Doing business

According to OECD estimates, in 2023, global excess steel production capacity reached 610 million tons in annual terms. India and Asian countries are increasing steel production capacity. China produced 1 billion tons of steel in 2023 (54% of global production) and exported more than 90 million tons of steel in 2023. Due to sanctions, Russia offers its steel products and semi-finished products at a heavy discount. All the above factors lead to aggressive growth of imports to local markets, forcing other countries to apply trade protection measures in order not to lose local production

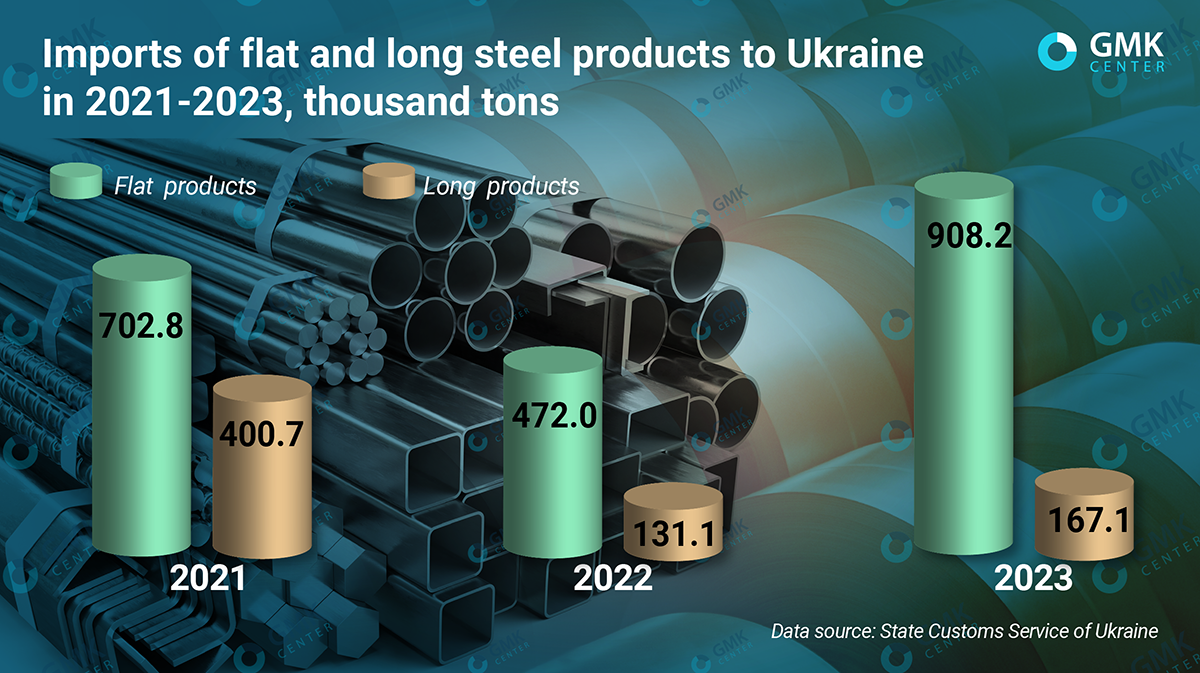

Since the beginning of the war, imports of steel products to the Ukrainian market have increased dramatically. The reason for this was the shortage of some types of iron and steel products, which arose due to the reduction of own production. Two plants in Mariupol have been under occupation, and the remaining enterprises are operating at under-utilization.

According to Ukrmetalurgprom, imports of rolled steel products to Ukraine last year increased by 80% – to 1.12 million tons, which amounted to 32% of domestic steel consumption. As GMK Center calculated, in 2023 imports of flat-rolled steel to Ukraine increased by 93.2% y/y – to 908.2 thousand tons, long products – by 28% y/y, to 167.1 thousand tons. Ukraine is rapidly approaching the status of a net importer of flat products.

The increase in imports of steel products to Ukraine and the need to protect domestic producers raises the issue of imposing trade restrictions. Since September last year, Ukraine has imposed final anti-dumping duties on imports of rebar and wire rod from Belarus, as well as coated sheet steel from China. These anti-dumping investigations began before the war, and new ones were not carried out after the start of the full-scale aggression of the Russian Federation

The most obvious option is to tighten sanctions against Russia and Belarus. Although there has been virtually no direct trade with these countries since the beginning of the war, the option remains to impose, following the example of the European Union, restrictions on imports of products from third countries made with materials from Russia and Belarus.

«The European Commission has proposed a mechanism to prove the country of origin of steel raw materials and a list of documents that importers must provide. Such documents include the Mill Test Certificate EN 10204 3.2 and/or the manufacturer’s official confirmation that the imported products are produced without the use of semi-finished products and raw materials of Russian origin. The importer is responsible for the reliability of the information provided,» says Oleksandr Kalenkov, President of the Ukrmetalurgprom Association of Enterprises.

Ukraine can introduce a similar mechanism of trade restrictions. To introduce such a ban, it is necessary to assess the possibilities of import substitution of products with a component of materials from the Russian Federation and Belarus, preferably with Ukrainian goods. No less important is the mechanism of control over the movement of such goods across the border.

«There are two ways: the first is the introduction of sanctions by the National Security and Defense Council of Ukraine regarding the activities of specific entities (producers of goods) in Ukraine; the second is a ban on the import (import) of goods into Ukraine as a type of sanctions. In the second case, amendments to Ukrainian legislation will be required. It is necessary to establish a mechanism to administer such a ban, as well as to dive into the process of production of such goods», says Alena Omelchenko, partner of Ilyashev & Partners law firm, head of international trade practice.

At the moment, not even control over the import of goods from third countries to Ukraine that have been transited through the Russian Federation is not ensured. This is not a difficult task compared to the identification of goods produced from Russian raw materials or semi-finished products.

Nevertheless, there are attempts to introduce such a mechanism. According to Oleksandr Kalenkov, starting from the summer of 2023, steelmakers have repeatedly raised the issue of the need to develop and introduce such a mechanism in Ukraine, both at the level of executive (Ministry of Economy, Ministry of Finance, State Customs Service) and legislative (the relevant committee of the Verkhovna Rada) authorities.

“We have proposed a concrete action plan. Since the implementation of this mechanism requires amendments to the Customs Code, which implies the adoption of a relevant law, we have formulated positions to be included in this document and submitted for consideration to the mentioned authorities. At this stage our proposals are being considered, and we hope that in the foreseeable future this mechanism will also work in Ukraine,” says the head of the Ukrmetalurgprom.

Delaying the introduction of this mechanism in Ukraine seems illogical, as it was the Ukrainian authorities who insisted that the EU impose a ban on imports of products from third countries made with Russian materials. Ukraine needs to do everything possible to ensure that Ukrainian legislation and sanctions policy correlate with the relevant EU norms.

«Sometimes we complain that the European Commission is too slow in implementing sanctions against Russian steel and rolled metal, but in this case, the EU member states clearly outpaced Ukraine in introducing restrictions that took place precisely at the initiative of representatives of our state. The European Commission has already introduced similar requirements for importers and they have come into force in EU member states since September 30, 2023, and in Ukraine this issue is still under development and there is no information when such requirements can be introduced in our country also», says Mauro Longobardo, CEO of ArcelorMittal Kryvyi Rih.

However, there are still options for introducing new trade restrictions against steel products from other countries, such as China (26% of total steel imports to Ukraine in 2023). On the one hand, supplies of steel products from China are already restricted by anti-dumping duties on many types of steel products. However, on the other hand, these duties are not always effective. For example, under the existing trade restrictions on imports of Chinese pipes, their supplies last year compared to 2021, their supplies increased by 2.5 times, up to 43 thousand tons.

«The Ukrainian pipe market is completely open, any producer from any country comes to it and sells its products. Therefore, it is possible to directly limit the import of Chinese pipes to Ukraine by setting strict quotas similar to the EU measures for the same pipes from China. There are no other options to limit supplies. Yes, now in Ukraine there is a 52% anti-dumping duty against pipe products from China, but it is zero for a certain range of pipes. This is what suppliers take advantage of when importing Chinese pipes to Ukraine. The revision of these duties will begin only in two years. In general, for Chinese pipe exporters Ukrainian anti-dumping duties are not an obstacle – they can sell at any price, taking into account subsidies to their producers from the PRC authorities,» says Georhiy Polskyy, CEO of Ukrtruboprom.

Amid incomplete utilization of Ukrainian steel capacities, it is extremely important to stimulate domestic demand for steel products. The most effective was the program of reconstruction of war-damaged infrastructure (housing, social facilities, bridges, production facilities), which predetermined the growth of domestic steel consumption by 2.2 times in 2023 as compared to the first year of the war. Metinvest-SMC estimates that Ukraine will need about 3.5 million tons of steel to rebuild destroyed housing and social infrastructure.

Support for domestic producers is also important given the significant increase in imports of steel products to Ukraine. The «Made in Ukraine» platform envisages expansion of the list of categories of goods purchased from local manufacturers in public procurement and adaptation to state support programs. In this case, we can consider prioritizing Ukrainian steel over imported steel in public procurement.

«The problem of the shameful share of import penetration in public procurement must be solved – before the war this figure was about 40%. Now nobody counts it. In the EU, this figure is about 5 percent,» Dmytro Kisilevskyy, MP, deputy head of the Verkhovna Rada committee for economic development, said.

According to Georgiy Polskyy, our country needs to stimulate domestic consumption of Ukrainian pipes. And this can be done by setting the percentage of localization in public procurement through the Prozorro system, following the example of procurement of engineering products (from January 2024 – 20%). For the state, the purchase of Ukrainian-made products means the return of a certain amount of money to the budget in the form of taxes, while imports do not bring anything to the treasury.

For their part, Ukrainian producers are ready to increase production in order to increase the volume of infrastructure rehabilitation and industrial output.

«We are ready to take maximum part in the post-war reconstruction of Ukraine with the help of our range of products», says Mauro Longobardo.

Source https://gmk.center/ua/