Doing business

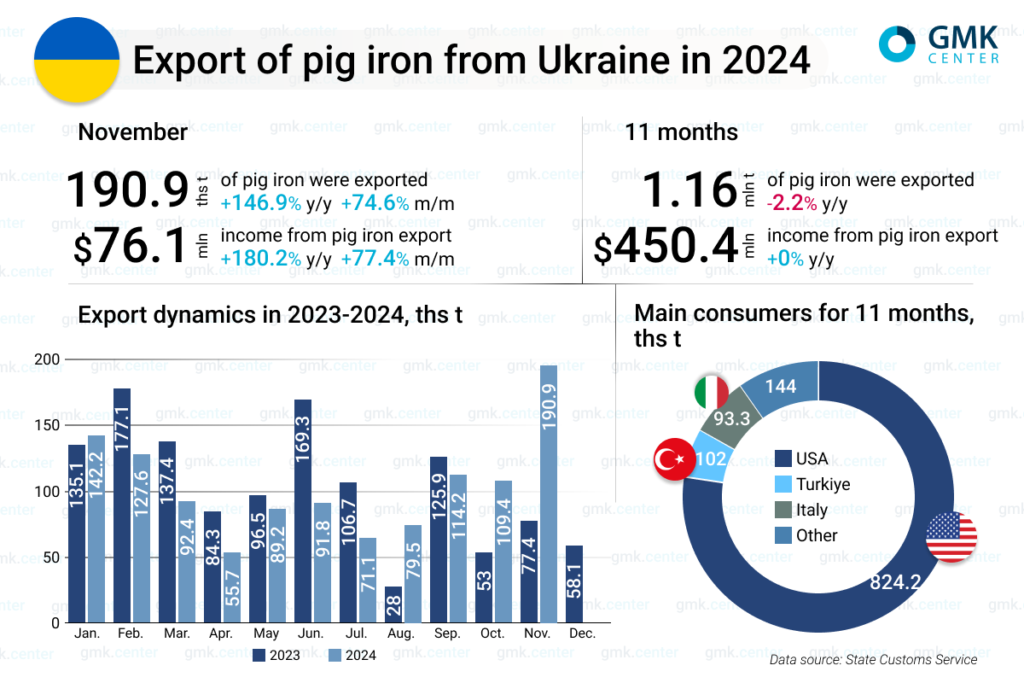

In November 2024, Ukrainian steel companies increased their exports of commercial pig iron by 74.6% compared to the previous month, to 190.99 thousand tons. The figure increased by 146.9% compared to the same month in 2023. This is evidenced by the data of the State Customs Service.

There was a multidirectional trend among key consumers in November. In particular, exports to the US increased by 63.1% m/m – to 153.94 thsd tonnes, to Poland decreased by 50.1% m/m – to 4.6 thsd tonnes, and to Turkey amounted to 30.04 thsd tonnes, while in October there were no deliveries. At the same time, Italy has not imported Ukrainian pig iron for the second month in a row.

In January-November of this year, pig iron shipments abroad amounted to 1.16 million tons, which is 2.2% less than in the same period in 2023. During this period, 824.2 thousand tons of the relevant products were shipped to the United States, 102.49 thousand tons to Turkey, 93.28 thousand tons to Italy, and 60.77 thousand tons to Poland.

Revenue from pig iron exports in January-November 2024 amounted to $450.45 million, which is equal to the same period in 2023. In November, it amounted to $76.12 million, up 180.2% y/y and 77.4% m/m.

Ukraine’s pig iron exports in November showed a significant increase, reaching their highest level since September 2022. The key lever to support exports was an increase in demand from the US and the resumption of shipments to Turkey, which indicates an improvement in the prospects for steel markets in these countries. At the same time, pig iron production (total) by Ukrainian steelmakers in November decreased by 13.1% m/m and increased by 0.3% y/y – to 542.9 thousand tons, the lowest since March.

In general, due to the global decline in demand for rolled steel and the decline in the competitiveness of domestic steelmakers amid a number of negative factors, including higher electricity and logistics tariffs, steelmakers are forced to switch to low-value-added products. Recently, Kametstal resumed production of pig iron for export after a break of more than six months. The products are being shipped to customers in North America.

“The EU steel market, which is the main market for Ukrainian steel producers, is going through a tough time. Local steelmakers are unable to raise prices and are operating at a loss due to the influx of imports, including square billets from China. In this environment, it has become unprofitable for Ukrainian producers, who have higher energy costs than in Europe and high transportation costs, to sell steel or pig iron to the EU. A more profitable market is the US, but only pig iron can be supplied there. That’s why we see such a turnaround in trade and production,” comments Andriy Tarasenko, Chief Analyst at GMK Center.

As GMK Center reported earlier, in 2023, Ukraine reduced pig iron exports by 5.8% compared to 2022, to 1.25 million tons. Compared to the pre-war year of 2021, pig iron shipments abroad decreased by 61.4%, or 1.99 million tons. Export revenues of domestic enterprises decreased by 26.2% y/y – to $471.5 million.

Poland was the largest consumer of Ukrainian pig iron in 2023, accounting for 51.9% in monetary terms. Spain accounted for 21.4% of export shipments and the United States – for 13.1%.

Source: https://gmk.center