Crude steel output in 2024 exceeded expectations, but the next year output could fall by 9%, exports by 16%

The state of the Ukrainian iron and steel industry is an important component of the country’s economic forecasts. The iron and steel sector provided 5.7% of GDP, incl. supply chain in 2023 and contributed almost 15% to export of goods.

Unprecedented challenges of the war, as well as an unfavorable situation on global commodities markets create the basis for cautious expectations.

Steel output in 2024 exceeded expectations

Steel output in Ukraine in 2024 turned out to be much better than expected. By the end of the year, it could amount to 7.5 million tons, which is 21% higher than last year. But this is still 65% less than pre-war. In 2021, steel production in Ukraine amounted to 21.4 million tons.

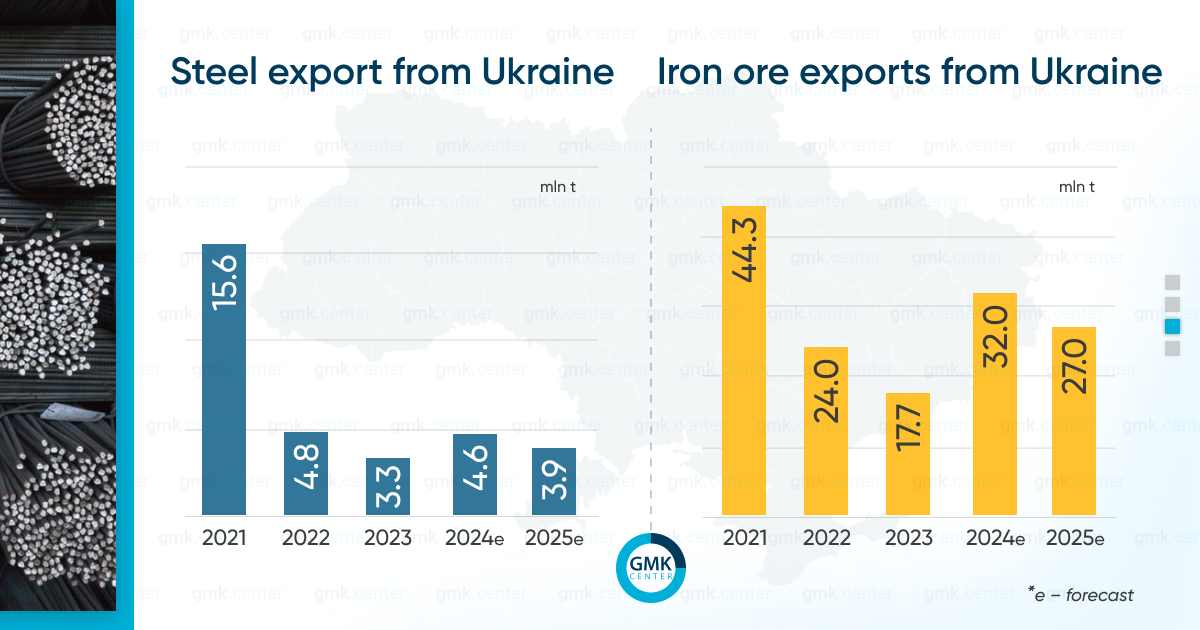

The so-called «Sea Corridor», which was launched at the end of 2023, helped to relieve transport routes on the western borders and simplify the logistical tasks of steel exports. In the spring of 2024, the second blast furnace at ArcelorMittal Kryvyi Rih was launched. As a result, the export of semi-finished products increased by 650 thousand tons or 60% over 11 months of 2024, and finished steel – by 500 thousand tons or 40%.

The «Sea Corridor» also contributed to the resumption of iron ore exports to China. Over the 11 months of 2024, 13.0 million tons of iron ore were delivered to China from Ukraine, 43% of all Ukrainian iron ore exports.

Our forecasts for 2025 are based on increased risks for the entire supply chain of Ukrainian iron and steel sector. The sum of these challenges and their negative consequences will directly affect the reduction in the output.

Prices are expected to decline in 2025

The global steel and raw materials market is going through a crisis period. The growth of steel exports from China coincided with a period of weak demand on key markets. These are two key factors that affect prices.

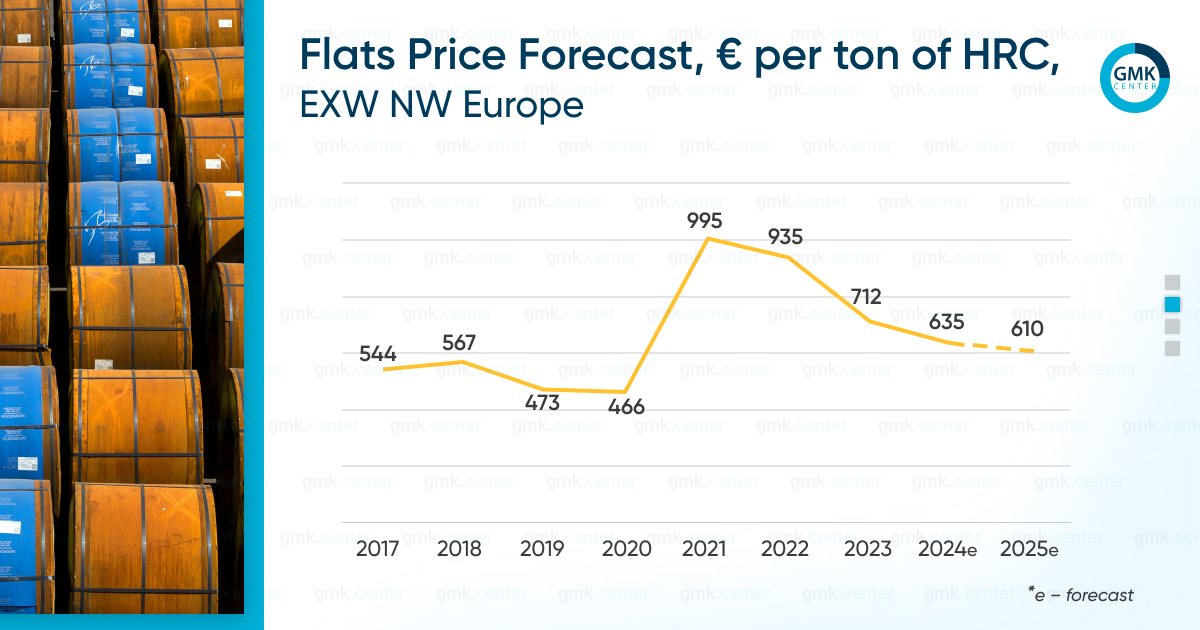

For example, steel exports from China this year may grow by 25% to 115-118 million tons, including semis. At the same time, the activity of steel-consuming industries in the EU may fall by 3-4%. SO, there is excess supply on global market. As a result, flats prices in the EU fell by 11% in 2024, and many steelmakers found themselves on the verge of solvency.

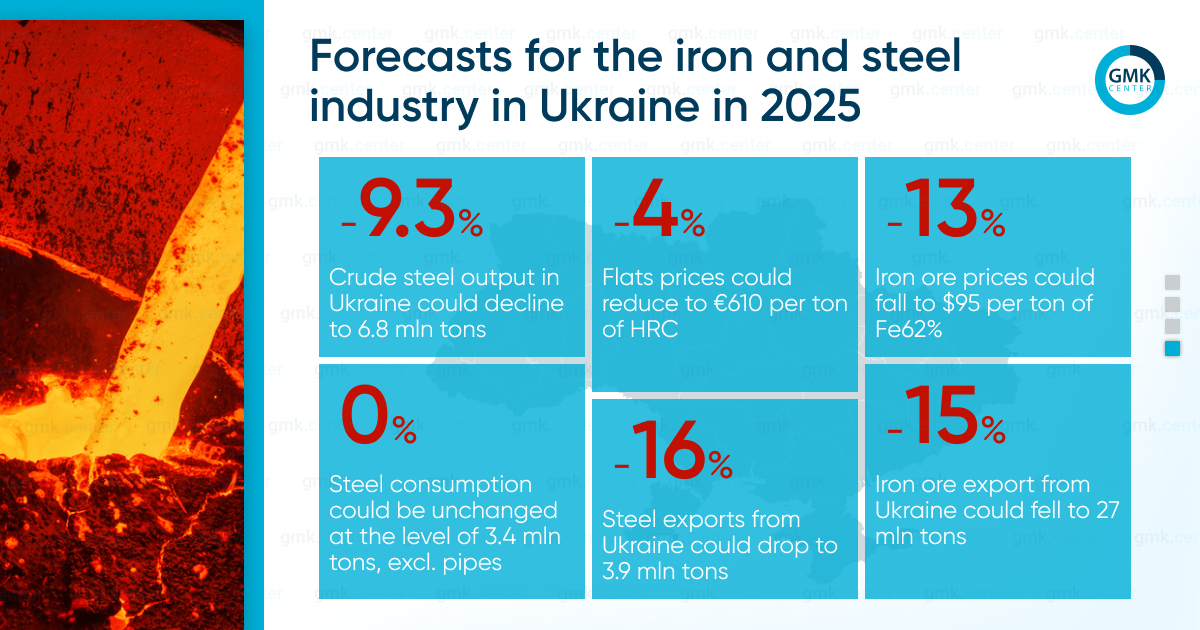

The next year also promises to be challenging. China’s steel consumption is expected to decline by 1.5% in 2025. Exports are likely to remain high at around 100 million tons. So, pressure on prices on global markets to keep strong. Steel demand in the EU, major market for Ukraine, could continue to decline amid worsening economic forecasts. The decline next year is expected to be around 0.7% with some recovery in the second half of the year. Therefore, we expect flats prices in the EU to decline by another 4% in 2025.

In an effort to increase margins, Chinese steel companies put pressure on raw material suppliers, which is normal response to lower steel prices. It was facilitated by the build-up of iron ore inventories in Chinese ports, against the background of good supply, while demand was reduced in certain periods. Although by the end of the year, steel production in China has a chance to remain at the level of last year. As a result, in 2024, the average price of iron ore fell by 10% to $110 per ton of Fe62% in China.

We are pessimistic about iron ore prices next year. China faces a systemic struggle with excess capacities and needs of output cuts in the coming years. It is clear that steel demand in China will stagnate, and the stimulus is only intended to soften the impact. We expect high volatility in iron ore prices next year, given the high remaining inventories and likely oversupply. In such an environment, iron ore prices could again lose 13-14% to $95.

The fall in iron ore prices has a negative impact on the competitiveness of vertically integrated steel producers in Ukraine, for whom the iron ore segment was previously an important factor of resilience. Therefore, a reduction in margins along the entire chain may also lead to a reduction in steel exports from Ukraine.

Steel and iron ore exports to fall in 2025

The outgoing 2024 was marked by a local peak in steel and iron ore exports from Ukraine. We expect a decrease in steel exports from Ukraine next year. Firstly, we expect the price situation to worsen. Secondly, a wave of increased import restrictions is observed around the world.

If negative scenarios can be avoided, the export of steel products from Ukraine in 2025 may decrease by 600-700 thousand tons. There are too many risk factors for the iron and steel sector, that can completely turn the picture for the worse.

Pig iron and semis

Export of semi-finished products, as you remember, was the key factor in the growth of steel exports from Ukraine in 2024. The disparity between falling iron ore prices and relatively expensive scrap made the export of square billet profitable. In Q4 2024, scrap prices dropped due to active export of billets from China, which will likely negatively affect global exports of billet, and from Ukraine in particular. The second point here is that ArcelorMittal Kryvyi Rih stopped the blast furnace and continues to operate with one. Next year, exports of semis from Ukraine may decrease by 300-500 thousand tons.

Pig iron exports have remained at 1.3 million tons for the third year in a row and have every chance of remaining at that level in 2025. However, the geography of exports may change towards the US, where the market offers greater profitability compared to the European market.

Challenges in the EU

The «sea corridor» has largely untied the hands of Ukrainian steelmakers. But if you look at the export statistics, it has grown at the expense of neighboring EU countries, access to which is possible by railway. Therefore, a special risk is the extension of the regime of exclusion of Ukraine from import duties in the EU, which expires in early June 2025.

Aggressive export of agricultural products this year and conflicts with our European neighboring states may lead to the fact that the duty-free regime with the EU will be under threat. As a result, the export of steel products from Ukraine may also fall under the restrictions of safeguard measures in the EU. Let us remind that the mechanism of safeguard TRQ system on the steel market in the EU will be revised towards tightening and presented by April 2025. It is impossible to assess the consequences today, but it will be extremely negative for the entire economy of Ukraine.

Import restrictions in the US

Trump’s return to the White House is expected to intensify trade wars. For example, an extension of the duty-free steel trade deal between the US and the EU is considered unlikely. It can be assumed that the same decision will be applied to Ukraine in the matter of exemption from Section 232. Today, Ukrainian steel products are not subject to the 25% import duty. This made it possible to export about 60 thousand tons of pipe products in 2024. Finished steel from Ukraine is not supplied to the US due to a number of anti-dumping measures. But next year, pipe export volumes are under threat.

Coal supply issues

Coal supplies are a major risk for Ukrainian steelmakers, which may affect export volumes. Domestic supplies of coking coal in Ukraine are highly concentrated. According to our estimates, the Pokrovske Coal Mine market share in 2024 was 66%. As a result of hostilities, the mine operations may be stopped. In this case, the Ukrainian industry may face the lack of coal supply of up to 2.5 million tons. It is possible to physically replace domestic supplies with imports. But imported coal will be more expensive. For example, if we are talking about coal from Australia, it is up to $50 more expensive and will increase the cost of steel by 10-12%. Domestic steelmakers don’t have such margins. Thus, the question of the economic feasibility of such imports may arise, limiting steel production by reducing exports. First of all, sea exports may suffer, which is associated with higher transportation costs.

Iron ore export

A price of $95 is insufficient for profitable supply of iron ore products to China from Ukraine. High US dollar nominated inflation in Ukraine has significantly increased the costs of iron ore production. For example, one of the producers, by the end of the first half of the year, reported its cost in dollars increase by 11% y/y. In addition, high electricity prices are an important problem, which accounts for up to 50% of the costs of producing iron ore concentrate. Therefore, next year, we expect a reduction in iron ore exports from Ukraine by 15% to 27 million tons.

The end of hostilities will somewhat stimulate iron ore exports by reducing the cost of transportation by sea, but the effect will not be fast. Today, the «sea corridor» provides for increased payments for freight, insurance and risk premiums for crew. But according to logistics market players, transportation costs will not decrease quickly. Firstly, the number of vessels ready to service Black Sea region is limited. Secondly, risks in the Black Sea will remain due to a large number of threats, such as sea mines.

Domestic market stagnates

If in 2023 steel consumption in Ukraine increased by 57%, which was a recovery from the shock of the beginning of the war. Then in 2024 consumption could remain at about the same level – 3.4 million tons, excluding pipes. Despite economic growth of 3.5%-4.0%, in 2024 we didn’t see an increase in steel consumption.

The indicators of consumption sectors were contradictory. On the one hand, construction of buildings added a significant 26% in the first half of 2024. At the same time, the area of new residential starts decreased by 6.6% y/y. It can be explained by the intensification of the completion of projects in the process of construction. But no one was in a hurry to start new projects. Hence the lower consumption of steel at the final stages of construction work. According to our estimates, before the war, the construction sector accounted for 78% of steel consumption in Ukraine.

Industrial sectors also showed mixed dynamics. For example, the output of steel structures for construction increased by 21.7% over the first 6 months of 2024, while the output of metal containers decreased by 0.6%. The output of machinery and equipment increased by 11.9%, while the output of vehicles fell by 2.5%.

Next year, we also expect neutral dynamics in the domestic market. If active hostilities continue for most of the year, consumption has a chance to decline by 5%. If hostilities are stopped at the beginning of the year and reconstruction programs begin by the end of 2025, consumption has a chance to grow by 5%.

The implementation of post-war reconstruction programs may be a growth factor. But there is a lot of room for scenarios and various calculation options here. The range of estimates of steel consumption for post-war reconstruction varies from 1 million tons to 3 million tons, according to different sources. This additional demand volume will be “blurred” over several years. We don’t believe that in the first months after the end of hostilities, the demand for steel will be explosive. In addition, Ukraine does not have successful experience in implementing large-scale infrastructure projects. It is enough to recall EURO 2012. Therefore, we are skeptical in assessing the impact of this factor on steel consumption in Ukraine.

Strength is depleted

The entire European iron and steel industry was in a state of crisis in 2024 and will be, at least, in the first half of 2025. Ukrainian iron and steel sector, which is an integral part of the European steel market, cannot remain aloof from these negative processes.

The above-mentioned risk factors and the already exhausted resilience margin of the industry in Ukraine have determined our expectations of a decline in all key indicators. In our opinion, steel output in Ukraine in 2025 may decrease by 9.3% to 6.8 million tons. But there are more pessimistic scenarios with a complete shutdown of some producers of both iron ore and steel sectors.

Supply chain problems, a stagnant domestic market, and deteriorating export conditions are the main factors limiting the development of the Ukrainian steel sector. In 2025, not only physical indicators will deteriorate, but also companies` profitability, which will lead to underinvestment. The end of hostilities will have a partial positive impact on the industry, but only a year later. All factors indicate that 2025 will be a very difficult year for the Ukrainian iron and steel sector.

Source: https://gmk.center