Doing business

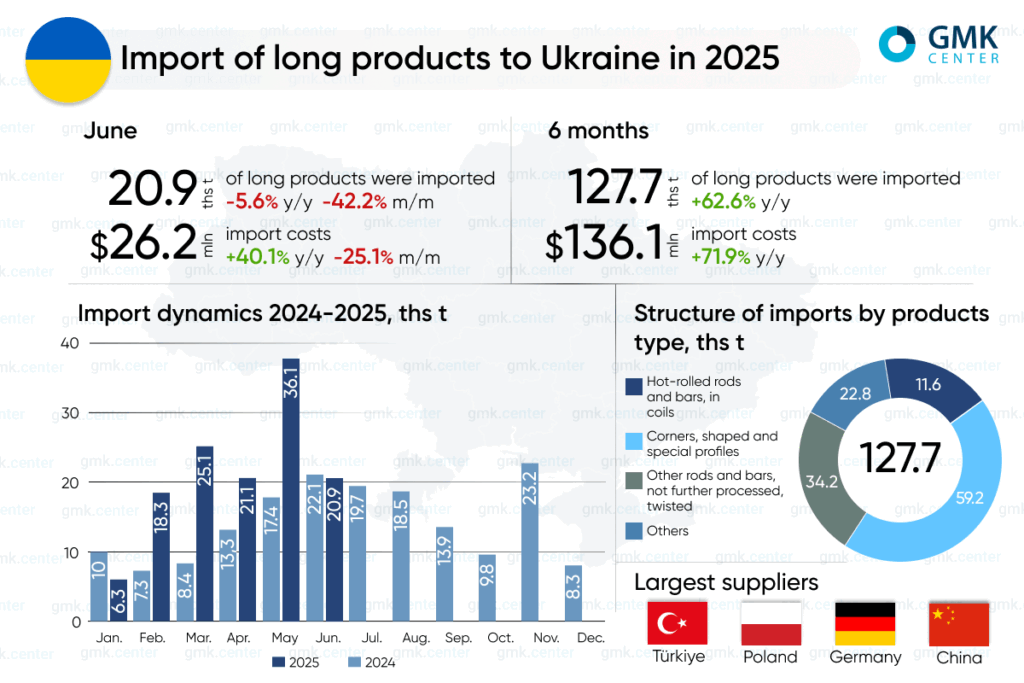

In January-June 2025, the long rolled steel market in Ukraine showed significant growth in imports – by 62.6% compared to the same period in 2024 – to 127.75 thousand tons.

The main volumes of supplies are accounted for by angles, shaped and special profiles (HS – 7216) – 59.16 thousand tons, which is 69.8% more year-on-year. Turkey supplied 46.78 thousand tons of such products to the Ukrainian market, Poland – 5.61 thousand tons, and Germany – 0.95 thousand tons.

In addition, 34.19 thousand tons of other carbon steel bars and rods, without further processing, twisted (HS – 7214) were imported, which is 95.9% more than last year. Turkey imported 28.48 thousand tons of such products, Bulgaria – 2.79 thousand tons, and China – 1.89 thousand tons.

A small share of supplies is accounted for by hot-rolled bars and rods made of carbon steel, in coils (HS – 7213) – 11.57 thousand tons (+29.7% y/y). China sent 11.45 thousand tons to Ukraine.

Thus, Turkey is the main supplier of long rolled metal products to the Ukrainian market. Turkish supplies of these products to the Ukrainian market in 2024 are estimated at 108.87 thousand tons, which is more than 63% of total imports. In 2023, the trend was similar – 98.03 thousand tons, which corresponds to 63.9% of long rolled steel imports to Ukraine.

In June 2025, 20.86 thousand tons of long rolled metal products were sent to the Ukrainian market, which is 5.6% less than in June 2024 and 42.2% less than in the previous month. Consumption of key import items during the month was as follows:

Expenditures on imports of long products increased by 71.9% y-o-y over six months, to $136.15 million. In June, the indicator increased by 40.1% y-o-y and decreased by 25.1% m-o-m, to $26.25 million.

It should be noted that in the first five months of this year, the consumption of long products in Ukraine increased by 12.9% y/y, to 550 thousand tons. At the same time, the share of imports in consumption increased to 3.2% compared to 1.5-1.6% in 2023-2024.

However, current geopolitical risks may lead to further growth in foreign supplies. The destructive impact will manifest itself not only in the replacement of local production volumes, but also in pressure on prices. Foreign manufacturers are able to offer products at lower prices, having certain “trump cards.”

Currently, there are only two anti-dumping measures in place for imports of long products to Ukraine — against bars from Belarus and Moldova. Large global players such as Turkey and China are not subject to any restrictions, being the largest suppliers of products to the Ukrainian market.

In the fourth year of full-scale invasion, Ukrainian metallurgists are facing major challenges – expensive electricity and logistics, fierce competition not only from Asian producers but also from Russian products, staff shortages, the need to import coking coal, trade barriers, etc.

Against the backdrop of these problems, the continued influx of imports into Ukraine carries the risk of halting production and investment projects.

As GMK Center reported earlier, at the end of 2024, Ukraine increased its imports of long products by 12.1% compared to 2023, to 171.9 thousand tons.

The main volumes of supplies were accounted for by angles, shapes, and special profiles (HS code 7216) – 76.69 thousand tons, which is 47.9% more year-on-year. Also, 43.84 thousand tons of other carbon steel bars and rods, without further processing, twisted (HS – 7214) were imported, which is 29.7% less than in 2023.

Source: https://gmk.center/