Doing business

Across Europe, much of 2022 was overshadowed by Russia’s invasion of Ukraine and its reverberations across the continent. The war quickly triggered a refugee crisis, an unprecedented number of sanctions against Moscow, a surge in energy prices and a general feeling of uneasiness among investors. Coupled with inflation, the end of rock-bottom interest rates and the easing off from the peak of the Covid-19 pandemic, foreign direct investment (FDI) faced a challenging backdrop.

Europe’s slice of the global FDI pie shrank in 2022, accounting for 41.2% of project announcements, down from 49.2% the year prior. However its share is nearly twice as large as its closest competitor, Asia-Pacific, which attracted 22.1% of announced projects.

Despite the military challenges, Dnipropetrovsk region is developing and improving its position as an investment destination. This year the region took fourth place in the ranking “European Cities and Regions of the Future 2023” in the category “FDI Strategy”. This ranking shows the economic, financial and business potential of the European cities and regions.

Since the beginning of the full-scale invasion, Dnipropetrovsk region has become a hub for relocated enterprises, higher education institutions, IT companies and research institutions. The region generates about 10% of the country’s GDP, and its budget is the largest among the regions of Ukraine. Nowadays more than 1000 companies from over 63 countries work in Dnipropetrovsk region.

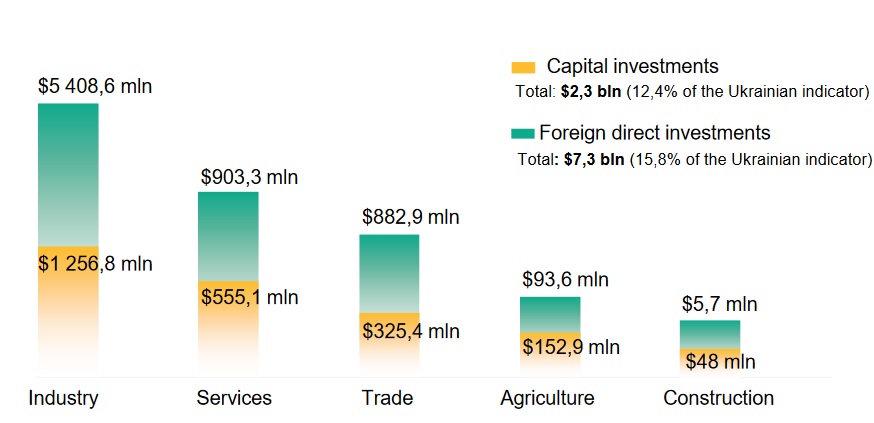

The region covers a significant share of investment activity of the whole country and demonstrates a tendency to annual growth in this sphere and leads among regions in terms of foreign direct and capital investments, the volume of sold products and export of goods.

Fig.1 Investment distribution by sectors of the economy

Dnipropetrovsk Regional Investment Agency (DIA) of the Dnipropetrovsk Regional Council actively cooperates with FDI Intelligence – the world’s largest foreign direct investment (FDI) analysis center. Such recognition gives weighty advantages to emphasize the investment opportunities of the region.

Dnipropetrovsk region, supporting the trends of digitalization, offers interactive tools to get acquainted with the potential of the region. Investment guide 2022/2023 is available here, which presents the most current indicators of investment activity and the main sectors of the economy for the past year, as well as the current situation during the martial law.

“Dnipropetrovsk region has been and remains in the focus of international investors attention who continue economic activity in our territory, supporting its stable development and expressing their trust to the authorities. This result is grounded in reforming of the legislation at the national level in accordance with the EU standards, stimulate the development of the territory and form a comfortable environment for doing business. This is confirmed by the intensification of requests for cooperation from the following foreign partners: Poland, China, Turkey, Italy, Slovakia, the USA, Germany, the Czech Republic, Romania, and Bulgaria. The full potential for FDI attraction may be reached after Ukraine’s victory over the aggressor and the establishment of international security guarantees. We are grateful to our international partners for their help in difficult times, for their military and humanitarian aid” – said Valentyna Zatyshniak, director of DIA.

You can read more about the FDI Intelligence ranking here.

For information:

“fDi Intelligence” is a specialized division of the “Financial Times” company, which provides advanced analytical data on investment activity and FDI trends. Against this backdrop, the European Cities and Regions of the Future 2023 ranking benchmarked against each other the most promising investment destinations across Europe. It assessed as many as 370 European cities divided by population size into five groups — major, large, mid-sized, small and micro cities — as well as 148 European regions divided into three groups — large, mid-sized and small regions. It also assessed 38 local enterprise partnerships in the UK.