Doing business

Strengthening the banking sector and developing a well-functioning capital market will be essential for the successful reconstruction of Ukraine. This column sets out an initial roadmap for this process. We argue that specific preparations can and should start already during the war. These include planning for a comprehensive asset quality review and the subsequent recapitalisation of the banking sector; drawing up privatization plans for some of the large state banks; and designing efficient processes to handle the non-performing loans that will inevitably be a legacy of the war.

The financial sector will be central to a successful reconstruction of Ukraine’s economy. In our chapter in the CEPR volume Rebuilding Ukraine (Gorodnichenko et al. 2022), we highlight the key reform priorities needed to foster Ukraine’s financial development. It is clear that once the war ends, very substantial volumes of domestic and external funds will need to be mobilised and channelled to the right projects. This will need to happen swiftly but without compromising financial stability. Getting this balancing act right will be important: earlier boom-bust episodes have eroded public support for a market-based economic system among Ukrainians (De Haas et al. 2016).

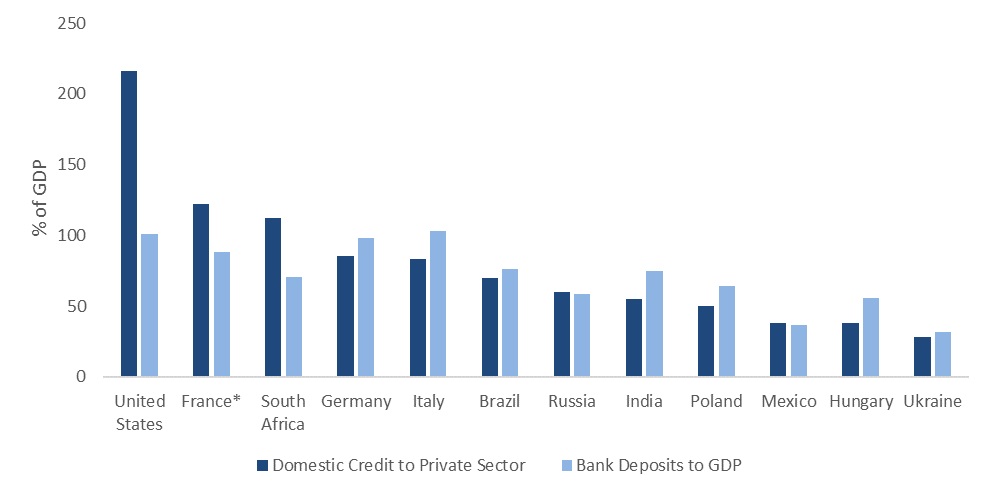

Ukraine’s pre-war financial sector was underdeveloped and heavily bank-based. The country’s traumatic transition experience – combined with weak institutions and high inequality (and thus a thin local investor base) – has held back financial market development (Pivovarsky 2016). Even though Ukraine’s financial sector is predominantly bank-based, the total stock of bank lending to the private sector stood at just 28 percent of GDP in 2021. The country’s deposit base remained low, too (Figure 1).

Figure 1 Ukraine’s banking system in international comparison

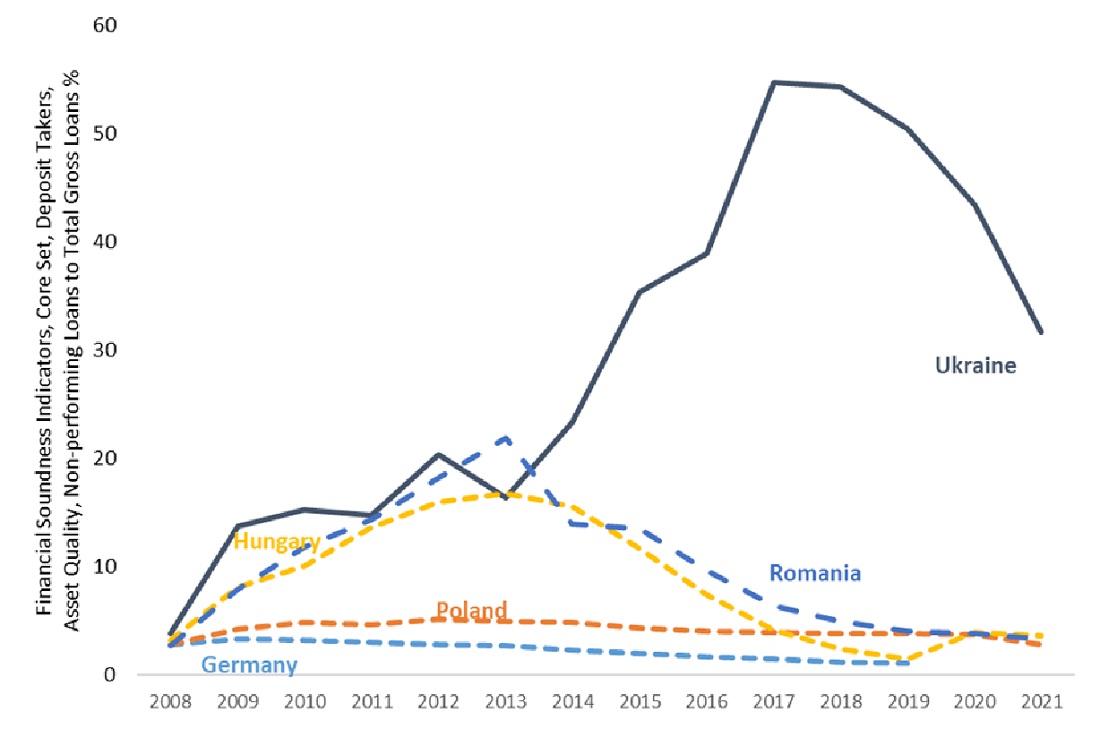

For years, the Ukrainian banking system suffered from weak risk management, widespread related-party lending and regulatory forbearance. After Russia’s annexation of Crimea and the onset of the war in Donbas in 2014, the country experienced a severe economic crisis. As a consequence of the crisis and the introduction of proper oversight by the National Bank of Ukraine (NBU), the share of non-performing loans (NPLs) increased from less than one fifth of the total in 2013 to over half of all loans in 2017.

Following two rounds of asset quality reviews, more than 80 banks were closed and PrivatBank (the country’s largest lender) was nationalised. Other banks were recapitalised and strict limits for their related-party exposures were enforced by the central bank. After peaking in 2017, NPLs started to come down as a result (Figure 2).

Non-bank financial intermediation was also underdeveloped before the war. The insurance market, money market, and bond markets all remained very shallow. Ukraine’s equity market capitalisation stood at just 5 percent of GDP in 2021 and capital market infrastructure was highly fragmented.

Figure 2 Non-performing loans in Ukraine and comparator countries

Dealing with the NPL legacy of the war

As auditors currently cannot visit many business premises, a comprehensive and detailed evaluation of asset quality is only possible after the cessation of hostilities. Soon after the war, a comprehensive asset quality review (AQR) should allow the NBU to calibrate bank-specific recapitalisation needs. After the AQR, a sector-wide and strategic approach to NPL resolution will be required. This process should be efficient and quick, and avoid discriminating across types of banks (for example, state versus private or domestic versus foreign banks).

A (substantial) part of all NPLs may be the direct result of hostilities and occupation rather than economic distress per se. Recovering (some of) the loan value in these cases will be different from traditional post-crisis workouts that involve lawsuits, negotiations and/or the collection of collateral from debtors. Instead, it will resemble the foreclosing of collateral during the 2014–2015 occupation of Crimea. Loans that lost value due to the war, and that might be recovered later from Ukraine’s claims on Russian assets frozen in third countries, could be centralised in a specialised agency.

Getting the sequencing of AQR, the creation of a new, specialised agency (if needed) and recapitalisation right will be crucial. It will be worth learning from the experience of other countries that introduced specialized agencies in post-crisis situations (e.g. the Republic of Korea). Preparations for an in-depth asset quality review could and should start during the war. Once the war ends, a detailed asset quality review should take place immediately, followed by a swift recapitalisation, using prepared and bank-specific recovery plans. While bank recapitalisation during the war is unlikely, planning should start early to ensure continued confidence in the banks. For those banks that continued to be profitable, initial recapitalisation may already start during the war.

Large-scale equity injections will likely be needed when the war ends and the AQR has been finalised. Recapitalisation can be done through direct injections of capital or subordinated debt by the government; by foreign parents of the remaining international bank subsidiaries; or by private owners of independent local banks. In the case of state banks or any new nationalisations, recapitalisations should be followed by bank commercialisation (introducing independent board members, market-based salaries, proper risk management and underwriting standards, improved transparency) and, lastly, by preparing for privatisation.

Further commercialisation of the banking sector

Ukraine’s banking sector has long suffered from the harmful effects of politically motivated lending. Hence, its post-war restart will be an opportunity for the Ukrainian government to clean up not just banks’ balance sheets but also their shareholder and management structure where needed and with international support. This will involve even stricter due diligence of bank owners and managers to weed out related lending, building on the positive experience after the 2014–15 crisis.

Deepening Ukraine’s banking sector will require the privatisation of most of its main state lenders, which will account for an even greater majority of all banking assets after the war. An important problem to be addressed urgently is that state banks remain reluctant to write off or restructure debt in a way that would reduce the value of any (collateralised) state assets. While there is no legal restriction on financial restructuring by state banks, in practice the perception is that any loan restructuring that entails a (partial) write-off may be challenged by law enforcement agencies and considered as misappropriation or damage to state property. State banks therefore continue to ‘evergreen’ loans by substantially extending maturities, thus preventing a more thorough clean-up of their balance sheets.

Regulatory alignment with the EU

Ukraine is now an EU candidate country and aims to pursue EU membership as soon as possible. Even before accession, regulatory and institutional alignment with existing EU frameworks can provide important economic benefits. Regulatory and supervisory alignment can help in levelling the playing field for subsidiaries of international banking groups and support long-term sustainability of cross-border activities in Ukraine. For example, alignment of Ukraine’s framework for professional secrecy and confidentiality with EU standards will allow Ukrainian representation on joint supervisory and resolution colleges.

Developing money, debt, and equity markets

It will be critical to rebalance the financial sector towards capital markets as Ukrainian companies and entrepreneurs will need a wider range of instruments to support the growth of their businesses. Moreover, many enterprises will have depleted their equity base during the war, thereby also limiting their ability to take on additional debt.

Further regulatory reforms will be needed to reinvigorate the securities market. Ukraine still lacks a financial collateral law and reforms of the derivatives markets are needed to ensure Ukraine will obtain a clean legal opinion on netting and close-out netting from the International Swaps and Derivatives Association.

As there may be significant interest among a range of social and responsible investors to support Ukraine’s economic recovery, the securities market regulator (NSSMC) should prioritise designing and implementing regulations enabling the issuance of corporate and municipal bonds with specific social use of proceeds.

Small business finance and financial inclusion

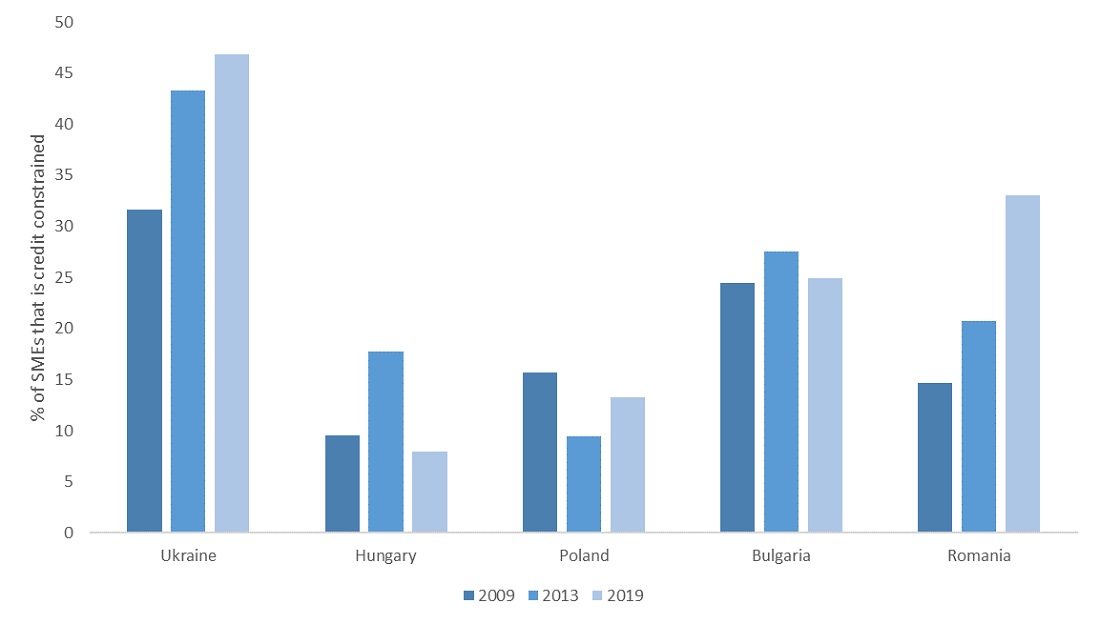

The deepening of Ukraine’s financial sector should benefit broad segments of the country’s population, thus helping to restore jobs and livelihoods. Banks – especially those that traditionally have focused on large, state-owned and/or connected companies – will have to adjust their lending practices to become more inclusive and broad-based lenders. Even before the war, the share of SMEs that were credit constrained was high and increasing (Figure 3). The Ukrainian government introduced several SME-focused COVID-19 support policies and programmes, which provided partial interest rate compensation as well as credit guarantees. Some of these programmes can be used again after the war.

In line with attempts to rebalance Ukraine’s financial system towards a greater use of equity instruments, the government can also explore tax incentive schemes to support firms that would like to raise equity. Lastly, donor-sponsored advisory support for SMEs can help war-affected but viable companies scale up and, where appropriate, digitalise their operations. Small-scale exporters can be helped to meet EU standards. This will be especially important for businesses that were reliant on trade with Russia and Belarus and that need to access new markets.

Figure 3 Credit constrained SMEs in Ukraine and in comparator countries

Mobilising external financing while maintaining financial stability

As international donors assist Ukraine with its rebuilding efforts after the war, it will be critical to ensure that donor inflows are predictable over time and progressively rely on commercial solutions with the goal to establish a vibrant financial and capital market in Ukraine once the reconstruction period ends. Setting aside a large pool of resources to offer risk insurance via specialised agencies – such as the World Bank’s Multilateral Investment Guarantee Agency (MIGA) – would be critical to mitigate political and war risks. This may be needed for an extended period as the durability of any peace agreement will need to be tested. The earlier the authorities articulate a post-war financial-sector strategy, the lower policy uncertainty will be and the easier it will be to engage private sector investors in Ukraine’s reconstruction.

Source: https://voxukraine.org/