Ukraine has the potential to increase iron ore exports to China, but imports of Chinese coated sheets and pipes threaten local producers

Before the outbreak of the full-scale war, China was Ukraine’s main trade partner. Due to the destruction of familiar supply chains and changes in logistics, European countries have become the main export markets for Ukraine, but imports from China still lead our trade balance.

The launch of the sea corridor and the reopening of Greater Odessa ports creates opportunities for Ukrainian exporters of iron and steel to return to the familiar Chinese market, albeit with smaller volumes due to the drop in domestic production.

Mutual trade

In 2021, China was Ukraine’s main trading partner, with trade turnover between the countries totaling $19 billion. Due to the war and other commodity flows and logistics routes, the situation has changed. According to the State Customs Service of Ukraine (SCSU), in 2023, China is only in third place ($2.4 billion) in terms of exports from Ukraine, after Poland ($4.75 billion) and Romania ($3.8 billion). Compared to 2022, China has moved up one rank ahead of Türkiye ($2.37 billion).

At the same time, China is the leader among import suppliers in 2023 with $10.4 billion (16.4% of the total). It is followed by Poland (10%) and Germany (8%) – $6.6 bln and $4.9 bln respectively.

Because of the war, Ukrainian exports to China in 2021-2023 declined by 71% in volume terms, while imports from China – by only 11%. In 2022, Chinese shipments to Ukraine decreased by 800,000 tons due to logistical difficulties, but they largely recovered in 2023.

The trend is roughly the same for goods trade in financial terms: Ukrainian exports to China have fallen by almost 70%, while Ukrainian imports from China remained at almost pre-war level. In absolute terms, China increased its exports by almost $1.8 billion in 2023.

The structure of trade between Ukraine and China in physical terms shows that our country exports iron ore, corn, sunflower oil, meal and other agricultural products. Ukraine traditionally imports consumer and industrial goods, machinery and equipment from China.

Steel balance

Due to logistical difficulties, Ukraine is limited in its ability to export iron and steel to China.

According to the State Customs Service, iron & steel supplies from Ukraine to this country decreased in physical terms by 68% year-on-year – to 1.4 million tons, in monetary terms – by 78% year-on-year, to $94.6 million. There were similar dynamics in 2022.

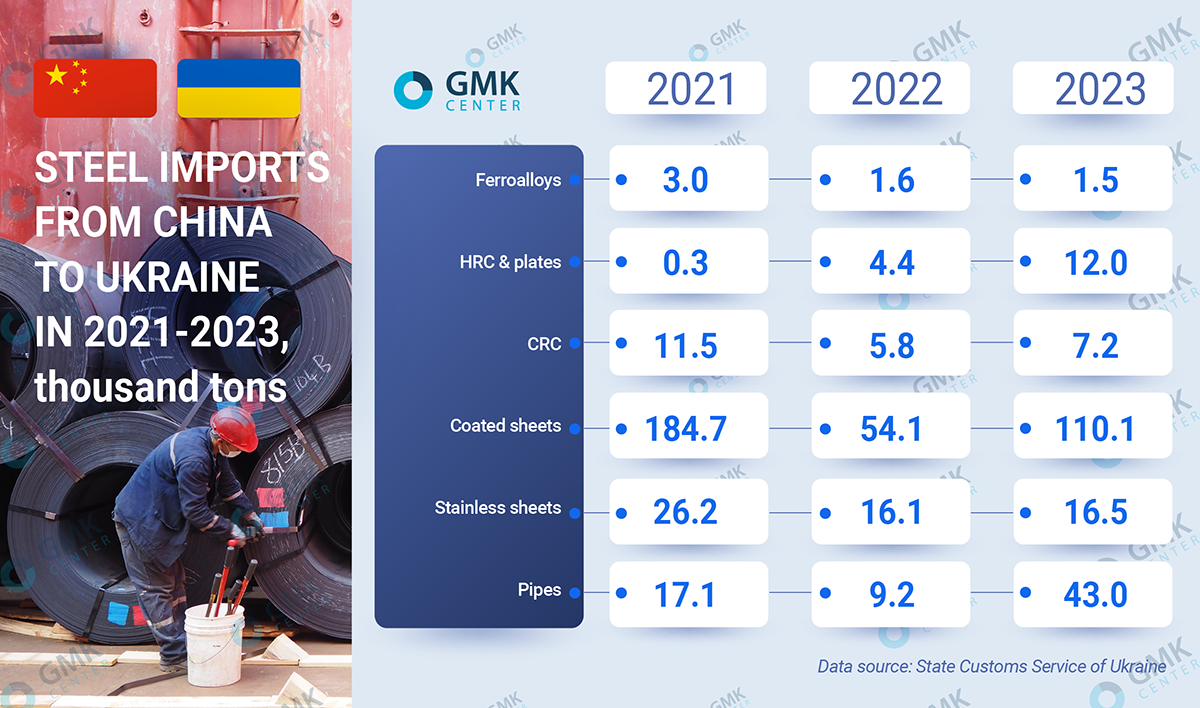

In its turn, China managed to increase supplies of steel products to the Ukrainian market last year. According to the data of State Customs Service, Chinese steel imports to Ukraine in 2023 increased by 2.1 times – to 204 thousand tons, in money terms – by 82% y/y, to $327 million. In 2022 compared to 2021 was a decline, which amounted to 61% y/y – to 99,000 tons and 50% y/y – to $180 mln respectively.

In total, at the end of last year, supplies from the PRC amounted to 26% of Ukrainian steel imports. This is more than the share of its nearest neighbor Poland (9.1%), but less than that of Türkiye (39%).

Iron ore exports

Ukrainian iron and steel exports to China are represented by a very limited list of products. China’s strong steel sector, low domestic prices, expensive logistics and protectionism make supplies of finished steel products from Ukraine practically impossible. Therefore, Ukrainian companies supply raw materials to China.

Both before the war and now, the most massive export item to China is iron ore. However, due to the war and logistical difficulties caused by it, iron ore supplies from Ukraine fell to 1.4 million tons in 2023. In pre-war 2021 iron ore exports to China amounted to 18.5 million tons.

In 2022 Ukraine supplied pig iron, ferroalloys and steel semi-finished products to China, these deliveries were made in January-February, before the blockade of sea ports. Last year, there were no deliveries of steel products, except for shipment of ferroalloys (2.4 thousand tons).

In 2022-2023, there were small deliveries of finished steel products (alloyed bars and bars, corrosion-resistant shaped sections and seamless pipes) – up to 100 tons.

The key problem in exporting iron and steel products to China is logistics. Last year iron ore supplies to China in the amount of 1.4 million tons became possible after the opening of the sea corridor. According to some sources, the first shipment to China could be made as early as September-2023. At that time the bulk carrier Ying Hao 01 with deadweight of 75 thousand tons left Pivdennyi port.

The opening of the corridor allowed Ukrainian mining companies to reach a significant volume of ore exports by sea – 1.3 million tons in December-2023. By the end of the first quarter, iron and steel companies may export 2-3 million tons of iron ore per month.

Restraining factors for iron ore exports through the ports of Greater Odessa are the general operability and safety of the sea corridor, throughput capacity of railway infrastructure and the price situation on the world iron ore market. Additional problem is connected with the increased risks for export routes through the Red Sea, which are blocked by Yemeni Hussites, for ships and cargoes of a number of countries.

Coated imports

The key product of Chinese steel exports for the Ukrainian market is coated sheets. Their shipments between pre-war 2021 and 2023 fell by 40% – to 110,000 tons. However, a slight recovery of the Ukrainian economy led to a doubling of shipments in 2023 compared to 2022.

According to Metipol, Chinese coated sheets are the market leader in terms of consumption – in 2023, its share in total consumption of coated sheets amounted to 34% (+87% y/y in tons). The figure could have been even higher if not for the introduction of anti-dumping duties in September 2023.

The share of Chinese coated sheets will decrease in 2024 not only due to trade restrictions, but also due to an increase in domestic production. Last year, a new producer of polymer-coated galvanized steel Polysteel appeared in Ukraine with an output capacity of 100 thousand tons per year.

Among other significant Chinese steel products on the Ukrainian market we can mention HRC & plates, the supplies of which last year compared to 2021 increased 35 times – up to 12 thousand tons and pipes – with an increase of 2.5 times, up to 43 thousand tons.

Imports of pipes are growing even despite the established trade restrictions.

Chinese pipe imports compete in the domestic market with Ukrainian products, limiting the recovery of production at Ukrainian enterprises.

«The year-end production results could have been higher if imported products from China did not enter the domestic market in large volumes, especially when analogs are produced in Ukraine. Chinese pipe products simply filled the Ukrainian market both in the private segment and at tenders of state-owned companies,» notes Heorhiy Polskyy, CEO of Ukrtruboprom association.

According to the Prozorro platform, state-owned Ukrhazvydobuvannya held 23 tenders for the purchase of casing pipes in 2023. The Chinese intermediary Vorex took part in 17 tenders out of 23, resulting in 11 supply contracts for $100.5 million. Only for casing pipes in 2023, the share of contracts concluded with the intermediary supplier of pipes from China Vorex in the total value of completed tenders with its participation amounted to 59%.

Perhaps the creation of the All-Ukrainian platform «Made in Ukraine» with a permanent direct dialog between the state and business will provide support for Ukrainian manufacturers and change the policy of state companies and tenders, focusing them on the national manufacturer.

Trade prospects

Ukraine is limited in its ability to increase exports of pig iron and semi-finished products to China due to insufficient domestic production and expensive logistics. However, with sufficient security of the sea corridor, our country can increase ore supplies.

At the moment, it is difficult to forecast the dynamics of demand for iron ore in China. For example, forecasts for steel production and consumption in China this year is still contradictory: the dynamics will largely depend on the recovery of the real estate sector and the Chinese government’s stimulus measures.

There are many indications that ore imports may decline slightly in 2024. Demand for iron ore may weaken due to a likely decline in pig iron production due to the requirements of the PRC authorities to reduce emissions. In addition, economic growth in the country is likely to be lower – it is currently estimated in the range of 4.5-4.7% (5.2% in 2023).

Ukrainian iron ore supplies to the Chinese market even before the war occupied an insignificant share of the Chinese market, and now even less. In 2023, China increased its ore imports by 6.6% y/y – to 1.179 billion tons, while steel production increased by 0.6% y/y – to 1.019 billion tons, to 1.019 bln tons.

Ukraine may increase exports to the Chinese iron ore market. Currently, China is a capacious and promising market for sales of agricultural and mining products from Ukraine, but only with stable and safe operation of the sea corridor.

Source: https://gmk.center