Doing business

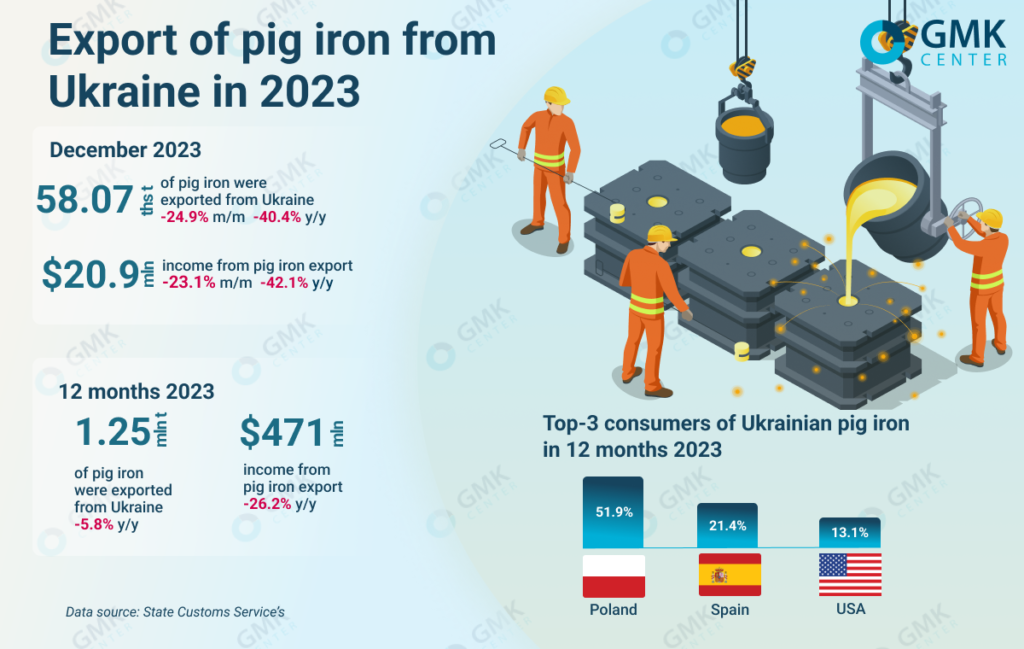

In 2023, Ukrainian steelmaking companies reduced pig iron exports by 5.8% compared to 2022, to 1.25 million tons. Compared to the pre-war year of 2021, pig iron shipments abroad decreased by 61.4%, or 1.99 million tons. This is evidenced by data from the State Customs Service.

Revenues of domestic enterprises from pig iron exports last year decreased by 26.2% compared to 2022, to $471.5 million. The figure fell by 71.3% compared to 2021.

In December 2023, Ukraine exported 58.07 thousand tons of pig iron, down 24.9% month-on-month and 40.4% y/y. Export revenues for the month decreased by 23.1% m/m and 42.1% y/y. The average monthly volume of pig iron exports for the year amounted to 104.0 thousand tons, compared to 110.4 thousand tons in 2022.

Poland was the largest consumer of Ukrainian pig iron in 2023, accounting for 51.9% in monetary terms. Spain accounted for 21.4% of export shipments and the United States for 13.1%. In 2022, the top three importers of pig iron from Ukraine were the United States (38.5%), Poland (32.9%), and Turkiye (8.1%), mainly due to significant export volumes in January-February. At the same time, in 2021, the United States was the main destination for pig iron exports, accounting for 53.6%. Italy and Turkiye accounted for 22.1% and 9.7%, respectively.

In 2023, Ukrainian steelmakers continued to operate amid limited logistics capabilities and unfavorable global market conditions. The main pig iron producers in Ukraine, Metinvest Group companies (Kametstal and Zaporizhstal) and ArcelorMittal Kryvyi Rih, operated at capacity utilization rates of 65-75% and 20-30%, respectively, last year.

Increased utilization is not possible in the current environment due to logistical constraints. Seaports are not operating at full capacity. The main market for the company’s products is the European Union. Until recently, Ukrainian pig iron suppliers had to compete with Russian producers who offered discounts on their products in the EU market.

In the 12th package of sanctions, which was adopted at the end of 2023, the EU introduced new and expanded existing restrictions on Russian iron and steel products. In particular, the ban on imports of pig iron and mirror iron and direct reduced iron (DRI) from Russia was extended.

This decision was quite expected – despite the resistance of steel lobbyists (consumers of Russian pig iron), the EU managed to approve the ban on pig iron imports on the fifth attempt. The new restrictions will ban imports of pig iron and DRI from January 1, 2026, and until then, quotas will be in place to reduce the volume of supplies.

«The ousting of Russian suppliers from the European market creates the preconditions for increasing pig iron exports from Ukraine. However, the realization of this potential will directly depend on the logistics capabilities for exporting products. It is logistics that determines production volumes in the steel industry today,» said Andriy Glushchenko, GMK Center analyst.

In 2022, Ukrainian steel companies reduced pig iron exports by 59% compared to 2021, to 1.32 million tons. Last year, steelmakers’ revenue from pig iron exports amounted to $638.8 million, down 61.1% from 2021. The United States was the main consumer of raw materials, accounting for 38.47% of total exports.

Source https://gmk.center/ua/