Doing business

Investments are the key solution to overcoming the current energy crisis. The main tasks faced by businesses and the authorities of many countries are the following: to reduce pressure on consumers, to follow the carbon neutrality program, to accelerate economic recovery and – in particular for Europe – to reduce dependence on russia after its invasion of Ukraine.

Global energy investment is set to grow by more than 8% in 2022 to a total of $2.4 trillion, well above pre-pandemic levels. The main focus is increasingly shifting towards investments in renewable energy sources and networks. The rapid rise in electricity prices in Europe has exposed the weaknesses of the fossil fuel-dominated market, which is the biggest contributor to the price formation of energy, despite a declining overall contribution to the energy matrix.

The marginal cost of low-carbon electricity sources (renewable, nuclear and hydropower) is close to zero, while the cost of electricity from gas-fired plants rose to more than 600 EUR per megawatt-hour (MWh) in many European countries at the end of August, when russia was still reduced gas supply more.

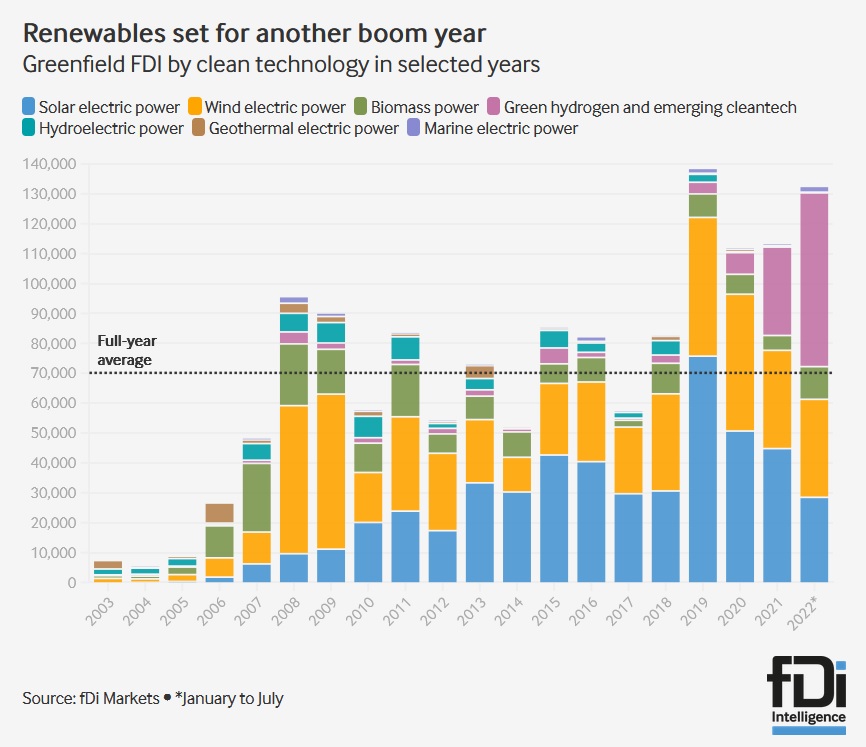

Investments in new renewable energy projects and their number have increased and reached a maximum in the last 3 years. According to data from fDi Markets, foreign investors announced 327 projects in the field of renewable energy between January and July 2022, which corresponds to the average figure for the previous three years. What’s more, these 327 projects have mobilized a whopping $132.2 billion in committed capital investment, already higher than the full-year figures for 2021 and 2020, and just shy of the $138.3 billion announced in 2019, which remains a record year.

Foreign direct investment (FDI) in renewable energy is set to reach new highs in 2022 as mega-developments in hydrogen and offshore wind have dramatically increased the sector’s capital intensity. The main credit for this shift belongs to green hydrogen. Hype around its potential remains high, with developers announcing multibillion-dollar power-to-x projects that combine large-scale solar and wind power to produce hydrogen in various geographic regions. Offshore wind energy, which requires an average of US$3 billion to develop 1 GW of installed capacity, has also been a major driver of investment in the sector.

Overall, green hydrogen and other new clean technologies such as carbon capture accounted for 44% of the $132.2 billion in FDI directed into the renewable energy sector between January and July, followed by wind energy (24.8%), solar energy (21.5%), biomass (8.3%) and the rest of other technologies, fDi Markets figures show.

The consequences of military aggression have also changed the focus of investment in fossil energy sources. New liquefied natural gas projects are driven primarily by short-term increases in natural gas demand in Europe and Asia due to russia’s war in Ukraine and subsequent sanctions and restrictions on russian gas exports. The main motive is to reduce dependence on Russian energy resources, especially for European countries.

The vast majority of announced FDI projects for natural gas extraction in the first half of the year are in Qatar. In addition to projects in Qatar, Western investors have announced gas projects in countries such as Israel, Norway, Australia and New Zealand, reinforcing an emerging trend in which investors from developed countries are more inclined to do business with similar partners in other developed countries to mitigate geopolitical risks. Global energy players have stepped up efforts to secure natural gas supplies.

Thus, Russia’s military aggression against Ukraine is changing the modern energy market. High prices are prompting some countries to increase investment in fossil fuels as they seek to secure and diversify their sources of supply. However, long-term solutions to today’s crisis lie in accelerating the clean energy transition by increasing investment in efficiency, clean electricity and a range of alternative fuels. And more and more projects are implemented precisely with a long-term perspective in mind.

Source: www.fdiintelligence.com

Source: www.fdiintelligence.com