was a response to a sharp jump in export volumes, with scrap sales abroad increasing 14-fold in the first half of 2021.

Despite the high level of duties, export flows began to grow again after 2022. This is primarily due to the possibility of transiting Ukrainian scrap through EU countries without paying duties, primarily Poland, from where the raw materials are actively re-exported to Turkey. At the same time, high world prices make the sale of scrap abroad financially attractive even with additional costs.

At the same time, scrap procurement in Ukraine is declining—from 4-5 million tons per year before the war to 1.2-1.5 million tons in 2023-2025 due to the consequences of the war and the decline in economic activity. This increases the risks for domestic steel plants, which are struggling to access scarce raw materials.

According to the Opendatabot platform, in 2024, only 11 companies with a total staff of 116 people exported scrap, with average tax revenues of about UAH 104 per ton. This export structure indicates a low fiscal effect from the export of strategic raw materials abroad.

Against this backdrop, the government is preparing a new stage of regulation. From 2026, the Cabinet of Ministers proposes to introduce licensing and quotas for scrap exports with a zero quota. This will effectively mean a ban on exports and should be a response to Ukraine’s limited ability to influence the terms of free trade with the EU, as well as the global trend towards tighter control over strategic raw materials.

Source: https://gmk.center