Doing business

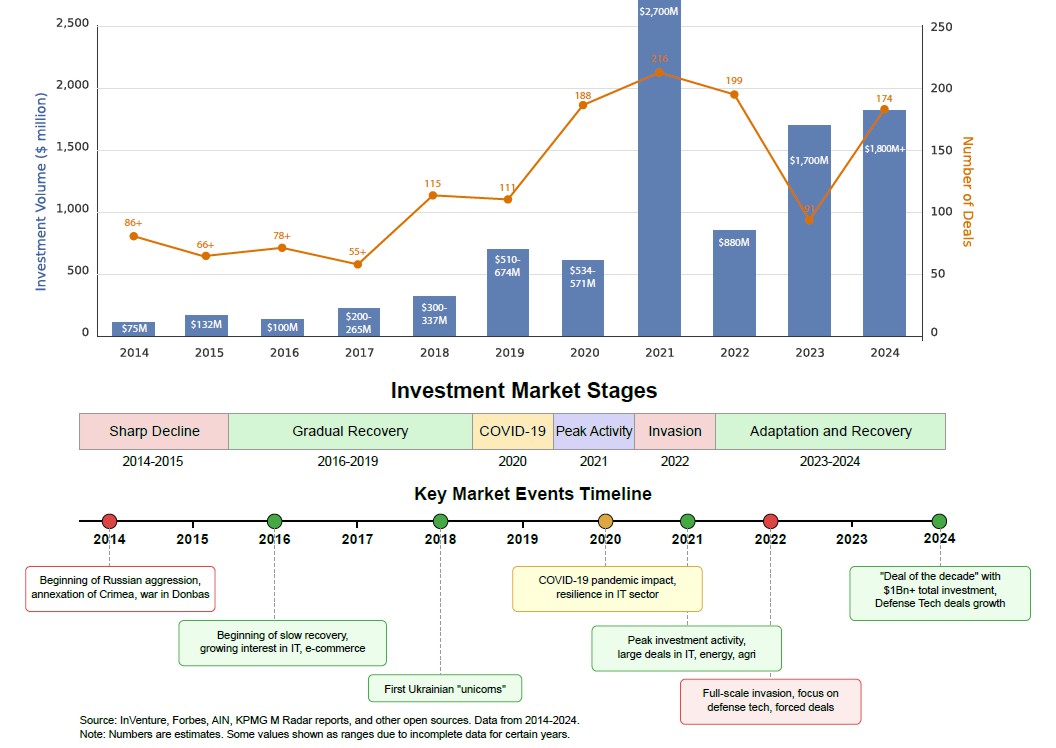

Ukraine’s venture market shows signs of recovery — the number of investment deals in 2024 grew to 174, nearly double the 91 deals recorded in 2023.

This is according to the Ukrainian Venture Capital and Private Equity Association (UVCA) in its report titled “A STORMY DECADE: A Ten-Year Retrospective on the Ukrainian Investment Landscape.”

One of the most notable events of the year was the “deal of the decade” — the merger of Lifecell, DATA Group, and Volia, with a transaction volume exceeding $1 billion. Additionally, defense tech deals began to play a significant role in the venture capital structure.

UVCA notes that 2023–2024 marked a period of adaptation and partial recovery: while the number of deals increased, their average size remained modest.

According to the Association, total investment volume in 2024 exceeded $1.8 billion, compared to $1.7 billion in 2023.

The most successful year for Ukraines investment market remains 2021, when 216 deals were closed totaling $2.7 billion, primarily in the IT, energy, and agribusiness sectors.

In total, more than 1,400 deals were concluded in Ukraine between 2014 and 2024, with a cumulative volume of $8.8–9.2 billion.

Ukrainian Investment Market Dynamics (2014–2024)

Investment Volume, Number of Deals, and Key Historical Events

| Year | Investment Volume ($ million) (Estimate) | Number of Deals (Estimate) | Key Events |

| 2014 | ~50-100 | 86-88 | Beginning of Russian aggression, annexation of Crimea, war in Donbas |

| 2015 | ~132-146 | 66-69 | Continued decline, extreme investor caution |

| 2016 | ~100 | 78-87 | Beginning of slow recovery, growing interest in IT, e-commerce |

| 2017 | ~200-265 | 55-89 | Continued growth, investments in IT outsourcing, product companies |

| 2018 | ~300-337 | ~115 | Further growth, emergence of the first unicorns |

| 2019 | ~510-674 | ~111 | Growth of interest in the agricultural sector and infrastructure, dominance of domestic M&A deals (KPMG) |

| 2020 | ~534-571 | ~188 | Decline due to the COVID-19 pandemic, but continued activity in IT |

| 2021 | 2,700 | ~216 | Peak investment activity, large deals in IT, energy, agriculture |

| 2022 | ~880 | ~199 | Sharp decline due to the full-scale invasion, focus on defense tech, forced deals |

| 2023 | 1,700 | ~91 | Gradual recovery, increase in the number of deals, but smaller checks |

| 2024 | 1,800+ | ~174 | Continued recovery of investment market Closed deal of the decade with a total investment of $1Bn + Defence Tech sector deals play key role in venture capital deals |

Key Challenges and Decade-Long Trends

UVCA highlights a longstanding shortage of institutional investors (LPs) in Ukraine’s investment ecosystem — nearly half the average for the CEE region.

International and regional fund activity also remained limited, affecting capital inflow and the number of local PE fund managers.

Despite the full-scale war, Ukrainian private funds continue to operate and focus on diversified investment strategies across technology, agriculture, food processing, energy, infrastructure, and industry — all crucial sectors for economic recovery.

Shifting Deal Structures and Regional Dynamics (2023–2024):

Overall, during the war years, domestic investment rose to 55% of all deals (compared to 40% in 2014–2021), while the share of American and European investors fell from 22% to 17%, and investors from other countries — from 16% to 11%.

Growth Sectors: MilTech, Energy, Agribusiness

Since 2022, there has been a surge in interest toward defense technologies (drones, communication systems, cybersecurity, military software).

Simultaneously, energy security has drawn more attention — with investments in renewables, energy storage, and gas extraction.

The agricultural sector remains attractive, though focus has shifted to logistics, processing, and exports. Investment activity in real estate, retail, and non-critical sectors has declined.

UVCA lists among the notable deals:

UVCA estimates that MilTech investments during 2022–2024 may have exceeded $200 million, although exact figures are difficult to determine due to confidentiality.

The Tech Sector Remains a Magnet for Investment

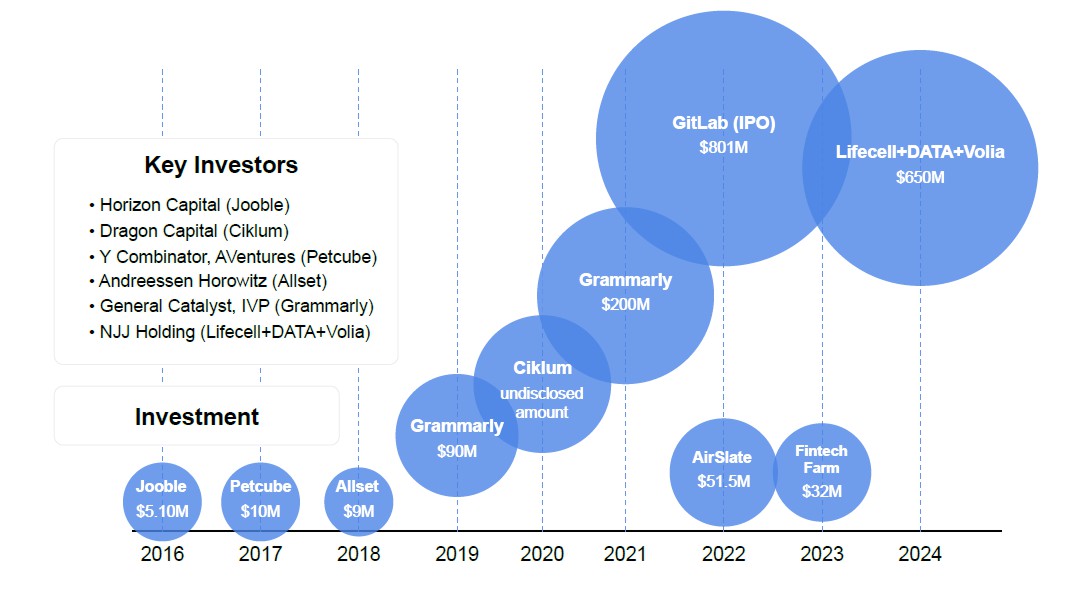

Despite the war, the IT sector continues to be one of the most resilient. Notable deals include Grammarly, Creatio, Allset, as well as the acquisition of Ukrainian tech companies such as Intellias and Digitally Inspired by international players.

However, by 2024, the share of IT and telecom in total investment declined to 35% (from 46% in 2021), agribusiness to 12.5% (from 17.6%), while energy rose to 17.6% (from 7.5%), and MilTech to 8% (from 0.5%). Construction and real estate remained stable at 12.5%.

Key IT Sector Investments in Ukraine (2016–2024)

Source: https://inventure.com.ua