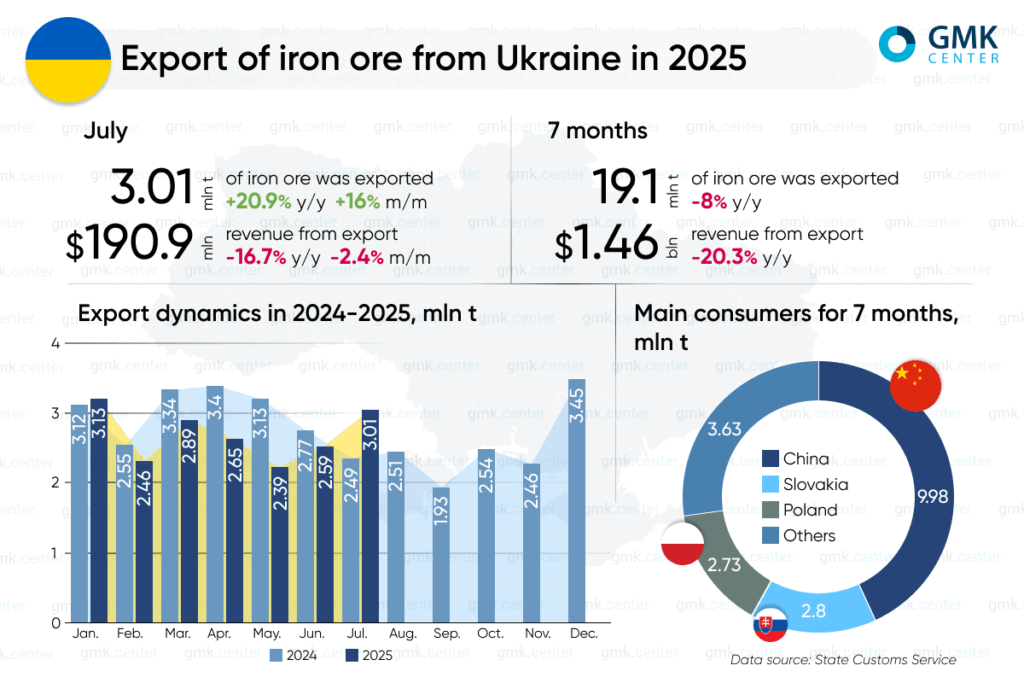

In January-July 2025, Ukraine’s mining industry reduced iron ore exports by 8% compared to the same period in 2024, to 19.1 million tons. This is evidenced by GMK Center calculations based on data from the State Customs Service.

China is traditionally the largest consumer of Ukrainian iron ore. During this period, shipments of raw materials in this direction amounted to 9.98 million tons (+7.8% y/y). Slovakia received 2.8 million tons (-7.5% y/y), and Poland received 2.73 million tons (-8.4% y/y).

In July, Ukraine exported 3.01 million tons of raw materials, which is 16% more than in the previous month and 20.9% more than in July 2024. Shipments exceeded 3 million tons for the first time since January this year. 1.71 million tons (+41.3% m/m; +106.2% y/y) of raw materials were shipped to China, 386.18 thousand tons (-8.2% m/m; -0.1% y/y), and 403.97 thousand tons (+1.8% m/m; -4.8% y/y) to Poland.

Revenues from mineral resource exports in July amounted to $190.9 million (-2.4% m/m -16.7% y/y), and in January-July – $1.46 billion (-20.3% y/y).

As GMK Center reported earlier, in 2024 Ukraine increased its iron ore exports by 89.9% compared to 2023, to 33.699 million tons. Shipment volumes increased mainly due to the opening of the maritime corridor in August 2023. Revenue from iron ore exports from Ukraine in 2024 amounted to $2.8 billion (+58.7% y/y).

The main producers of iron ore raw materials in Ukraine are Ingulets Mining, Kryvyi Rih Iron Ore Plant, Poltava Mining, Yeristovsky Mining, Northern Mining, Central Mining, Southern Mining, ArcelorMittal Kryvyi Rih, Sukha Balka, and Rudomain.

Source: https://gmk.center/