The prospects for improving the economic situation in Ukraine by the end of this year appear limited

The results of the first six months of 2025 show that Ukraine’s economic growth reserves have effectively reached their limits. The previously dominant factor in development — the recovery effect after the 2022 recession, combined with budgetary stimulus and international financial assistance — is no longer capable of sustaining economic activity.

As a result, most key economic indicators showed minimal growth in the first half of the year, with some indicators already turning negative. According to preliminary calculations by the Institute for Economic Research and Policy Consulting, Ukraine’s GDP growth reached 1.3% year-on-year in the first half of the year.

The key obstacles to improving the economic situation in Ukraine are:

- high gas and electricity tariffs;

- a huge foreign trade deficit (in the first half of the year, it increased by 49% year-on-year – to $18.5 billion);

- increased rocket and drone attacks on energy and gas infrastructure;

- labor shortages;

- deterioration in the agricultural sector (agricultural production fell by 18.5% y/y in January-July);

- tense geopolitical situation and global trade conflicts, etc.

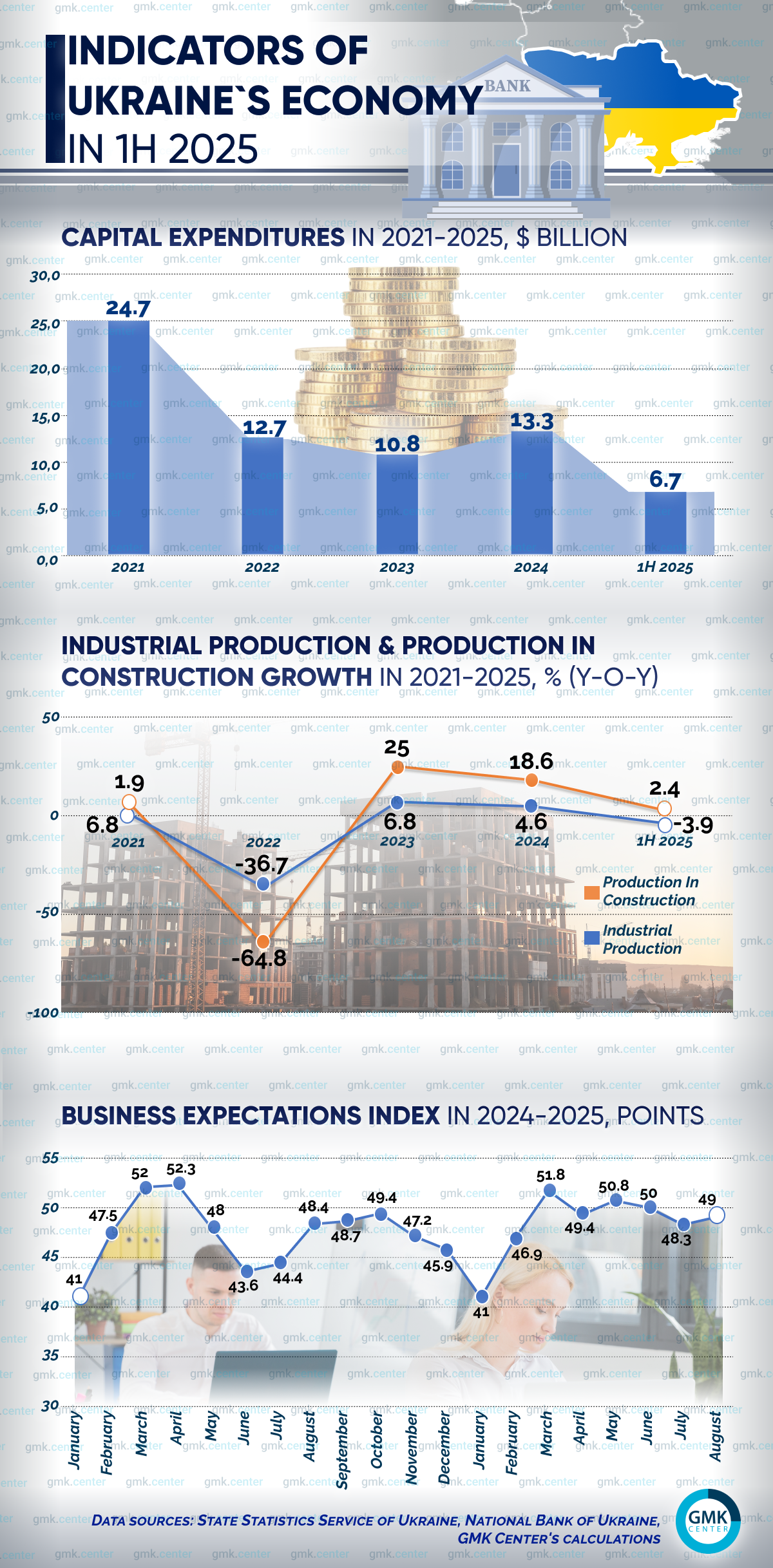

Meanwhile, capital investments in the Ukrainian economy continue to show positive dynamics. In January-June, capital investments increased by 22.4% year-on-year, reaching $6.7 billion. According to the State Statistics Service, in the first half of the year, the most significant growth in capital investments was recorded in the agricultural sector – by 46.6% y/y, industry – by 32.1% y/y, and the transport and logistics complex – by 12.3% y/y. Capital investments are characterized by greater inertia relative to other economic indicators, which is also explained by the accumulated underinvestment in the previous two years and the low base of comparison.

Other macroeconomic parameters are already showing a negative trend. The decline in industrial production in Ukraine in the first half of 2025 amounted to 3.9% y/y. In particular, the decline in the extractive industries reached 12.6% y/y, in energy supply and the gas sector – 1.6% y/y, and in manufacturing – 0.6% y/y. Only the defense industry and related segments, as well as industries serving the domestic consumer market, continue to show positive dynamics.

The situation in the construction sector is slightly better. According to the results for January-June, the volume of construction work completed in Ukraine grew by only 2.4% y/y, compared to last year’s growth of 18.6% y/y. The situation has been significantly complicated by an 8.7% y/y decline in the volume of engineering infrastructure construction, which had previously been a driver of growth for the entire construction industry.

Currently, commercial construction is the only driver of the industry, showing a 26% year-on-year increase in January-June. This is facilitated by active construction of warehouses, elevators, production facilities, and hotels in the central and western regions of the country.

Business sentiment assessments are on the verge between pessimistic and neutral positions. Since March, the business expectations index has fluctuated within a limited range around the neutral mark of 50 points (p.). Its latest change was an increase to 49 p. in August from 48.3 p. in July, which is associated with stable consumer demand and the situation in the energy sector, as well as a decline in inflation.

This indicates moderate pessimism in the business environment, although these estimates may change dramatically in the current circumstances, for example, if Russia intensifies its attacks on energy and other strategically important infrastructure. At the same time, the prospects for improving the economic situation in Ukraine by the end of 2025 appear limited.

Source: https://gmk.center/ua