In 2023, Germany became the third largest importer of goods to Ukraine

After the start of the Russian military aggression, Germany became not only the most important political partner, but also an economic one – a supplier of oil products and goods that have become critical for Ukraine and its economy. In addition, under the conditions of the war, Germany supported Ukrainian producers with demand for agricultural products, cables, woodworking products and furniture, as well as pipes. Equally important are the investments of German companies in Ukraine, all of which have continued their business even under war conditions.

Trade balance

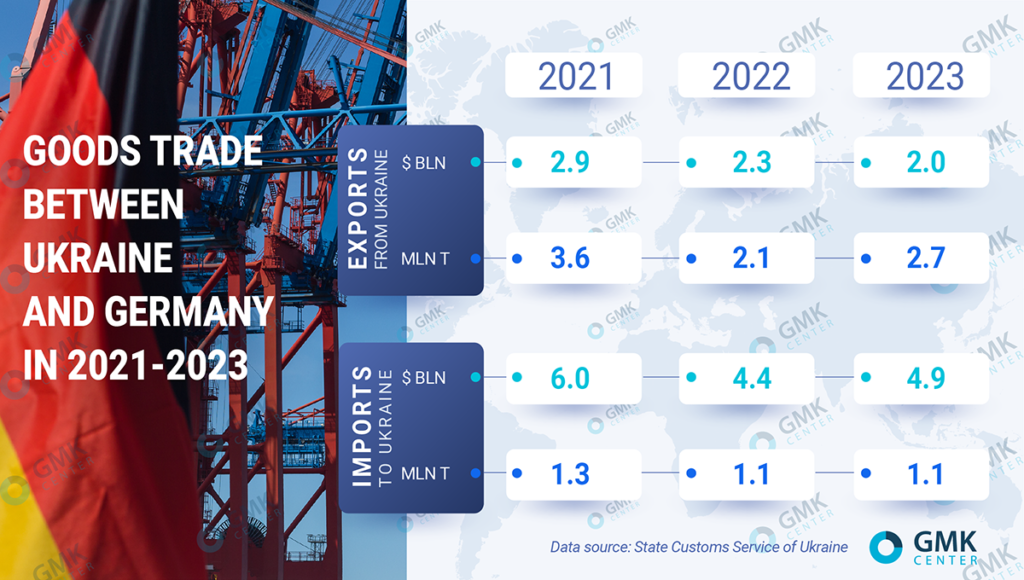

Germany is one of Ukraine’s most important trade partners. At the end of last year it became the third ($4.9 billion) in terms of imports of goods to Ukraine and the fifth ($2 billion) in terms of exports from our country.

Due to geographical proximity, the indicators of mutual trade in goods have not sagged very significantly since the beginning of the war. Between pre-war 2021 and 2023, Ukrainian exports to Germany fell by 26% in volume terms, while German imports fell by 18%.

New supply chains and increased capacity at western crossings allowed Ukrainian exports to Germany to recover last year compared to 2022 and grow by 30% to 2.7 million tons, but in monetary terms the figure fell by 11% – to $2 billion. In turn, German imports declined by 2.6% y/y – in turn, German imports fell by 2.6% y/y – to 1.1 mln tons, but grew in monetary terms by 10% y/y – to $4.9 bln.

Our country supplies significantly more products to Germany in physical terms, which is due to the high share of raw materials in Ukrainian exports. In particular, Ukraine exports agricultural products (rapeseed – $351 million, corn – $120 million, soybeans – $92 million) and wood products ($138 million). But there are also significant supplies of products with high added value – cable ($240 mln), furniture ($125 mln), pipes ($113 mln) and, to a lesser extent, food products, various consumer and industrial goods.

In turn, imported goods from Germany have a higher added value, which is evident from the ratio of revenue in 2023: German imports – $4.9 billion, Ukrainian exports – $2 billion. In the structure of imports prevail cars ($645 million), medicines ($355 million), petroleum products ($289 million), chemical products for agro-industrial complex ($104 million), agricultural machinery ($103 million), food products, various industrial products and consumer goods, tools, machinery and equipment.

Steel supplies

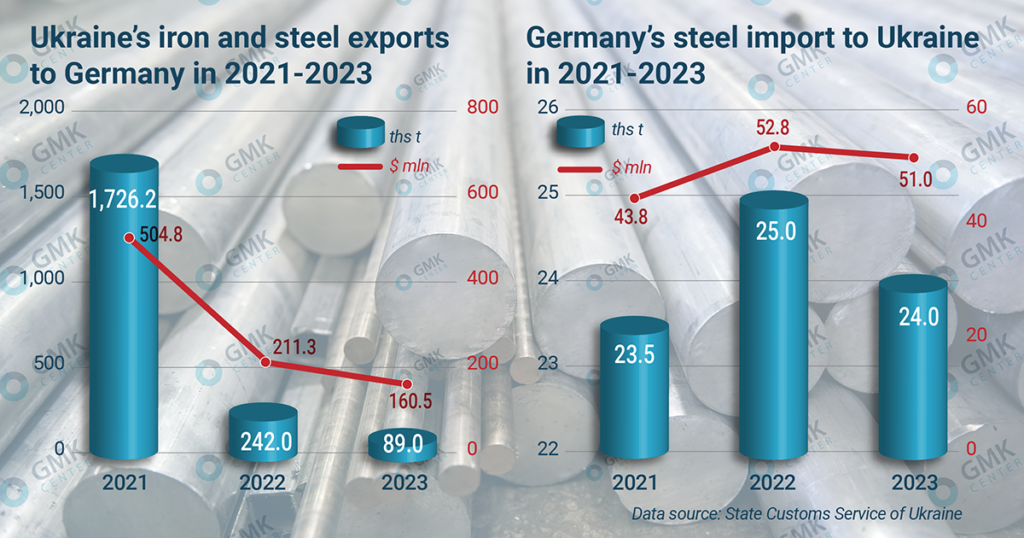

Judging by mutual trade in iron and steel products, neither Ukraine nor Germany are significant markets for each other for most types of products. Due to declining domestic production and logistical difficulties, Ukraine has sharply reduced iron and steel exports to Germany since the beginning of the war. Between pre-war 2021 and 2023, Ukrainian shipments of ore and steel to that country collapsed in volume terms from 1.7 million tons to 89,000 tons.

The largest item of Ukrainian iron and steel exports to Germany until 2022 was iron ore, but the size of its shipments dropped from 1.6 million tons in 2021 to zero last year. Since the beginning of the war, Ukrainian mining companies have reduced production levels, and logistical opportunities before the opening of the sea corridor allowed exports only to neighboring countries. However, there is enough supply on the global iron ore market, so Germany has been able to refocus on other sources. At the end of 2023, the largest suppliers of iron ore to the country were Canada (€1.34 billion), South Africa (€757 million) and Brazil (€752 million).

The products with the highest added value in the structure of Ukrainian exports of steel products to Germany are pipes. Their share in 2023 amounted to 19% of total imports in monetary terms and 10% in tons. Also Germany is significant for Ukrainian export of wire (code 7217) – 19% of the total indicator in tons last year.

Since 2021, such steel products from Ukraine have almost or completely left the German market: flat hot-rolled steel, semi-finished steel products, alloy steel bars, shaped products, ferroalloys, etc. In pre-war 2021 their deliveries were at the level of 3-16 thousand tons.

Supplies of German steel products to the Ukrainian market – about 25 thousand tons per year – have remained almost unchanged since the beginning of the war, which at the end of 2023 amounted to only 2% of Ukrainian steel imports. This is many times less than other countries – Poland (9.1%) and Romania (4.5%) – where the volume of steel production is much lower.

Conditionally significant is the import to the Ukrainian market only of coated rolled products (7.1 thousand tons in 2023) and alloy steel bars (5.9 thousand tons), of which supplies of only the second position have increased since the beginning of the war. Rail shipments have also grown slightly.

The probable extension by the European Union of the regime of abolition of import duties and quotas on exports from Ukraine and logistical proximity create good conditions for increasing the presence of Ukrainian steel products on the German market. At the moment, the difficulties consist in the depressed demand for steel products in Germany (although a slight increase is expected this year) and the blockade of logistics routes through Poland.

The most obvious direction for the development of cooperation is investment in new production sites – Ukraine may become an alternative to China and Russia for German business in terms of location of some production facilities. Germany and German companies are also planning to actively participate in programs to rebuild Ukrainian infrastructure after the war.

Source: https://gmk.center