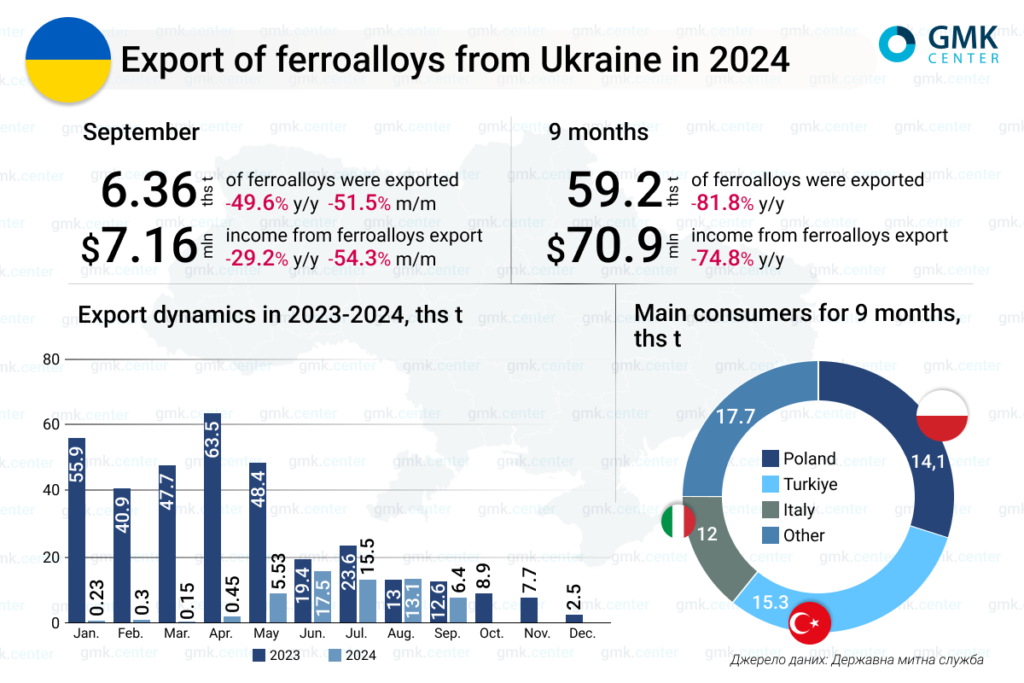

In January-September 2024, Ukraine’s ferroalloy industry reduced exports by 81.8% compared to the same period in 2023, to 59.2 thousand tons (325.07 thousand tons in January-September 2023). This is evidenced by the data of the State Customs Service of Ukraine.

In September, Ukrainian producers exported 6.36 thousand tons of ferroalloys, down 51.5% month-on-month and 49.6% y/y. Export volumes have been declining month-on-month for the third month in a row after 4 months of growth.

The main consumers of the products are Poland – 14.15 thousand tons over 9 months, and 2.62 thousand tons in September (+39.5% m/m), Turkey – 15.3 thousand tons (did not import in September), and Italy – 12.06 thousand tons and 2.4 thousand tons (-22.5% m/m), respectively.

Shipments of ferroalloys have resumed since May this year, after almost stopping in January-April due to the partial resumption of Zaporizhzhya Ferroalloy Plant (ZFP). As previously reported, the plant is operating two furnaces, which is only 7% of its total capacity, and has no visible plans to increase its utilization. Since the end of June, the NGF has also been operating at a minimum level. Currently, the companies are working with stocks of raw materials left over from previous periods and the electricity they can get. Pokrovsk Mining, Marganets Mining, and Pobuzhsky Ferronickel Plant (PFP) are idle.

At the same time, Ukraine’s heavy industry is facing many challenges, including a decline in demand for products, problems with energy supply, a shortage of personnel due to mobilization, etc. The ferroalloy industry is particularly pressured by high electricity tariffs and problems with electricity shortages, as the production of ferroalloys is an energy-intensive process.

Rising electricity costs are driving up production costs, making it uneconomical to continue production, and some mining and metals companies warn that this could lead to a complete shutdown. In general, the restriction of electricity supplies will inevitably lead to a significant decline in production and exports.

Revenue from ferroalloy exports in 9M2024 decreased by 74.8% y/y – to $70.96 million, and in September it fell by 29.2% y/y and 54.3% m/m – to $7.16 million.

As GMK Center reported earlier, in 2023, Ukraine’s production of ferroalloys decreased by 57.4% compared to 2022. Exports fell by 4.9% y/y – to 344.2 thousand tons. Compared to pre-war 2021, shipments of ferroalloys abroad decreased by 48.5%, or 324.4 thousand tons. Poland was the largest consumer of Ukrainian-made ferroalloys in 2023, accounting for 52.8% in monetary terms. Turkey accounted for 14.1% of export shipments and the Netherlands for 8.5%.

In 2024, according to Sergiy Kudryavtsev, Executive Director of the Ukrainian Ferroalloy Producers Association (UkrFA), the state of Ukraine’s ferroalloy industry will depend on three factors: shelling, logistics, and available electricity. In particular, in January-August, production decreased by 4.6 times y/y – to 41.05 thousand tons.

Source: https://gmk.center