Doing business

The Ukrainian steel trade market can be considered as an indicator of the general economic situation in Ukraine. If the business is confident in the future, it builds and produces products, which inevitably results in an increase in demand for steel products. However, the war made significant adjustments to the operation of the market and the level of demand.

Figures and trends

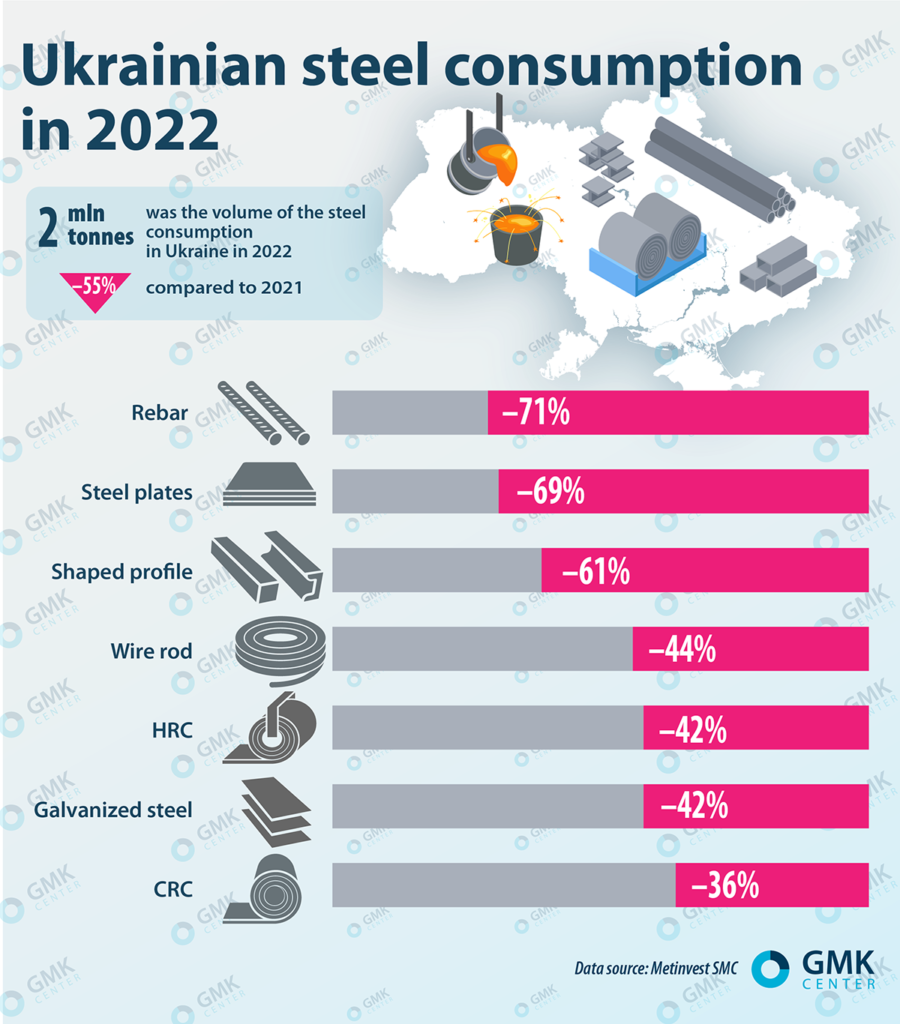

According to the estimates of Metinvest SMC, the market capacity in physical terms in 2022 decreased by 55% and amounted to 2 million tons. In monetary terms, the market volume fell less – by 46%. The decrease was smoothed out due to the significant devaluation of the hryvnia (the official rate of the NBU) in the second half of the year. The average price level in hryvnias increased by 20% in 2022.

At the same time, in dollar terms, prices for steel products also increased by 5%. The reasons for the increase in dollar prices were a sharp increase in prices on international markets in the first half of 2022 after the start of the war on the territory of Ukraine, the disruption of the logistics supply chain of rolled steel from Ukraine, as well as the partial withdrawal of Russia from the markets of the EU and Turkiye due to the introduction of sanctions.

In general, the results of individual steel trading companies in 2022 is more than acceptable.

“In 2022, we expect an increase in steel sales in physical terms by approximately 4 times. This is largely due to the fact that a part of Ukrainian steel products has disappeared from sales (there are almost no pre-war stocks left in the warehouses), which have been replaced by imports,” says the director of the Eurometal company Vitaliy Prytula.

Key trends in the steel trade market include:

All interviewed market experts note that the biggest decrease in demand came from the construction industry and producers of steel structures. According to the estimates of Metinvest SMC, the demand in the construction segment and production of steel structures fell by 70-75%. In particular, according to the State Statistics Service, the volume of completed construction works in the first half of 2022 fell by 2.1 times compared to the same period of 2021.

“In terms of industries, the demand from builders, who have frozen many facilities, has greatly decreased. In fact, they are now completing projects that had a high level of readiness (80% and above). But at this stage of construction, steel consumption is minimal, as it is about internal work,” explains Sergiy Krut, CEO of the Metal Holding Trade company.

Among the relatively stable consumers of steel products, experts name mechanical engineering (in terms of defense orders and the production of agricultural machinery), agro-industrial complex and food industry enterprises (from summer to autumn, when the reconstruction of war-ravaged areas began), hardware production, as well as export-oriented enterprises.

“Industries such as mechanical engineering, iron and steel sector and pipe production fell approximately as much as the rolled steel market – by 52-58%. Against the background of the market decline, the hardware industry (-44%) and the retail segment of consumption (-47%) showed a 55% lower rate of decline,” added Metinvest SMC.

At the same time, the market operators note that some of the customers, since the beginning of the war, partially postponed their plans, which include the purchase of steel products, and then returned to their implementation as soon as possible. Demand was also affected by the relocation of production to safe regions, particularly in the west of the country.

“Since the summer, the main buyers have become enterprises that produce steel structures. In the west of Ukraine, the construction market revived a little: frozen constructions resumed, some enterprises began to recover from the consequences of military actions. We have also experienced an increase in demand from companies that have moved their facilities to the western regions of the country, in particular to the Lviv region,” Vitaliy Prytula notes.

Producers of body armors now stand out among steel consumers, for which a number of companies in the industry purchased special steel in Europe and Turkiye.

Specific demand

The structure of demand during the war changed under the influence of the needs for steel products in specific industries. The downturn in construction led to a drop in demand for rebar, construction beams and shaped rolled products for construction purposes.

In the segment of rolled steel, the consumption of rebar fell the most. According to the estimates of the Vartis company, due to the war, the volume of the rebar market in 2022 will not even reach 300,000 tons. For comparison: in 2021, it was about 1 million tons. The company predicts that the consumption of rebar in 2023 will amount to 350 -400 thousand

“The situation is somewhat better with the demand for sheet steel from the mechanical engineering and design circles, which are requested by enterprises working on defense orders. There was also a demand for graded rolled steel, but its nature strongly depended on the scope of application in a specific industry,” adds Serhiy Krut.

According to Serhiy Kovalenko, commercial director of the Vartis National network of steel centers, the market was supported by the consumption of flat and tubular rolled steel, as well as wire rod. The demand for wire rod was determined by the request of export customers for hardware products of Ukrainian production, for which wire rod is a raw material.

In general, according to Metinvest SMC estimates, consumption of the following product groups fell the most:

At the same time, in some segments the decrease was not so significant:

The disappearance from the market of the products of two Mariupol steel mills – Azovstal and Ilyich Iron and Steel Works – led to a shortage on the Ukrainian market of the products that these enterprises specialized in before the war. In particular, a few months after the start of the war, a shortage of thick sheet from 10 mm.

“The issue of import of thick-rolled steel has arisen acutely. In order to ensure the deficit, the company started deliveries of the specified products from the group’s Italian assets (Metinvest Trametal S.P.A, Ferrera Valsider S.P.A.), as well as from Romania (Liberty Galati S.A.), says Metinvest SMC.

The import of other steel products, which was lacking on the Ukrainian market, became relevant.

“Customers are in demand for profile pipes, channel, beam, corner and sheet. We bring this rolled steel from Poland, the Czech Republic, Germany, Portugal, Slovakia and Turkiye. With our imports, we replaced 90% of the Ukrainian products that disappeared from the market due to the war. Among the replaced products are hot-rolled sheet, I-beam, channel and even rail products,” Vitaliy Prytula notes.

Logistical issues

One of the most difficult issues for the steel trade has become the destruction of traditional supply chains and the need to build new ones.

“Since the beginning of the war, 90% of the company’s logistics has been reoriented to railway transport. From May 2022, in connection with the liberation of the territories in the north of Ukraine from the occupiers, auto-messages began to be restored. However, transportation by motor vehicle has become more expensive by about 150%. One of the ways to activate the steel industry of Ukraine in 2022 could be the opening of ports for the export of products. This applies to raw materials, semi-finished products, and finished products. So far, the only way of export is railway transport. But it does not fully provide the necessary volume and is much more expensive than sea transportation,” says Serhiy Kovalenko.

However, each company solved logistical issues in its own way.

“Logistics from Ukrainian plants remained unchanged – both rail and road transport are used. Ukrainian producers mainly had problems with the export of products due to the closure of ports for the transportation of rolled steel. This issue is still relevant and very important from the point of view of loading the capacities of both steel plants and enterprises producing iron ore and mining coal. As for import deliveries to Ukraine, the share of products from China, India, and South Korea decreased due to the closure of ports. There is a constant search for new logistics schemes for imports based on delivery terms and optimal cost,” Metinvest SMC emphasizes.

The blockade of Ukrainian Black Sea ports forced steel trading companies to switch to Poland’s Gdansk and Gdynia, as well as even Rotterdam and Hamburg. The delivery of steel from Turkiye through Ukrainian Danube ports has also been established.

A favorable trend was that after the first difficult months, the situation with auto logistics improved by the end of the year – the supply of road transport to Europe and EU countries increased, and the cost of delivery stabilized.

Unprofitable import

Everyone is talking about the fact that in the future, a lot of steel products will be needed to restore the infrastructure. But it is already clear today that within the framework of Western loans or grants for recovery, international partners will insist on purchasing the products of their companies or will provide material assistance in the form of finished products.

The first bells are already heard. Ukrzaliznytsia signed an agreement with the French producer Saarstahl Rail on the supply of rails worth up to €37.6 million – 20,000 tons of rails will allow for the repair of approximately 150 km of track. Funding will be provided as part of an agreement with the French government. In addition, the Cabinet of Ministers approved a draft agreement with Switzerland regarding a grant for the purchase of rail fasteners.

A memorandum was also signed between Ukravtodor and the French company Matiere on the supply of bridge structures worth about €25 million. As part of the restoration of the destroyed infrastructure, Ukraine has already received or will soon receive bridge structures from the Czech Republic, Sweden and Norway.

Thus, Ukrainian steelmakers and producers of steel structures may be partially excluded from the implementation of the country’s recovery programs, although they are capable of producing products. Only steel enterprises of the Metinvest Group, including the joint venture – Zaporizhstal plant, by the end of 2022 set up the production of 24 new types of steel products. One of the main directions for which the Group’s steel plants began to produce new products is the restoration of the country’s infrastructure and the provision of rolled steel to Ukrainian consumers.

Ukrainian producers are ready to restore the infrastructure and supply various steel products. The main thing is for the state to be patriotic in its purchases and to defend the interests of national producers in the domestic and foreign markets.

Source: www.gmk.center