Doing business

During war, Romania became the most important logistical hub for Ukrainian exports of grain and iron and steel products, which also contributed to a sharp increase in export-import operations between our countries. Compared to the pre-war level, Romanian commodity imports increased 2.2 times, and Ukrainian exports increased 3.4 times. Our country increased supplies to Romania primarily due to agricultural products. At the same time, the export of Ukrainian iron and steel products to Romania decreased by 30.6% – to $327.7 million. Despite this, Romania is an important market for Ukrainian iron and steel, where in 2023 exported 7.6% of the total in physical terms.

The war has boosted mutual commodity trade between Ukraine and Romania, which contributes to the integration of our economies and the development of logistics infrastructure.

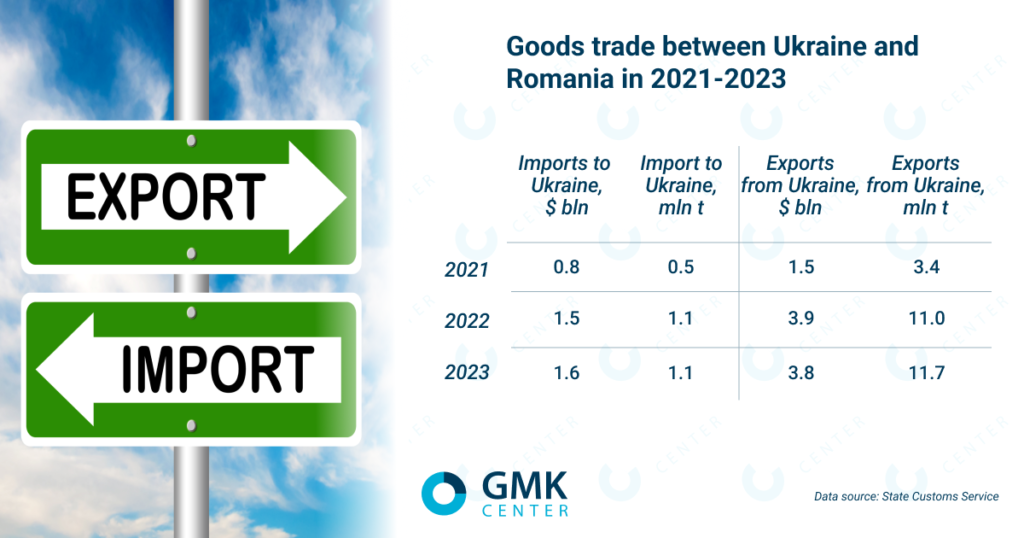

Compared to pre-war 2021, imports from Romania in 2023 increased 2.2 times in physical terms – to 1.07 million tons and 2 times in financial terms – to $1.56 billion. In turn, Ukrainian exports increased 3.4 times – to 11.7 million tons in physical terms and 2.4 times in financial terms – to $3.8 billion.

The higher dynamics of exports in physical terms suggests that Ukraine supplied Romania with a lot of raw materials, in particular agro-products with low added value.

Romania’s most important support to Ukraine was that in 2022, the country became a logistics hub for Ukrainian exports of grain and iron and steel products. The main role in this process was played by the Romanian port of Constanta. Most of the Ukrainian exports to Romania came in transit, as Constanta was the closest and most accessible in terms of free capacity for Ukraine. The huge inflow of Ukrainian cargo allowed the port to increase its total transshipment by 11.9% y/y in 2022 – to 75.5 million tons of cargo, and, in particular, iron ore by 46.9% y/y – to 7 million tons. Last year, the port was able to increase total transshipment by another 22.5% – to 92 million tons. Total Ukrainian cargo traffic in 2023 amounted to 25 million tons, including transit grain transshipment of more than 14 million tons.

Exporters actively use this route by road transshipment in Constanta. Ukrainian cargoes arrive at Constanta by road, rail and barge from the Danube ports of Reni and Izmail.

Romania will work together with Turkiye and Bulgaria to ensure the safety of Black Sea shipping. In January, these countries signed a memorandum on the formation of a coalition for the demining of the Black Sea. The practical implementation of the document may start as early as in April-May. That the Ukrainian sea corridor runs along the coastline of Ukraine and the countries of the anti-mine coalition, and the movement of commercial ships is threatened by drifting mines.

Logistical cooperation between Ukraine, Romania and Moldova in terms of rail links shows that with goodwill, dialog and investment, it is possible to increase the capacity of existing logistics routes relatively quickly.

In 2022, Romania promptly repaired a wide railroad track to the port of Galati. This made it possible to transport cargo from Ukraine to the Danube port without changing locomotives.

For its part, transit Moldova (its role should be considered in conjunction with Romania) is also actively repairing railway infrastructure and even simplifying the transit procedure itself. The role of this country is extremely important not only for the export of Ukrainian cargoes to the port of Galati, but also to the Ukrainian port of Reni. This is the only Ukrainian port that has no direct connection with the Ukrainian railroad network. Cargo deliveries to this port transit through the territory of Moldova.

Romania continues to expand its logistics capabilities. In 2022-2023, the modernization of railway and port infrastructure was actively pursued. Earlier this year, the EU allocated €126 million to Romanian ports to expand transshipment and storage capacities for handling Ukrainian cargo.

Automobile communication between the countries is also being actively developed. Last year Ukraine and Romania agreed to open a new road crossing Bila Tserkva (Zakarpattya region) – Sighetu Marmatii, which will be primarily designed to pass trucks. Now there are five automobile checkpoints and one for ferry traffic on the border with Romania. Of these, only two of them clear trucks: Porubnoe-Siret and Diakovo-Halmeu. In addition, a 450-kilometer Autostrada Moldovei is currently being built with Romanian and EU funds. It will run from Bucharest to the Ukrainian border. This road will create a new European transportation corridor for Ukraine and provide another access route to Romanian ports.

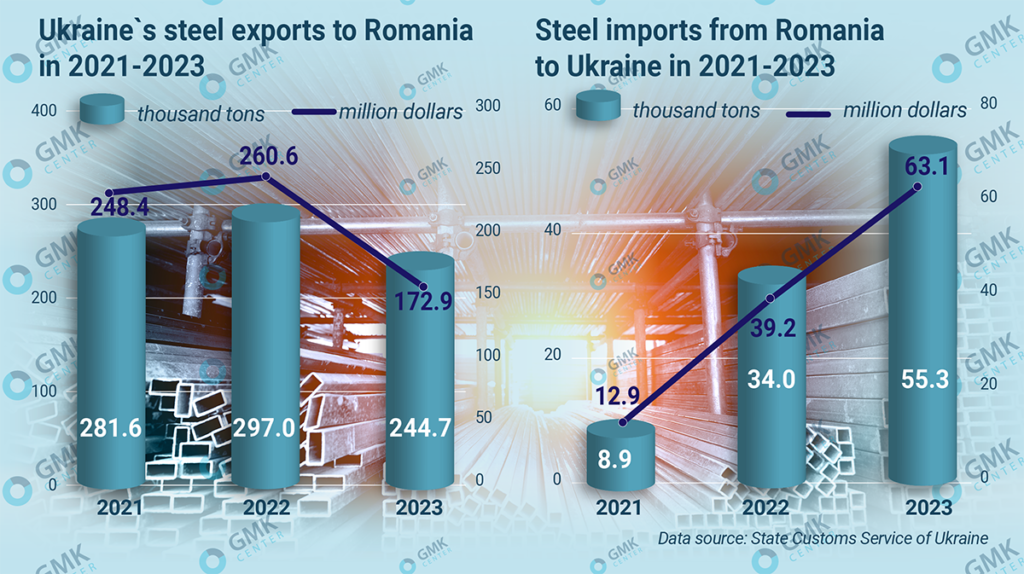

Romania’s geographical proximity has allowed Ukrainian steelmakers to increase their shipments of steel products to the Romanian market in the difficult year of 2022. For the same reasons, Romanian steelmakers were able to increase their exports to Ukraine in 2023. According to the State Customs Service of Ukraine, in 2022 Ukrainian steel exports to this country increased by 5.5% y/y – to 297 thousand tons. However, last year saw a decline – by 17.6% y/y, to 245,000 tons, which is probably due to a general decline in steel consumption in the Romanian market.

Even despite its own import dependence and reduction of steel production, Romania was able to increase supplies of steel products to the Ukrainian market under the conditions of the war. Compared to the pre-war 2021 Romanian exports of steel products in 2023 in physical terms increased by 6.2 times – to 55.3 thousand tons, in financial terms – by 4.9 times, to $63.1 million.

Ukrainian export of iron and steel to Romania is represented by many types of manufactured products. The most massive export item is iron ore, supplies of which have increased since 2021 and in 2023 amounted to almost 1.5 million tons worth $154 million. In 2021, there were small supplies of other raw materials – scrap (33.5 thousand tons) and coke (10.3 thousand tons), but they stopped in subsequent years.

For a number of key positions of steel products exports in the period 2021-2023, Ukraine was able to increase supplies to the Romanian market:

Most of these products are in transit, since Romania is a very large logistics hub for Ukraine.

At the same time, during this period, supplies of the following steel products decreased significantly:

The decrease in supplies of certain types of steel products can be attributed both to a decrease in demand in Romania and a reduction in Ukraine’s own production and increased logistics costs compared to the pre-war period.

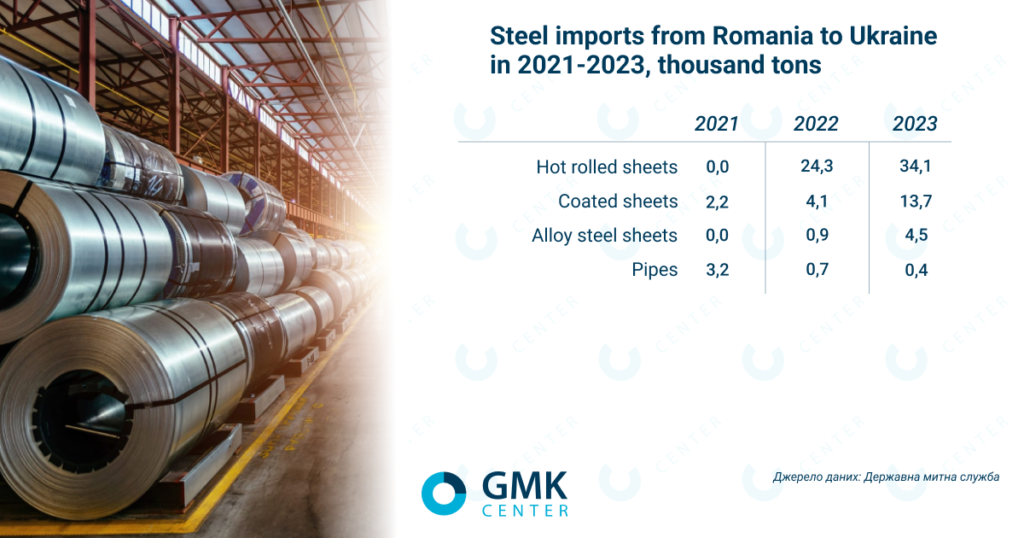

The key imports of steel products from Romania to Ukraine since the beginning of the war have been hot-rolled flat steel, coated steel and alloyed steel. Supplies of coated rolled products in 2023 compared to pre-war 2021 increased more than 6 times – up to 13.7 thousand tons. For the other two types of steel products there were practically no deliveries in 2021, so the dynamics of imports in 2023 for them is off the scale.

Although Romanian steel exports have increased several times during the war, their volumes remain small even for the scale of the Ukrainian market during the war. It represents only 4.5% of all Ukrainian steel imports or 1.6% of Ukraine’s steel consumption in 2023, suggesting that Romania has the potential to increase steel exports to Ukraine.

Romania is a small steel producer with stagnant output dynamics in recent years. According to WorldSteel, last year the country reduced steelmaking by 40% y/y – to 1.58 million tons, while the decline in 2022 was 22.2% y/y – to 2.62 million tons. Romania’s steel production in 2023 amounted to only 1.25% (1.9% in 2022) of the European total.

The specificity of Romanian steel industry is that its exports on average account for more than 90% of its own production. It turns out that domestic steel consumption in the country, which in 2021 and 2022 was at the level of 4.3 million tons and 3.8 million tons, is almost entirely dependent on imports. In all recent years, Romania’s imports of semi-finished and finished rolled steel products have exceeded 4 million tons per year.

The reasons for the stagnation of Romanian steel indistry lie in both local factors and European trends. Romanian steel sector has not been able to recover from the 2008 crisis. Having reached the maximum volume of steel production since the late 90s in 2007 (6.3 million tons), steel production in Romania collapsed in 2009 – 2.3 times, to 2.8 million tons. Since then, steelmaking in the country has not exceeded 4 million tons per year, and in 2023, falling even below the level of 2 million tons.

In September-December last year, Romanian steelmaker Liberty Galati in Galati stopped its only operating blast furnace for 69 days. The reason for this was the lack of sufficient raw materials. For the same reason, the plant stopped the unit again during the Christmas vacation. The Galati plant, like other Liberty Steel assets in Europe, has systemic problems.

On the other hand, the Romanian steel industry has potential and it is too early to discount it. Italian hot-rolled steel and special sections producer AFV Beltrame intends to invest €20 million in Romanian plants in Targoviste and Calarasi this year. In 2023, more than €30 million has already been invested in the renovation of these plants.

In addition, the Liberty Galati plant will soon undergo technical modernization – two electric arc furnaces, two CCMs and a hot-rolling mill are planned to be installed there. The capacity of the plant after modernization will be 3 million tons of steel and 2.85 million tons of rolled products per year.

The key factor for the growth of mutual trade between Romania and Ukraine will be the development of logistics infrastructure and growth of its capacity. Increasing the number of road crossings, repairing railroad tracks and railroad infrastructure, deepening the fairway in the Danube ports, mutual investments in transit terminals and many other projects will allow Ukraine and Romania to increase trade turnover and metal consumption. Romanian steel industry has good opportunities in the Ukrainian market, and Romanian logistics infrastructure can provide good support for exports of Ukrainian iron and steel products to other countries.