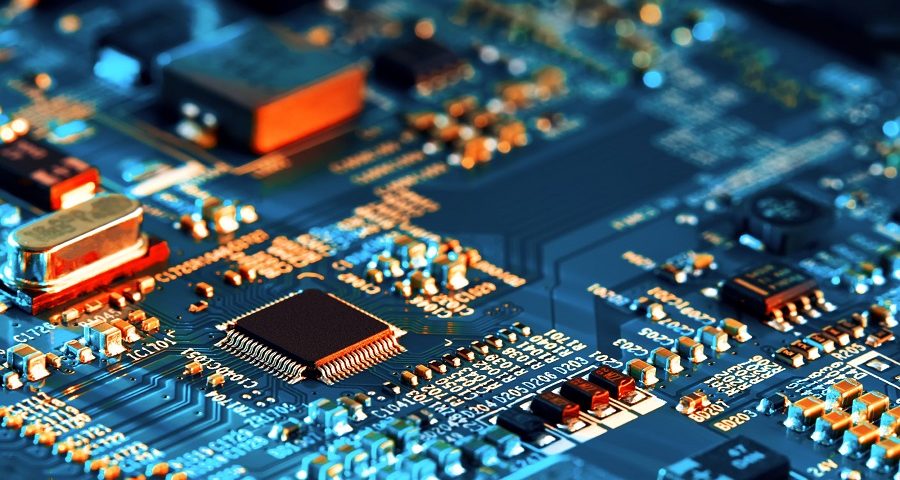

Four of the five largest foreign direct investment (FDI) projects recorded in 2022 were in the semiconductor subsector. The global chip shortage has been a key topic for almost two years, and Covid-19-related supply chain issues, which impacted several industries, were significantly felt in the development of chips.

Several large pushes have been made to ease these supply chain issues, while also developing national and regional propositions for a key target sector for future growth and security. The US CHIPS and Science Act and European Chips Act are two prime examples.

In turn, foreign investment in semiconductors is on the rise. Provisional data from our FDI Projects Database shows an 18% increase in project numbers in 2022.

The importance of semiconductors cannot be understated. The industry is expected to grow annually by 12.2%, reaching $1.38trn by 2029, according to Fortune Business Insights. Chips are used across a plethora of industries and are particularly important in tech and automotive sectors.

Below are the TOP-5 largest FDI projects announced in 2022 (where project value information was available):

1. TSMC increasing US investment to $40bn

TSMC, the world’s largest semiconductor company, announced plans to build a second semiconductor facility at its US site in Phoenix, Arizona, in December 2022. Previously, the company had invested $12bn (T$361.7bn) to build a new semiconductor plant on the site. Its latest plans up its total investment in the US to $40bn.

The second plant should open in 2026. It will produce tiny three-nanometre chips (the most advanced semiconductors). The company’s existing facility will start reducing the size of its current five-nanometre chips to four nanometres.

The investment amounts to one of the largest FDI projects in US history. It is also a firm nod to the US CHIPS and Science Act – a large-scale investment drive by the US to encourage research and development in the semiconductors industry. President Joe Biden has commented on the significance of this investment.

The TSMC project will put the US at the forefront of global semiconductor manufacturing. It also provides assurances to several large US companies that are continuing to feel the impact of the recent chip shortages.

2. Vedanta and Foxconn investing $18bn in India

Vedanta, an India-based oil, gas and metal company, signed two memoranda of understanding to establish a semiconductor fab unit, a display fab unit and a semiconductor assembling and testing unit in Gujarat, India. It will partner with Taiwan-based Foxconn in a 60:40 joint venture. The company estimates the project will cost around $18bn and create 100,000 jobs.

The proposed semiconductor manufacturing fab unit will operate on the 28-nanometre technology nodes and the display manufacturing unit will produce Generation 8 displays catering to small, medium and large applications.

3. SK Hynix’s $15bn facility in the US

SK Hynix, a South Korea-based supplier of dynamic random access memory chips and flash memory chips, plans to invest an estimated $15bn (Won18.4trn) to build a new advanced chips packaging manufacturing facility in the US. The investment is likely to create around 1,000 jobs. SK Group chairman Chey Tae-won highlighted the company’s continued investment into the US, while President Biden emphasised the US as the key destination for advanced technologies and the country’s willingness to do business with its allies.

4. Intel $13.4bn expansion of operations in Ireland

Intel, the US-based multinational corporation and technology company, announced plans to expand its chip production factory in Kildare, Ireland. The company will invest $13.4bn in the plant and create 1,600 new jobs. This will take the company’s total investments in Ireland to more than $30bn.

The investment is part of a spending spree in Europe. Although €17bn ($18.48bn) had been earmarked for a new mega-fab plant in Magdeburg, Germany, latest reports suggest Intel is still negotiating for subsidies amid increasing costs and difficult market conditions. Nonetheless, the company is committing at least €6.8bn to the Magdeburg facility.

5. AES offshore wind farm in Vietnam

Vietnam’s Ministry of Industry and Trade announced in July 2022 that AES, a global renewable energy provider, is planning to create a major offshore wind farm in the country. Vietnam says AES will invest $1.3bn to develop a 4,000-megawatt offshore wind farm in Binh Thuan. Although AES has not yet officially confirmed the project, an apparent letter of intent was submitted to a Vietnamese energy delegation.

Vietnam saw a huge growth in FDI projects in 2022. Renewable energy is the country’s eighth-largest FDI sector and it recorded a record number of projects in this field in 2022. Vietnam is intent on increasing its wind capacity and wants to become carbon neutral by 2050.

AES has been active in Vietnam since 2008 and has outlined how it can play a key role in meeting Vietnam’s demand for sustainable and affordable electricity.