Doing business

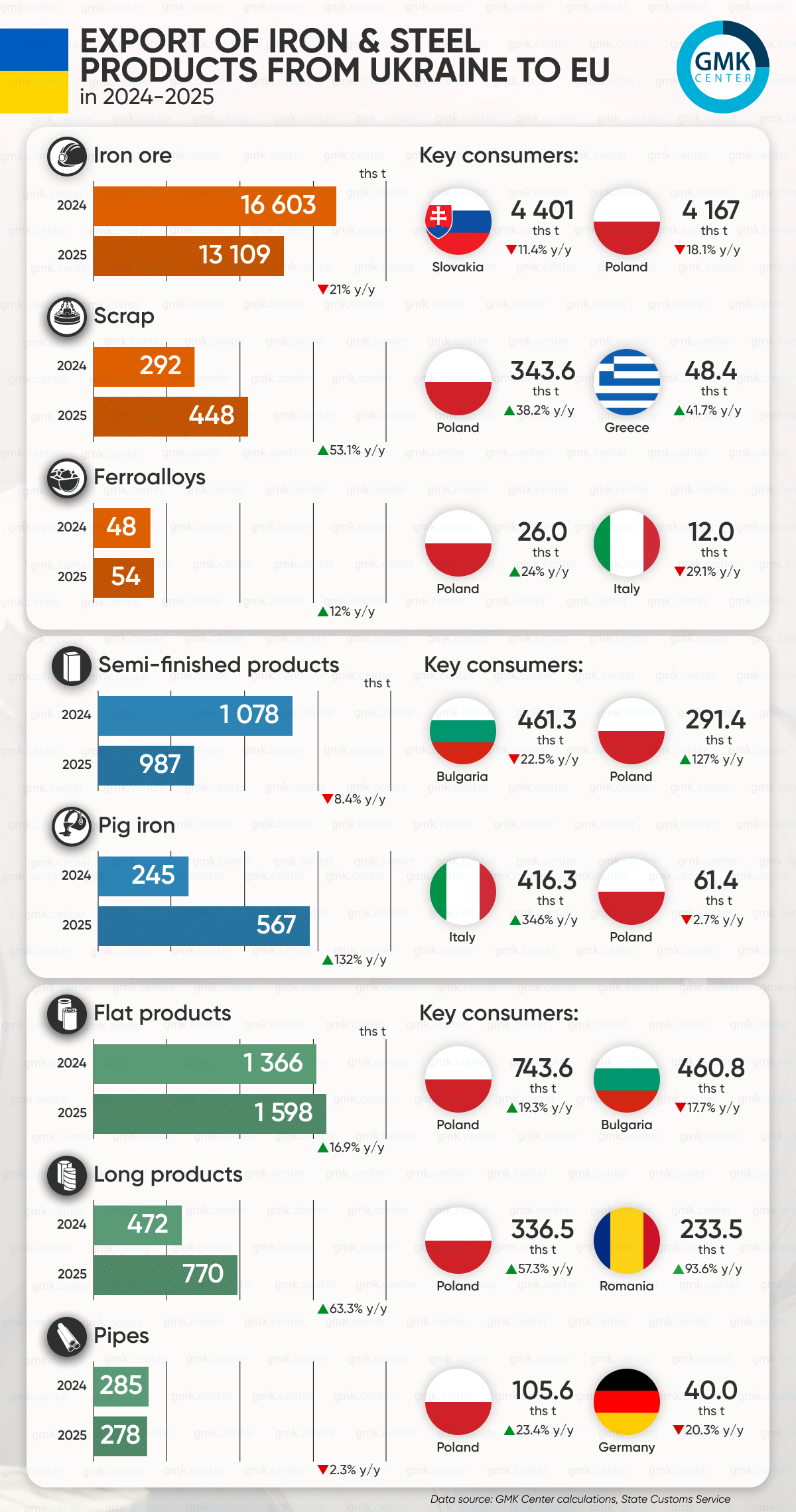

In 2025, Ukraine increased its supplies of finished steel products to the European Union. Exports of rolled steel products (flat and long products and pipes) grew by 24.6% y/y – to 2.65 million tons. The main contribution was made by the flat products segment, whose shipments increased by 16.9% y/y – to 1.60 million tons, as well as long products (+63.3% y/y – to 770,000 tons). At the same time, pipe exports remained almost at the previous year’s level, decreasing by 2.3% y/y – to 279 thousand tons.

Poland, Bulgaria, and Romania remain the largest markets for rolled steel products. In particular, flat rolled steel shipments to Poland increased by 19.3% y/y – to 744,000 tons, and to Bulgaria by 17.7% y/y – to 461,000 tons. In the long products segment, exports to Poland increased by 57.3% y/y – to 336 thousand tons, and to Romania by 93.6% y/y – to 233 thousand tons. Pipe supplies to Poland increased by 23.4% y/y – to 106 thousand tons, while exports to Germany decreased by 20.3% y/y – to 40 thousand tons.

At the same time, the raw materials group showed a sharp decline. Total exports of iron ore, semi-finished products, pig iron, ferroalloys, and scrap to the EU in 2025 decreased by 17% y/y – to 15.17 million tons. The key factor was a 21% y/y decrease in iron ore supplies to 13.11 million tons, as well as an 8.4% y/y decline in semi-finished products exports to 987,000 tons.

The largest decline in ore exports was recorded in exports to Poland (-18.1% y/y, to 4.17 million tons) and Slovakia (-11.4% y/y, to 4.40 million tons). In the semi-finished products segment, the decline in Bulgaria reached 22.5% y/y (to 461 thousand tons), while deliveries to Poland, on the contrary, increased by 126.9% y/y – to 291 thousand tons, but this was not enough to compensate for the overall decline.

Amid a reduction in key raw material flows, shipments of pig iron (+131.7% y/y, to 568 thousand tons), ferroalloys (+12% y/y, to 54 thousand tons), and scrap (+53.1% y/y, to 448 thousand tons) increased. In particular, exports of pig iron to Italy increased 4.5 times to 416 thousand tons, scrap to Poland – by 38.2% y/y to 344 thousand tons, and to Greece – by 41.7% y/y – to 48 thousand tons. At the same time, due to relatively small absolute volumes, these segments were unable to compensate for losses in iron ore.

Overall, exports of iron and steel products from Ukraine to the EU in 2025 decreased by 12.7% y/y – to 17.81 million tons. Poland and Slovakia remain key markets, but even here there has been a decline: deliveries to Poland decreased by 6.1% y/y – to 6.08 million tons, and to Slovakia by 11.2% y/y – to 4.44 million tons.

The current dynamics show that Ukraine is not and cannot become a factor of pressure on the European steel market. Even with the growth in rolled steel exports, total supplies to the EU are declining, and the possibilities for further growth are limited by internal problems in the industry. These include unstable operations of enterprises, shortages, and high costs of electricity, regular production stoppages due to power outages, and complex logistics in wartime conditions.

These factors are systemic in nature and constrain both raw material extraction and finished product output. In the absence of a stable energy supply and security guarantees, there are no prospects for significant growth in Ukrainian steel exports to the EU in the medium term. Ukraine remains a forced limited supplier rather than a competitive threat to European manufacturers.

Source: https://gmk.center