Consumption drivers – construction, mechanical engineering and defense industry, iron and steel dector and oil and gas production

In H1 2024, the growth of domestic steel consumption in Ukraine slowed down, which is caused by the completion of the stage of recovery of business activity after the most difficult 2022 and the strengthening of the negative impact of current factors – electricity shortages, tough mobilization, etc. Activity in construction, certain segments of mechanical engineering and the mining industry will continue to support demand.

Growth slowdown

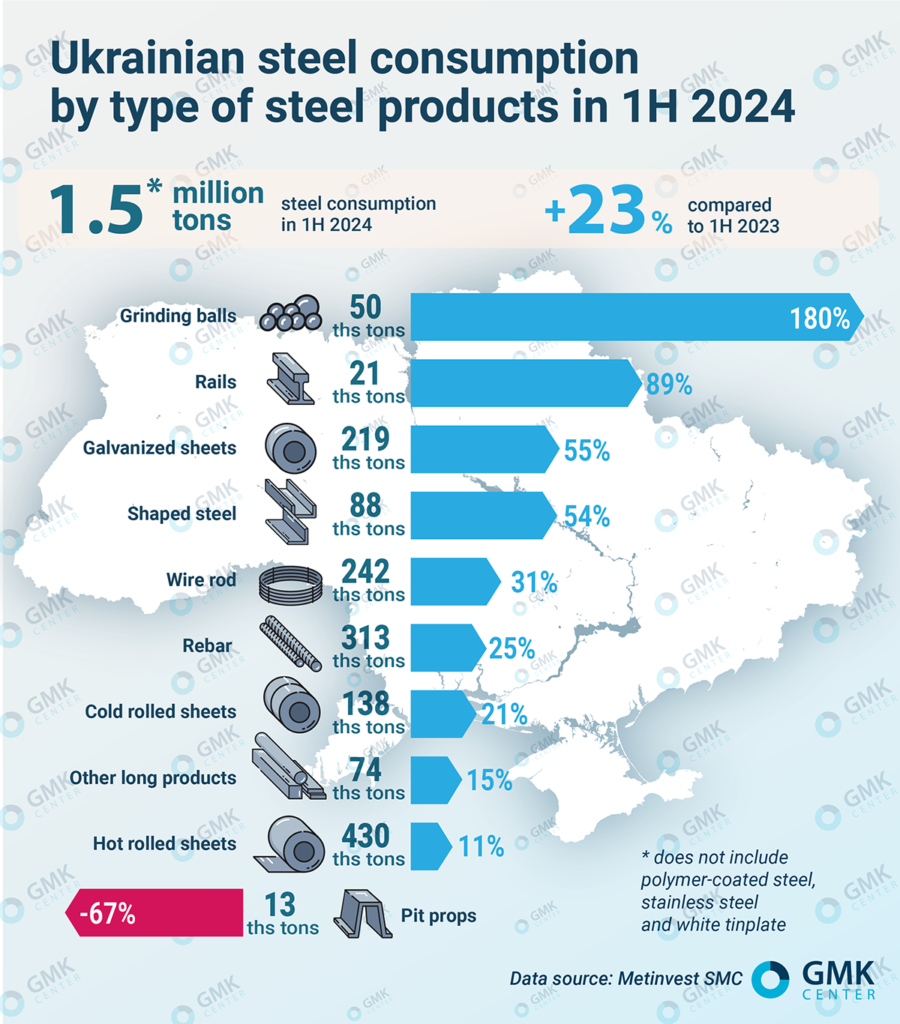

After a 2.2-fold increase at the end of last year, the dynamics of the increase in domestic steel consumption in the first half of 2024 slowed down significantly. According to the data of Ukrmetalurgprom, the consumption of rolled steel in January-June increased by 7.8% y/y – up to 1.74 million tons. At the same time, according to Metinvest-SMC estimates, in H1 2024, the capacity of the Ukrainian steel products market (excluding rolled products with a polymer coating, stainless rolled products and tinplate) increased by 23% compared to the same period in 2023 – up to 1.5 million tons.

Most of the surveyed steel traders report sales growth in the first half of the year by approximately 20-25% in physical terms. At the same time, the dynamics by month were uneven. According to the director of the Kozak Stal company, Viktor Kornilov, in January-February and in June, sales of rolled steel products were poor, while in March, April and May there was a significant surge.

Market operators note that there is no obvious shortage of any steel products on the Ukrainian market. Moreover, the dependence on imports has significantly decreased – from 39% in 2022 to the current 34.1%, although its share over the 6 months of 2024 increased by 3.4 percentage points. In total, according to the Ukrmetalurgprom, over the first half of the year, the import of rolled steel products increased by 19.7% – to 592.4 thousand tons.

The positive side of imports is that it allows to quickly cover the needs for the range of products, the production of which in Ukraine is either absent or insufficient. At the same time, for certain items, Ukraine has become completely dependent on imports, for example, rails, since during the Russian aggression, its own production facilities were destroyed. According to Metinvest-SMC, in the first half of the year, rail consumption increased by 89%, to 21 thousand tons. They arrived as part of a technical assistance package from Japan in the amount of 25 thousand tons of rails, which will be used to repair railway tracks.

Consumption Drivers

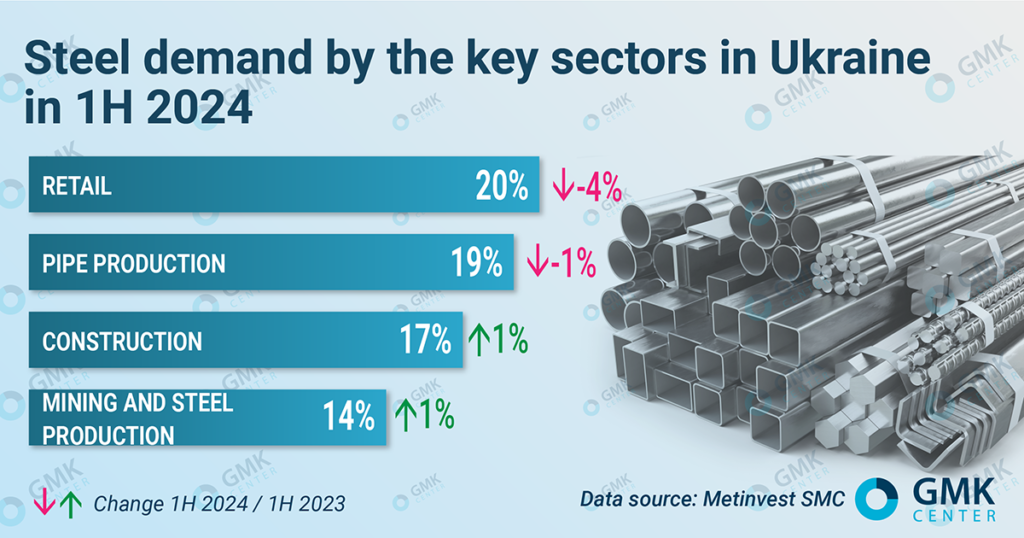

The industry structure of demand for steel products reflects the situation in the economy and its individual industries. According to Metinvest-SMC estimates, 20% of deliveries go to other steel traders. This is due to the fact that the company sells products of Metinvest Group enterprises (and other steel producers). At the same time, due to more active development of its own sales to end consumers, including small and medium businesses, the share of traders decreased from 24% to 20% based on the results of the first half of the year. Activity among private customers remains at an average level and is growing in line with the overall market dynamics.

Pipe industry

The second largest source of demand for steel in the first half of the year was pipe production, which is almost 90% export-oriented. This industry increased its production volume by approximately 15-20% in January-June, export growth for the period was 33% – 262.4 thousand tons.

Construction industry

Another key consumer is construction. In the sales structure of Metinvest-SMC, this industry accounts for 17% of sales, but the actual share is higher due to sales of construction steel products by other traders. According to Vartis estimates, in the first half of the year, the share of construction increased to 27% from 23% at the end of 2023.

The dynamics of consumption of construction steel products was quite high. According to the head of the analytics and pricing department of Metinvest-SMC, Olexander Vedernikov, infrastructure and defense projects were the main drivers of growth in the rebar market – by 25%, to 313 thousand tons, and wire rod – by 31%, to 242 thousand tons. In the first half of the year, there was a high demand for mesh for trenches, where wire rod is the raw material.

Demand for other types of construction steel products also showed high dynamics:

- galvanized steel – by 55%, up to 219 thousand tons;

- shaped steel (beam, angle, channel) – by 54%, up to 88 thousand tons.

In the construction sector, it is necessary to highlight three unrelated trends that influence the volume of steel product consumption in the industry to varying degrees:

- Increase in steel consumption in the western regions due to the construction of housing (Lviv and Ivano-Frankivsk regions) and hotels (Zakarpattia, Ivano-Frankivsk and Lviv regions), notes Serhiy Kovalenko, Commercial Director of Vartis. Plants, warehouses and elevators are also being actively built there. In turn, Metinvest-SMC notes an increase of 50%+ in steel sales in the Lviv region, mainly due to reinforcement.

- Slowdown in the processes of infrastructure restoration and construction of energy shelters. According to Vitaliy Prytula, Director of the Eurometall company (specializing in imported rolled steel), this year the scale of infrastructure construction, in particular the construction of protection over energy facilities, has sharply decreased. According to market participants, the state has not paid contractors for work already completed. In addition, in the spring there were personnel changes in government agencies responsible for restoration, which generally did not contribute to this process.

- The emergence of a new direction since February – the construction of fortification facilities, where the main demand is for wire rod. At the same time, there is ample evidence that these works are carried out with a significant increase in prices, and the facilities themselves in many cases are not suitable for use as defense.

“The growth of the galvanized rolled products market capacity is significantly higher than the dynamics of other flat rolled products segments, which is caused by the increase in imports amid the expected activation of this market segment. The following dynamics were observed for flat rolled products based on the results of the first half of the year: the capacity of the hot-rolled rolled products market increased by 11% – to 430 thousand tons, cold-rolled rolled products – by 21%, to 138 thousand tons,” says Olexander Vedernikov.

Iron and steel complex

Steel industry is one of the largest consumers in the sales structure of Metinvest-SMC, whose share in the first half of the year increased by 1 percentage point – to 14%. This is due to an increase in the consumption of grinding balls by 180% – to 50 thousand tons, which is provided by demand from iron and steel plants, which increased production and exports – by 2.2 times, to 18.3 million tons in the first half of the year. In turn, the prerequisite for increasing the utilisation of iron and steel plants was the opening of the sea corridor and the price attractiveness of iron ore exports.

Mechanical engineering

Vartis estimated the share of mechanical engineering in the overall consumption structure at 14% at the end of 2023, while Metinvest-SMC – at about 5% in January-June 2024. In any case, this industry remains the most important consumer of steel products, although the dynamics in various segments of mechanical engineering are in different directions.

Marketing and Sales Director of TAKT Metall Igor Udovichenko says that demand has grown significantly from defense industry manufacturers and their contractors who use high-speed tool grades and heat-resistant alloys.

There is also a slight increase in demand in railway engineering and the oil and gas industry. For example, Metinvest-SMC notes a 2+ fold increase in sales in Poltava region due to the increased activity of railcar manufacturing enterprises and steel plants. At the same time, other segments of mechanical engineering are generally experiencing a decline.

«We see weak demand in agricultural engineering, which is due to the loss of a large number of agricultural lands as a result of the Russian occupation, as well as from mining equipment producers, which is due to the drop in demand for coal due to the destruction of most thermal power plants,» explains Igor Udovichenko.

Metinvest-SMC notes that in the first half of the year, the consumption of special interchangeable profiles (SIP) fell by 3 times, to 13 thousand tons. SIP is used as support in mines. This is the only segment that showed a decline, which is due to a reduction in production and the curtailment of work in mines in the combat zone.

Market expectations

The current situation in the entire Ukrainian economy is characterized by volatility and high uncertainty. By the end of this year, the level of demand for steel products may be affected by at least the following factors:

- Worsening economic consequences of the escalation of hostilities. This risk remains very high, it may manifest itself very quickly and unpredictably in scale.

- Electricity deficit. The National Bank has worsened the forecast for electricity deficit for the III-IV quarters of 2024 to 10% and 12%, respectively. This may negatively affect economic activity in steel-consuming industries (more likely) and the economic feasibility of rolled steel production by Ukrainian manufacturers (less likely), who are forced to import expensive electricity from Europe for uninterrupted operation.

- Increased mobilization. This has already led to a shortage of labor (drivers, fitters, etc.) and may intensify the decline in business activity in a number of steel-consuming industries. According to Vitaly Prytula, some construction and installation projects have been stopped due to mobilization. Moreover, steel already paid for by customers is lying in the warehouses of steel trading companies, which no one is picking up: drivers are afraid to go, because they can be given a summons somewhere along the way.

At the same time, since the beginning of the war, the main national players in the steel trading market have become larger, have already acquired significant experience in working in conditions of uncertainty and have a certain «safety margin».

The factor supporting the demand for steel products (if there are no strong force majeure circumstances) will remain activity in construction, individual segments of mechanical engineering, including the military-industrial complex, iron and steel industry and oil and gas production. For example, according to Vartis estimates, the demand for reinforcement in 2024 will grow by 15% – to 723 thousand tons. Therefore, taking into account these factors, the immediate prospects of the market can be assessed moderately optimistically.

«It is difficult to talk about any specific forecasts for the end of the year. Nevertheless, there is a tendency towards an increase in domestic consumption of steel products,” notes Olexander Kalenkov, President of the Ukrmetalurgprom.

At the same time, Ukraine has a huge long-term need for the restoration and construction of new infrastructure, the consumption of steel within which will require several million tons per year.

Source: https://gmk.center