Doing business

After the beginning of the Russian military aggression, Bulgaria became an important partner of Ukraine in terms of oil product supplies, as well as a market for the products of the Ukrainian agro-industrial complex and steel industry. In particular, Metinvest’s Bulgarian asset – the rolling mill Promet Steel – has become the most important consumer of semi-finished products and hot-rolled steel amid difficulties in delivering products to the traditional Italian market.

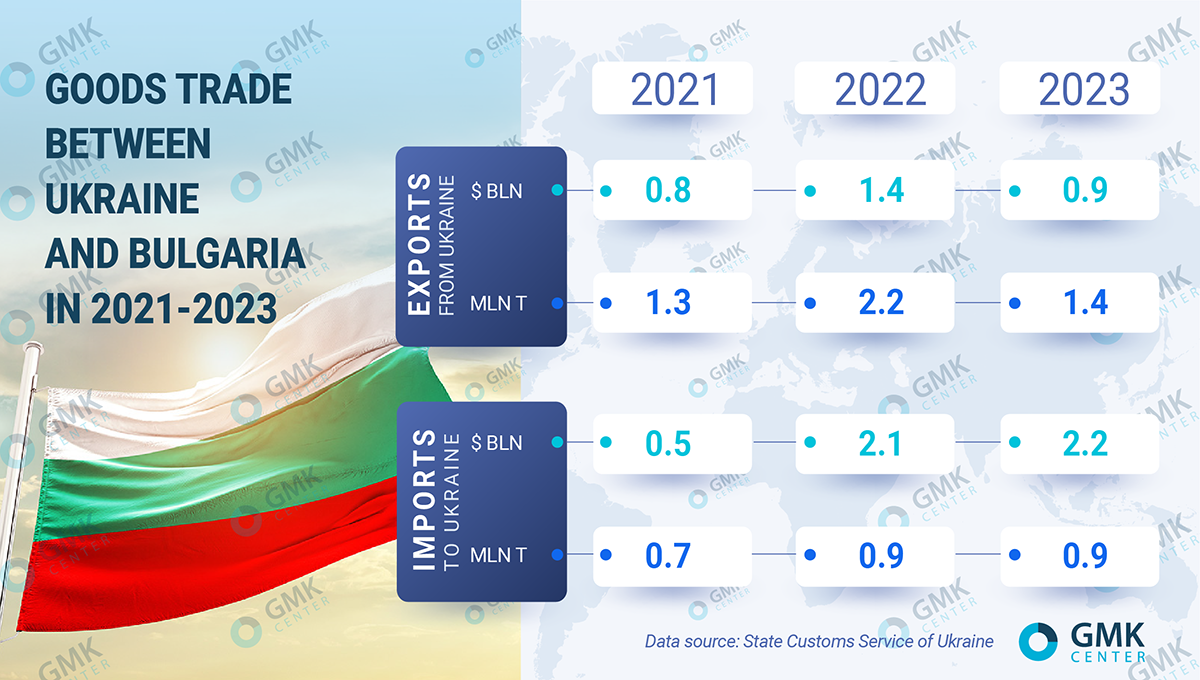

The dynamics of mutual commodity flows shows multidirectional trends. Ukrainian exports of products to Bulgaria in 2022 increased by more than 70% y/y – to 1.4 million tons worth $2.2 billion. However, in 2023, it sharply decreased due to a sharp decline in exports of agricultural products.

The largest items of Ukrainian exports in 2023 were steel products ($380 mln), sunflower oil ($158 mln), sunflower seeds ($45 mln) and sugar ($42 mln). There were also insignificant supplies of foodstuffs and wood products.

In turn, Bulgarian exports of goods to Ukraine since the beginning of the war have increased in monetary terms by 3.8 times – to $2.2bn, while in physical terms – by only 28% – to 0.9m tons by the end of 2023. The largest items of imports from Bulgaria are «other products» ($1.3 billion), which can be understood as military goods, petroleum products ($419 million) and fertilizers ($170 million). There are also insignificant supplies of consumer goods and industrial raw materials.

The situation with trade restrictions on the part of Bulgaria looks a little better than, for example, with Poland. In April last year, Bulgaria imposed a temporary ban on imports of 20 food products from Ukraine for two months. However, from May to September 2023, the European Commission itself imposed a temporary restriction on imports to five EU countries (Poland, Hungary, Bulgaria, Romania and Slovakia) of wheat, rapeseed, sunflower and corn from Ukraine. In October-November, Bulgaria imposed a ban on sunflower imports from Ukraine. However, since December 1, 2023, the ban on imports of wheat, corn, sunflower seeds and rapeseed from Ukraine was lifted. Poland did not lift the ban, and the Polish blockade of the border resulted in billions of dollars in losses for Ukraine.

Due to the absence of a common border, Bulgaria has a limited impact on the expansion of logistical opportunities for Ukrainian exports. At the same time, the country does not prohibit the transit of agricultural products (unlike Poland) and acts as an additional route for Ukrainian steel companies. For example, after the opening of the sea corridor, Interpipe transports its products from Odessa ports to Varna, accumulates the shipments there and then sends them by bulk carriers to the American Houston.

Ukraine is a net exporter of steel products to Bulgaria by a huge margin, although the volume of deliveries has decreased due to the war. Compared to pre-war 2021 exports of steel products to Bulgaria in 2023 in physical terms decreased by 17% to 702 thousand tons, in monetary terms – by 29% to $380 million.

Ukrainian exports of steel products to Bulgaria are quite widely represented. The most common export item is semi-finished steel products, the supplies of which in 2023 amounted to 458 thousand tons for $223 million. In particular, semi-finished products are supplied to Promet Steel (capacity of the enterprise is 500 thousand tons of rolled products per year), which produces long and shaped products. The plant is a foreign asset of Metinvest and receives products from the group’s Ukrainian enterprises.

Under the war conditions, Promet Steel was Metinvest’s largest foreign asset in terms of consumption of Ukrainian semi-finished products. For example, in 2021, Metinvest delivered 1.9 million tons of semi-finished steel products to its rolling mills in Italy – Ferriera Valsider and Metinvest Trametal. However, the war in Mariupol resulted in the loss of two steel mills, from which the deliveries of commercial slabs were made. Already in 2023, the supply of semi-finished products to Italy decreased to 121 thousand tons. Thus, Promet Steel became the largest foreign asset – a consumer of Metinvest’s products.

After the start of the war, Ukraine increased supplies of hot-rolled products to Bulgaria – up to 182 thousand tons for $108 mln. Other important positions saw a decline:

After the outbreak of the war, supplies of shaped rolled products, coke, rebar, coated rolled products, and semi-finished products made of alloy steel from Ukraine stopped completely. In 2021, their exports were at the level of 4-8 thousand tons, but almost completely stopped already in 2022. The decrease in supplies of certain types of steel products is due to the reduction of own production in Ukraine.

Bulgaria is a small steel producer. Steelmaking there in 2023 amounted to only 0.4% of the pan-European figure. According to WorldSteel, last year the country increased steel production by 1.4% y/y – to 489,000 tons, while in 2022 there was a 12% y/y decline – to 482,000 tons.

This level of steelmaking does not allow to cover even the needs of the domestic market. Thus, the volume of steel consumption in the country in 2021 and 2022 amounted to 1.3 million tons and 1.5 million tons. The country depends on imports, which are at the level of 2.1 million tons per year.

At the same time, Bulgaria exports approximately 1.1-1.3 million tons of steel products per year. The big difference between the export of steel products and steelmaking is formed by the operation of rolling facilities, such as Promet Steel.

The rather weak position in steel production is also reflected in the country’s exports. Compared to pre-war 2021, steel products supplies to Ukraine in 2023 in physical terms decreased by 12% to 30 thousand tons, while in monetary terms – increased by only 1.5%, to $25 million.

The key position of import of steel products from Bulgaria is rebar, import of which (13.6 thousand tons) last year amounted to about 2.1% of the total consumption of these products in Ukraine. Sufficiently significant are deliveries of shaped rolled products (4.9 thousand tons), which is 3.7% of total consumption. Already after the beginning of the war, deliveries of pipes and rolled products began – up to 5.5 thousand tons and 4 thousand tons in 2023.

Bulgarian steel imports to Ukraine represent only 2.4% of the total or 0.9% of Ukraine’s steel consumption in 2023. The key problem is limited domestic production, import dependence and the presence of nearby more marginal markets than Ukraine. Therefore, in the foreseeable future, supplies of steel products from Bulgaria will not be of any significance for the Ukrainian market.

Bulgaria is a major market for only a few types of export products of Ukrainian agro-industrial complex and steel sector. And taking into account the constant threat of restrictions on agricultural products, only the metallurgical component remains. There are no visible problems for supplies here.

In this respect, Bulgaria is an important market for Metinvest – a–consumer of Ukrainian semi-finished products, a country of processing and further export of higher value-added products to the EU, which serves as an excellent example of building a value-added chain between Ukraine and the EU. However, there are no significant opportunities for increasing the supply of semi-finished products to Bulgaria due to reaching the production capacity limit of Promet Steel.

Under the current conditions, the most necessary non-military products for Ukraine are supplies of oil products from Bulgaria, which is extremely important for fuel supply against the background of Russian strikes on the energy infrastructure.

Source https://gmk.center/ua/