Existing trade barriers for Ukrainian steel products limit the possibility of restoring the production of steel enterprises

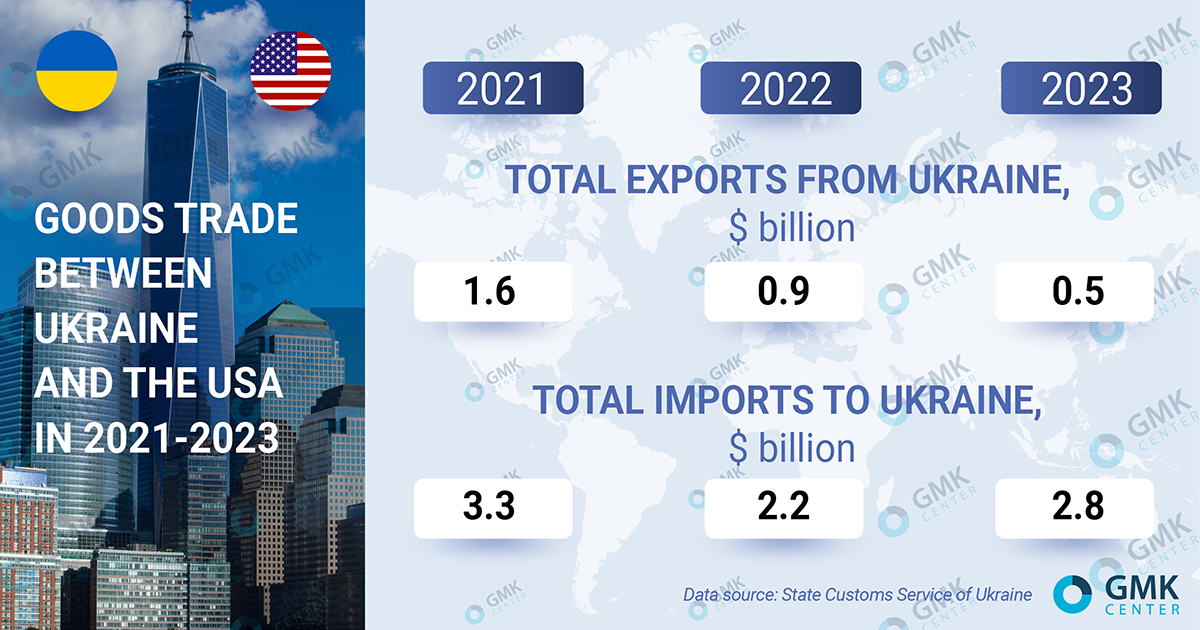

Ukraine is a favorable trade partner for the USA – our country imports many times more than it exports. In particular, last year Ukraine imported $2.8 billion worth of goods, while it exported $500 million. Among iron and steel products Ukraine exported 1.0 million tons of pig iron, 21 thousand tons of long products and 94 thousand tons of pipes to the USA in 2023. Supplies of steel products from the USA to Ukraine were insignificant (at the level of 208 tons) and represented mainly by pipes.

Attempts to increase exports of Ukrainian steel products to the US are facing anti-dumping duties, which cover almost the entire range of steel products. The trade restrictions that may become the main challenge for the recovery of production of Ukrainian iron and steel enterprises in the near term.

Trade balance

Despite the current strategic nature of the U.S.-Ukraine relationship, the performance of mutual trade in goods is not significant. This is due not so much to geographic distance and expensive logistics as to difficult access to the U.S. market, the high price of U.S. products, and Ukraine’s limited ability to offer sought-after goods.

The balance of trade in goods shows a significant predominance of U.S. imports – in financial terms, there are 5.5 times more imports than exports from Ukraine. Imports from the USA to Ukraine last year amounted to 4.4% of the total, which corresponds to the fifth position in the list of the largest countries supplying imports to Ukraine.

Over the past two years, trade in goods has predictably fallen. Imports from the United States between pre-war 2021 and 2023 fell by 72% in physical terms, while in monetary terms – by only 14%. Ukrainian exports fell by 70-85%, which is largely due to logistical difficulties and blocked ports.

The structure of imports from the USA is dominated by foodstuffs, seeds, chemical products and medicines, various consumer goods, industrial materials, apparatus, tools, machinery and equipment.

The largest import item is cars – in 2023 they were imported for $722 mln. Oil products ($306 mln), liquefied gas ($74 mln) and coal ($61 mln) are also important. Since the beginning of the war, supplies of coal and liquefied gas to Ukraine have significantly decreased – in 2021 their imports were at the level of $495 million and $285 million respectively.

The structure of Ukrainian exports is dominated by MMC products (pig iron, pipes, in some years – iron and titanium ore), in insignificant quantities – agro-products and processed products, as well as quite insignificant supplies of consumer goods, industrial products and raw materials.

For Interpipe, for example, the US pipe market plays an important role.

«We have been present in the market for more than 20 years. The North American Interpipe office has been opened in Houston, Texas. Interpipe offers U.S. customers a wide range of pipes for oil and gas exploration, development and transportation. Our product portfolio includes line pipe, OCTG pipe, with API threaded connections, semi-premium and premium connections that are CAL IV certified. In 2022, we shipped 30% of our products to the US market,» said Denis Morozov, First Deputy CEO of Interpipe.

Partial preferences

After the outbreak of the war, developed countries began to lift trade restrictions on Ukrainian imports, but the US did not strongly support this trend. For example, the EU and the UK canceled all import duties for a year, while the US in May 2022 canceled only the additional duty of 25% under Section 232, which has been in effect since 2018, for Ukrainian steel products.

«The abolition of Section 232 by the United States while anti-dumping duties remain in place is a declarative aid to Ukraine, as imports of steel products from Ukraine still remain blocked. One of the duties on hot-rolled flat products has been in force since 1997. Its rate is measured in hundreds of percent,» says GMK Center analyst Andriy Glushchenko.

At first, the abolition of duties on section 232 caused Ukrainian metallurgists to be more optimistic. Pipe companies, whose access to the US market is strictly regulated, had high hopes for this decision. In turn, Metinvest planned to enter the US market with square billets, welded pipes, rebar and wire rod. «ArcelorMittal Kryvyi Rih also expressed great interest in supplies to the U.S. market.

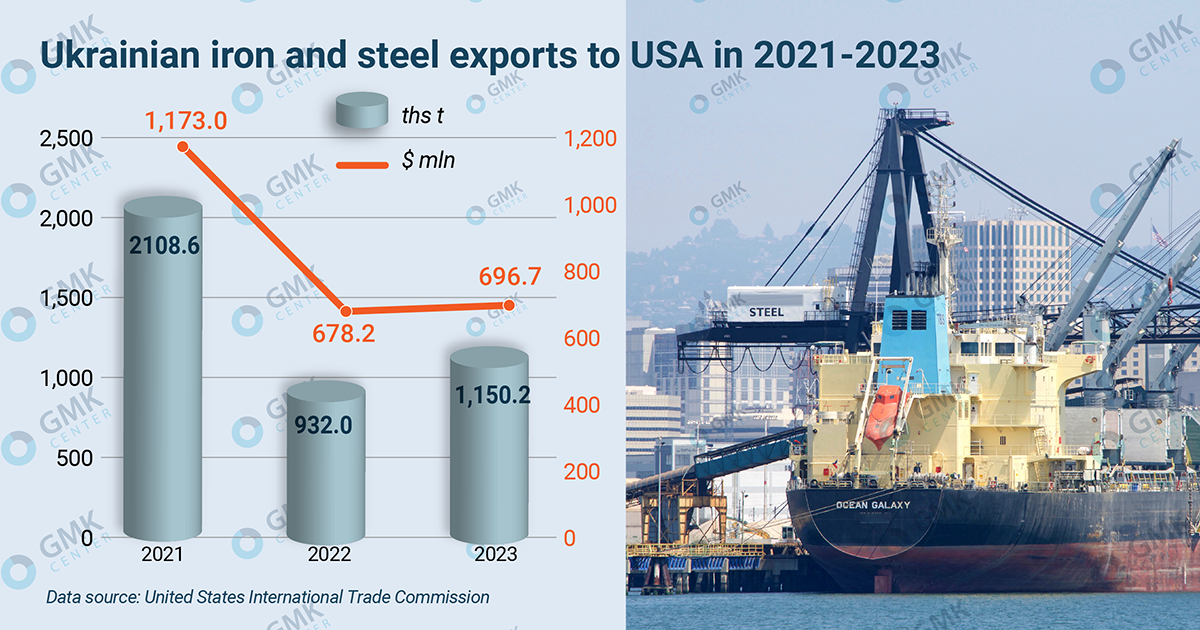

However, later, due to the persistence of anti-dumping duties, there was no growth of supplies to the U.S. market. According to U.S. customs statistics, exports of steel and iron ore products from Ukraine to the U.S. last year fell to 1.15 million tons compared to 2.1 million tons in pre-war 2021. Over the same period, export earnings fell to $697m from $1.2bn.

The main obstacle to increasing supplies of steel products to the USA is the duties that have been in force for 10-20 years and have long been out of date. The motivation for the introduction of anti-dumping duties against Ukrainian steel products was connected with supplying products to American consumers at lower prices compared to market price.

Officially, the anti-dumping duty on hot-rolled flat products in coils (90.3%) and hot-rolled flat products not in coils (81.4 – 237.9%) is still in force. Although 2 major flat-rolled steel producers, Ilyich Iron and Steel Works and Azovstal, were destroyed during the war, so there is not even a potential threat to the U.S. in the form of significant imports of finished flat products from Ukraine.

Other existing U.S. anti-dumping duties cover mainly products of Interpipe (pipes) and ArcelorMittal Kryvyi Rih (rebar and wire rod). The situation with the duties on the companies’ products was as follows:

«Several years ago, the cumulative amount of duties in force in the US market against Interpipe products exceeded 50%, which was, in fact, a barrier level,» commented Denys Morozov.

In 2023-2024. The US updated the list of restrictions – it introduced final anti-dumping duties on Interpipe’s OCTG pipes (4.89%) and seamless pipes (4.99%). These safeguard measures were in place from July-2014 and August-2021 respectively.

«Undoubtedly, if the 25% duty is returned, our sales to the US will become significantly more difficult,» Interpipe’s first deputy CEO added.

Recently, the US extended protective measures against wire rod from Ukraine (34.98% – 44.03%, in effect since March 2018), which, among others, is produced and exported by ArcelorMittal Kryvyi Rih. Regarding rebar from Ukraine, the U.S. Department of Commerce (DOC) conducted an expedited review, leaving the anti-dumping duty unchanged at 41.69% (in effect since September 2001). The final decision will be known after a full review by the U.S. International Trade Commission (USITC).

Iron and steel trade balance

The U.S. steel market is premium in terms of price parameters, but due to the strong policy of protectionism, access to it for finished rolled steel products from Ukraine is extremely difficult. Also, the war has made its adjustments – last year exports of iron and steel products to the U.S. compared to pre-war 2021 decreased by about 40-45% – to 1.15 million tons worth $697 million. It should be noted that Ukrainian customs statistics show a 10-fold drop. Ukraine’s share in the U.S. market has always been extremely low, not exceeding 1% of all steel imports to the U.S. market and posing no threat to local producers.

According to U.S. customs statistics, pig iron is the main article of import from Ukraine – last year its supplies amounted to over 1 million tons. The only export metal products with high added value are seamless pipes, the supplier of which is Interpipe. Since the beginning of the war, imports of Ukrainian pipes to the USA have decreased from 114.7 thousand tons in 2021 to 93.7 thousand tons last year.

The structure of imports from the USA is dominated by pipes – their supplies to Ukraine in 2021-2023 amounted to 200-400 tons. There are no clear economic benefits from imports of US steel products for Ukrainian consumers, so there are no prospects for imports to the Ukrainian market.

American dream

Ukrainian exporters can increase supplies to the US market without jeopardizing local producers. The most important prerequisite for this is the stable operation of the sea corridor and domestic logistics routes. The highest potential for increasing supplies exists in pipes and pig iron.

«Interpipe is constantly working to expand its customer pool in the United States. The market model involves working with distributors, who actually perform the functions of supply departments of oil and gas companies. Interpipe delivers to distributors, but at the same time works with representatives of mining companies regarding our product line, product quality, and innovations. In order for a distributor to purchase a certain product, the end consumer needs to know the brand. Drilling conditions in the US are becoming more complex, and we see the need to expand the line. Today, high-tork connections with increased operating torque are in demand on the market. Those. the product must withstand greater torsional force in the well. To do this, we have developed a new connection, Intrepid-MT, which can be rotated with great force during descent,” summarized Denys Morozov.

As for pig iron, the US previously imported pig iron from Ukraine and the Russian Federation. In 2018-2021. Ukraine supplied there 1.5-1.8 million tons of pig iron per year, while Russia supplied more than 2 million tons in 2021. Iron supplies from Russia stopped after May 2022 and Ukraine could replace Russia’s share in the US pig iron market. In addition, Ukrainian rolled products producers could increase the utilization of idle capacities due to supplies of finished products to the USA.

In any case, the U.S. market is important for Ukrainian producers of all types of steel products: from wire rod and rebar to flat products and pipes. With Ukraine and the US being geopolitical allies, it is no less important to develop trade partnerships.

Source: https://gmk.center