Doing business

In 2025, Ukraine’s steel industry increased its production of commercial rolled steel by 4.8% compared to 2024, to 6.52 million tons. This was reported by Ukrmetprom.

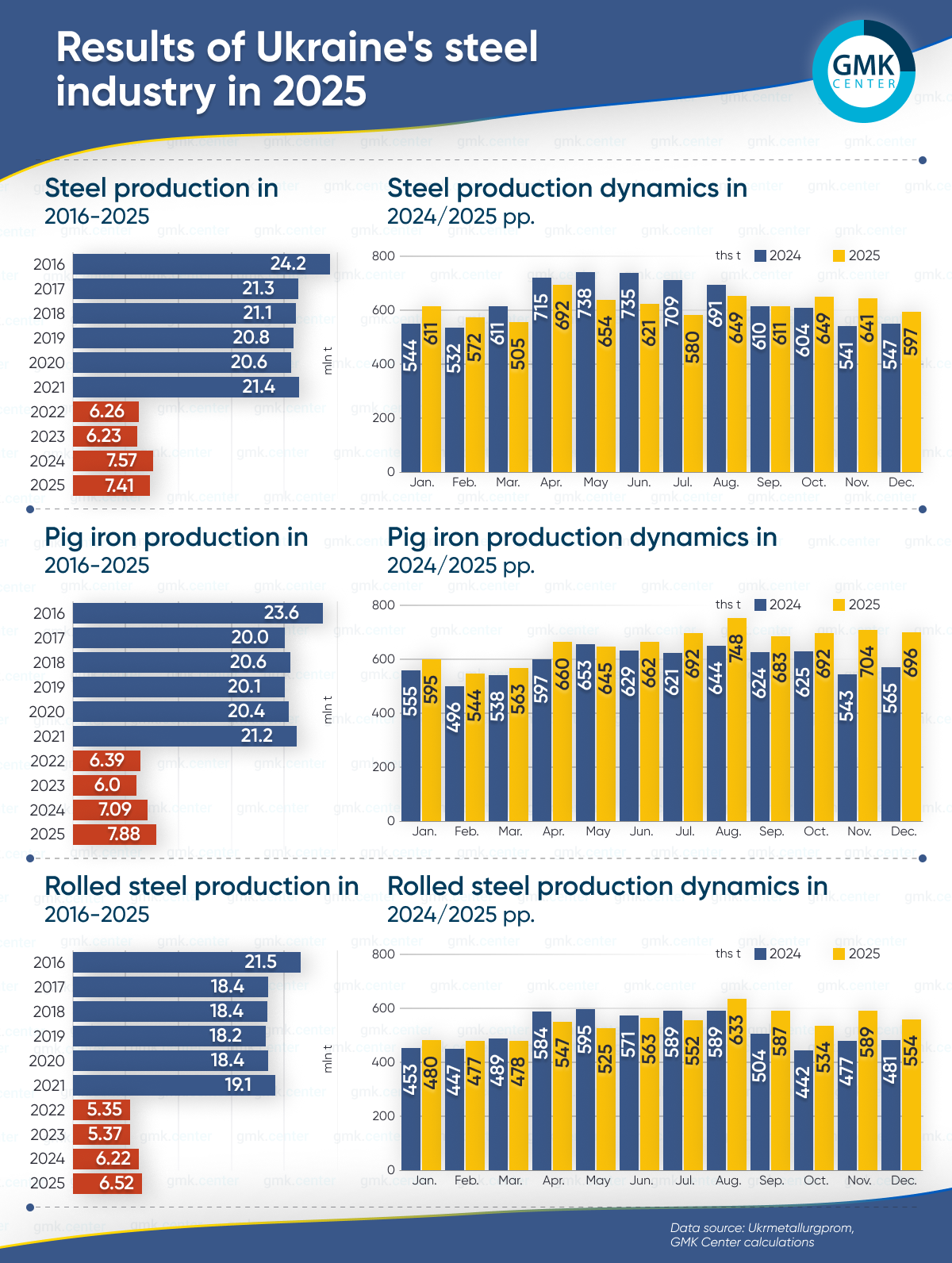

Pig iron production increased by 11.2% year-on-year to 7.88 million tons last year, while steel production decreased by 2.2% year-on-year to 7.41 million tons. Overall, the industry’s performance continued to grow in 2025, reaching its highest levels since the start of the full-scale invasion, except for steel production. Thus, the increase in pig iron output against the backdrop of a decline in the steel segment indicates structural changes in the industry and its adaptation to current market conditions. The growth in pig iron production is a direct result of increased external demand for raw materials, primarily from export markets.

Despite the gradual growth in production, the results are significantly lower than pre-war levels. In particular, pig iron production over the last five years is as follows: 2021 – 21.16 million tons, 2022 – 6.39 million tons, 2023 – 6 million tons, 2024 – 7.09 million tons, 2025 – 7.88 million tons. Steel production amounted to 21.37 million tons in 2021, 6.26 million tons in 2022, 6.23 million tons in 2023, 7.58 million tons in 2024, and 7.41 million tons in 2025. Rolled steel production was 19.08 million tons, 5.35 million tons, 5.37 million tons, 6.22 million tons, and 6.52 million tons, respectively.

In Q4 2025, the industry produced 2.09 million tons of pig iron (+20.7% y/y; -1.4% q/q), 1.89 million tons of steel (+11.5% y/y; +2.5% m/m), and 1.68 million tons of rolled products (+19.8% y/y; -5.4% q/q). In December, pig iron output amounted to 696.2 thousand tons (-1.2% m/m; +23.1% y/y), steel – 596.7 thousand tons (-6.9% m-o-m; +9.1% y-o-y), rolled products – 554.4 thousand tons (-5.9% m-o-m; +15.3% y-o-y).

The results of 2025 form a complex but indicative basis for assessing the industry’s prospects in 2026. According to GMK Center estimates, next year’s steel output in Ukraine is likely to remain at a neutral level – around 7.2 million tons in the baseline scenario, which effectively means reaching the current production ceiling in wartime conditions. Further growth will be hampered by weak global economic conditions, aggressive exports from China, high energy and logistics costs, and tighter trade restrictions in key markets.

At the same time, continued high demand for raw materials, especially pig iron, may continue to support blast furnace production. In 2026, potential growth in steel production in the EU and the European market’s rejection of Russian cast iron will create additional opportunities for Ukrainian exporters in this segment. This explains the structural imbalance in 2025, when cast iron production grew against the backdrop of stagnation in steelmaking.

The key risk factor for the industry in 2026 will remain the introduction of CBAM and new EU tariff quotas, which, given Ukraine’s high dependence on the European market, could significantly limit export opportunities. Under these conditions, manufacturers’ main hopes are pinned on the domestic market, which, if defense or reconstruction projects are implemented, could ensure limited but stabilizing growth in steel consumption.

A separate systemic risk for the industry remains the instability of energy supplies due to regular rocket and drone attacks on energy infrastructure. Over the past month, the production capacities of key enterprises have been repeatedly halted due to emergency shutdowns: Zaporizhstal suspended operations twice, complicating the production schedule and affecting the supply chains of the entire steel sector. ArcelorMittal Kryvyi Rih is facing similar challenges, where power outages are forcing the company to quickly adjust its production plans and use backup power sources. Such force majeure events significantly increase operational risks, force companies to increase their energy reserves and backup capacity, and create uncertainty about the uninterrupted operation of blast furnaces and rolling mills in 2026.

Source: https://gmk.center